Market Trends

Key Emerging Trends in the Saudi Arabia Agricultural Chemicals Market

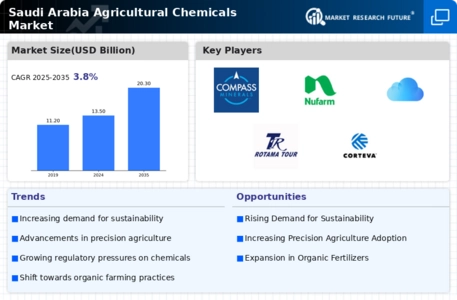

The supermarket for agricultural chemicals in Saudi Arabia is manifesting remarkable figures in the last few years due to the coventry move of which the agricultural sector in the country is going through. One main trend is sustainable agriculture getting more and more serious focus. Farmers and related stakeholders are finding the fact of the availability of eco-friendly and effecient agricultural chemicals which minimize environmental impacts yet boost agricultural output so crucial. However, the change to green sustainable agriculture is a result of both global apprehension about the climate change and the local requirement to use water resources conservatively in aridSaudi Arabia.

To reinforce, an observable movement is seen in the application of advanced technology within the agricultural chemicals domain. Smart farming which utilizes internet of things technology, such as drones, sensors, and GPS guided equipment, is splitting the market strongly towards its side. These technology integration is pivotal especially in ensuring accurate chemicals application on farming land so that their effectiveness is enhanced and all the wastage minimized. Farmers are implementing digital technologies to enhance the management processes and to address the health of the crops. These technologies help farmers in easy management of resources, hence higher productivity rate.

The authorities in Saudi Arabia have also made it their priority to seek an alternative source of income other than oil, which in the end also bears its impact on the market of agrochemicals. The basic Kingdom’s Future 2030 strategy lays a great deal of emphasis on food security, which causes the channeling of funds into the agricultural sector. Consequently, people in agriculture encourage the application of various chemicals mainly as a way of increasing crop production and every individual accessing the readily available food. Beside the gov's support by means of subsidies and bonuses to farmers, the scope of money demand for agrichemicals has also been increased.

One among the important tendencies is the transition to the natural way of farming and at the same time the growing appeal to organic agricultural chemicals. Consumers practice more conscious eating and environmental conscription, there is a stronger desire and attraction for organic produce resulting in an increase in demand. So the tendency drove farmers to bring up organic farming and creates the demand for organic fertilizers, pesticides, and other agricultural products. This results in an increase in companies in the Saudi Arabian market that are looking to meet the demand of the customers by diversifying their product line options.

While there are many positives on the one hand, difficult situation on the other hand also comes with the trends. Water requirements go up significantly to improve productivity and sustainability, which create tension in a region already having water constricted resources. Some measures such as water efficient management coupled with chemical water saving plants are paramount for coping with this issue. Also, the continuing global anxiety about the ecological effect of particular chemical substances has caused more societal vigilance that in turn leads to regulations and legislations.

Leave a Comment