Silica Gel Market Trends

Silica Gel Market Research Report Information By Application (Desiccant, Chromatography, Food Additives, Water Filtration, and Others), By Type (Type A, Type B, Type C, Silica Alumina Gel, and Others), By End-User (Oil & Gas, Pharmaceuticals, Petrochemicals, and Others) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035.

Market Summary

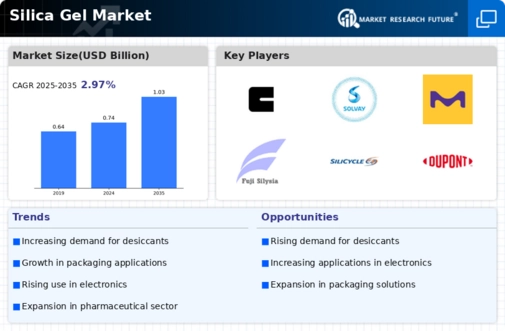

As per Market Research Future Analysis, the global silica gel market was valued at USD 0.74 billion in 2024 and is projected to grow to USD 1.02 billion by 2035, with a CAGR of 2.97% from 2025 to 2035. The growth is driven by increasing demand in the pharmaceutical and food & beverage industries, where silica gel is used for moisture control and shelf-life extension. The desiccant segment leads the market, while type A silica gel dominates in revenue generation. North America holds the largest market share, particularly in the petrochemical sector, followed by Europe and Asia-Pacific, which is expected to grow at the fastest rate.

Key Market Trends & Highlights

Key trends driving the silica gel market include its expanding applications and innovations.

- Silica gel Market Size in 2024: USD 0.74 billion. Projected Market Size by 2035: USD 1.02 billion. CAGR from 2025 to 2035: 2.97%. Desiccant segment accounts for the majority of market revenue.

Market Size & Forecast

| 2024 Market Size | USD 0.74 billion |

| 2035 Market Size | USD 1.02 billion |

| CAGR (2025-2035) | 2.97% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

<p>Clariant, Solvay, Merck KGaA, China National Bluestar (Group) Co, Ltd., Fuji Silysia Chemical Ltd., SiliCycle Inc., Multisorb, PQ Corporation.</p>

Market Trends

Increasing use in the food & beverages industry as food additives drive market growth

Market CAGR for silica gel is driven by its increasing use as a food additive in the food & beverages industry. Silica gel can improve the taste and quality of non-alcoholic beverages, liquors, essential oils, and snacks. It also improves the smoothness of beverages, for which additives such as precipitated this gel is widely used in food and beverage products. This gel removes turbid polymers that create haziness or cloudiness in liquids, making the drink finer and more visible.

Many food products and supplements contain silica gel, as it helps prevent clumping, allowing for easier packaging, transit, eventual consumption, and flowability. All such advantages are expected to increase demand for silica gel and, thus, drive revenue growth in the market.

Additionally, the rapid industrialization and increase in the use of desiccants in various industries have led to the expansion of the silica gel market. Silica gel is used as pellets in paper envelopes to dry the immediate environment. It is extensively utilized in the shipping and packaging industry, where the transported materials must be kept safe from moisture. Because of its qualities, such as being non-toxic, tasteless, and chemically inert, silica gel is used in the food and beverages industry to increase the shelf life of packaged food by keeping it moisture free.

It is also used to absorb the foul odor from refrigerators, automobiles, shoes, lockers, etc. Silica gel column is also a major component used during the chromatographic separation of drugs in the pharmaceutical industry.

Additionally, silica gel makes the skin appear supple and radiant. Pharmaceutical packaging typically utilizes this gel to protect medications from moisture and other contaminants. Silica gel column chromatography is utilized in the pharmaceutical industry to collect or split distinct medication components. Since the gel is utilized in the pharmaceutical industry as glidants, lubricants, viscosity agents, colorants, solvents, preservatives, and others, the rising pharmaceutical industry has augmented medication production and boosted revenue growth of the silica gel market.

Since silica gel is only utilized for preservation and packaging to maintain the items moisture-free, the increase in the production of medications is boosting the silica gel market revenue.

Clariant, a focused and inventive specialty chemical firm, has launched a new standard tube/desiccant stopper product designed and sized to meet the needs of the Vietnam market. The new product includes a 25 mm x 132 mm tube and a spiral closure for packaging and protecting effervescent tablets from breakage and moisture damage. The design also works well with chewables and lozenges.

July 2023: Among the recent market novelties have been bio-based silica gels. The latter is seen as a better alternative to the traditional silica gel derived from petroleum due to environmental concerns. Renewable raw materials such as rice husk ash or bamboo are used in the manufacture of these environmentally friendly gels, which reduces the industry's carbon footprint.

<p>The global silica gel market is poised for growth, driven by increasing demand across various industries for moisture control and preservation applications.</p>

U.S. Geological Survey

Silica Gel Market Market Drivers

Growing Demand from Packaging Industry

The Global Silica Gel Market Industry experiences a notable surge in demand from the packaging sector, driven by the need for moisture control in various products. Silica gel is extensively utilized in packaging to prevent moisture damage, thereby preserving product integrity. As the global packaging market expands, particularly in food and pharmaceuticals, the demand for silica gel is projected to increase. In 2024, the market value is estimated at 0.74 USD Billion, reflecting the growing awareness of product quality and shelf life. This trend is expected to continue, with the market potentially reaching 1.03 USD Billion by 2035, indicating a robust growth trajectory.

Market Segment Insights

Silica Gel Application Insights

<p>The silica gel market segmentation, based on application, includes desiccant, chromatography, food additive, water filtration, and others. The desiccant segment dominated the market, accounting for the major market revenue over the forecast period. A desiccant made of it is frequently used daily to keep things dry by absorbing moisture from the air. It can successfully prevent mold development, food spoilage, and potential condensation that could hinder electronic devices. For desiccants, a single silicon atom is connected with two oxygen atoms to form beads.</p>

Silica Gel Type Insights

<p>The silica gel market segmentation, based on type, includes type A, type B, type C, silica-alumina gel, and others. The type A category generated the most income over the forecast period. It has an increased moisture-absorbing ability at low humidity and fine pore silica gel. A-type gel is utilized as a desiccant for storing food and metal parts. Type A absorbs atmospheric water vapor in the standard humidity range. It has a variety of benefits, including adsorbent, separator, catalyst carrier, and variable-pressure adsorbent.</p>

Silica Gel End-User Insights

<p>The silica gel market segmentation, based on end-user, includes oil & gas, pharmaceuticals, petrochemicals, and others. The pharmaceuticals category generated the most income over the forecast period. It is frequently used in pharmaceutical packaging to protect medicines from moisture and other impurities. In the pharmaceutical sector, gel column chromatography is used to collect or separate various drug components.</p>

<p>Figure 1: Silica Gel Market by End-User, 2022 & 2032 (USD billion)Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review</p>

Get more detailed insights about Silica Gel Market Research Report- Forecast to 2027

Regional Insights

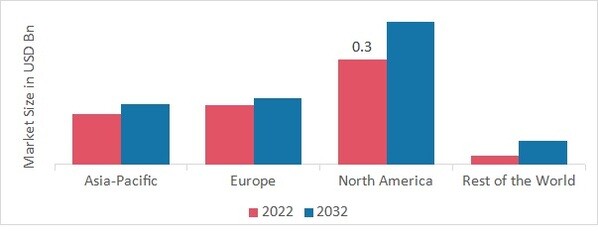

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American silica gel market area will dominate this market, owing to its usage as a catalyst in the petrochemical industry and the refining and processing of natural gas, silica gel is in high demand in the petrochemical and oil & gas sectors in the region. Further, the US silica gel market held the largest market share, and the Canada silica gel market was the fastest-growing market in the North America region.

Further, the prominent countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: SILICA GEL MARKET SHARE BY REGION 2022 (%)  Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Europe silica gel market accounts for the second-largest market share due to the region's established and innovative industrial infrastructure, which is anticipated to increase demand for the gel in the region. Further, the German silica gel market held the largest market share, and the UK silica gel market was the fastest-growing market in the European region.

The Asia-Pacific silica gel market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to rising demand from the packaging industry and the high demand for electronics and food & beverage products in the region. Moreover, China silica gel market held the largest market share, and the Indian silica gel market was the fastest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the silica gel market grow even more. Market participants are also undertaking several strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The silica gel industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the silica gel industry to benefit clients and increase the market sector. Major players in the silica gel market, including Clariant, Solvay, Merck KGaA, China National Bluestar (Group) Co, Ltd., Fuji Silysia Chemical Ltd., SiliCycle Inc., Multisorb, PQ Corporation, and others, are attempting to increase market requirement by investing in research and development operations.

DuPont de Nemours, Inc., commonly known as DuPont, is an American multinational chemical corporation first formed in 1802 by French-American chemist and industrialist Éleuthère Irénée du Pont de Nemours. The enterprise played a significant role in the development of Delaware and first arose as a major supplier of gunpowder. In February 2022, DuPont launched a new online sales portal for the needs of bioprocessing industry purchasers. DuPont bioprocessing enables sophisticated separations and purification for therapeutics, with different DuPont brands such as AmberChrom and AmberLite being very well established in the biopharma industry.

Merck KGaA is a pharmaceutical and chemical organization. The Company researches drugs in oncology and neurodegenerative as well as autoimmune and inflammatory diseases. Also, it markets cardiovascular, fertility, endocrinology, and over-the-counter products, as well as products for flat screens and pharmaceuticals, food, cosmetics, packaging, and coatings. In Sept 2021, Merck KGaA opened a new production facility in Gernsheim to strengthen its Xirona and Colorstream Silica-based product line, used in numerous applications for the paints and coating industry.

Key Companies in the Silica Gel Market market include

Industry Developments

May 2021: W.R. Grace & Co. announced in May 2021 that they finished expanding their manufacturing plants in Kuantan, Malaysia. The company took this step to address the increasing demand for its silica gel products.

On May, 2019, Intermolecular signed a definitive agreement under which it was acquired by Merck KGaA, Darmstadt, Germany, through its wholly-owned subsidiary at a price of USD 1.20 per share in cash, representing net worth of Intermolecular being approximately USD 62 million dollars. In combination with the Research & Development (R&D) power of Merck KGaA, Darmstadt, Germany, and powered by Intermolecular's strong capability in high-throughput materials testing capabilities would enable material innovation at Merck through parallel composition and comprehensive performance tests and characterizations.

In January 2024, BASF partnered with Stena Recycling to develop a new recycling technology for lithium-ion batteries (LIBs) used in electric vehicles.

In December 2023, AGC Inc., known for producing glassware chemicals and high-tech materials, among other things, revealed plans to expand its biopharma CDMO capacity at AGC Yokohama Technical Center.

Future Outlook

Silica Gel Market Future Outlook

<p>The Global Silica Gel Market is projected to grow at a 2.97% CAGR from 2025 to 2035, driven by increasing demand in packaging and electronics sectors.</p>

New opportunities lie in:

- <p>Develop eco-friendly silica gel products to meet sustainability trends. Expand into emerging markets with tailored marketing strategies. Leverage advanced technology for enhanced moisture control solutions.</p>

<p>By 2035, the market is expected to demonstrate robust growth, reflecting evolving consumer needs and technological advancements.</p>

Market Segmentation

Outlook

- Desiccant

- Chromatography

- Food Additives

- Water Filtration

- Others

Silica Gel Type Outlook

- Type A

- Type B

- Type C

- Silica Alumina Gel

- Others

Silica Gel Regional Outlook

- {"North America"=>["US"

- "Canada"]}

- {"Europe"=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {"Rest of the World"=>["Middle East"

- "Africa"

- "Latin America"]}

Silica Gel End-User Outlook

- Oil & Gas

- Pharmaceuticals

- Petrochemicals

- Others

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 0.74 billion |

| Market Size 2035 | 1.02 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 2.97% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019- 2021 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Growth Factors, Market Competitive Landscape, and Trends |

| Segments Covered | Type, Application, End-User, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Evonik Industries (Germany), Clariant (Switzerland), Solvay (Belgium), Merck Group (Germany), China National Bluestar Company Limited (China), Fuji Silysia Chemical (China), Nissan Chemical Industries (Japan), DowDuPont (U.S.), Qingdao Haiyang Chemical (China) and Millennium Chemicals (U.S.) Among others. |

| Key Market Opportunities | Increasing utilization of silica gel in the pharmaceutical enterprise for packaging to protect medicines from the moist environment |

| Key Market Dynamics | Increasing demand for silica gel in the electronic and food & beverages industry |

| Market Size 2025 | 0.76 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the silica gel market?

Silica Gel Market crossed a valuation of USD 0.74 Billion in 2024

What is the growth rate of the silica gel market?

Silica Gel Market is expected to grow with a CAGR of 2.97% in the period 2025-2035

Which region held the largest market share in the silica gel market?

North America had the largest share of the market

Who are the key players in the silica gel market?

The key players in the market are Clariant (Switzerland), Evonik Industries (Germany), Solvay (Belgium), Merck Group (Germany), and China National Bluestar Company Limited (China)

Which type led the market?

The desiccant category dominated the market in 2022

Which application had the largest market share in the silica gel market?

Type A had the largest share of the market

Which end-user had the largest market share in the silica gel industry?

Pharmaceuticals had the largest share of the market

-

--- |-Table of Contents:1 Executive Summary2 Scope of the Report2.1 Market Definition2.2 Scope of the Study2.2.1 Research Objectives2.2.2 Assumptions & Limitations2.3 Markets Structure3 Market Research Methodology3.1 Research Process3.2 Secondary Research3.3 Primary Research3.4 Forecast Model4 Market Landscape4.1 Porter’s Five Forces Analysis4.1.1 Threat of New Entrants4.1.2 Bargaining power of buyers4.1.3 Threat of substitutes4.1.4 Segment rivalry4.2 Value Chain/Supply Chain of Global Silica Gel Market5 Industry Overview of Global Silica Gel Market5.1 Introduction5.2 Growth Drivers5.3 Impact analysis5.4 Market Challenges6 Market Trends6.1 Introduction6.2 Growth Trends6.3 Impact analysis7. Global Silica Gel Market by Type7.1 Introduction7.2 Type A 7.2.1 Market Estimates & Forecast, 2023-20307.2.2 Market Estimates & Forecast by Region, 2023-20307.3 Type B7.3.1 Market Estimates & Forecast, 2023-20307.3.2 Market Estimates & Forecast by Region, 2023-20307.4 Type C7.4.1 Market Estimates & Forecast, 2023-20307.4.2 Market Estimates & Forecast by Region, 2023-20307.5 Silica alumina gel7.5.1 Market Estimates & Forecast, 2023-20307.5.2 Market Estimates & Forecast by Region, 2023-20307.6 Others7.6.1 Market Estimates & Forecast, 2023-20307.6.2 Market Estimates & Forecast by Region, 2023-2030 8. Global Silica Gel Market by Application8.1 Introduction8.2 Desiccant8.2.1 Market Estimates & Forecast, 2023-20308.2.2 Market Estimates & Forecast by Region, 2023-20308.3 Chromatography8.3.1 Market Estimates & Forecast, 2023-20308.3.2 Market Estimates & Forecast by Region, 2023-20308.4 Food additives8.4.1 Market Estimates & Forecast, 2023-20308.4.2 Market Estimates & Forecast by Region, 2023-20308.5 Water Filtration8.5.1 Market Estimates & Forecast, 2023-20308.5.2 Market Estimates & Forecast by Region, 2023-20308.6 Others8.6.1 Market Estimates & Forecast, 2023-20308.6.2 Market Estimates & Forecast by Region, 2023-20309. Global Silica Gel Market by End Use Industry9.1 Introduction9.2 Oil and Gas9.2.1 Market Estimates & Forecast, 2023-20309.2.2 Market Estimates & Forecast by Region, 2023-20309.3 Pharmaceuticals 9.3.1 Market Estimates & Forecast, 2023-20309.3.2 Market Estimates & Forecast by Region, 2023-20309.4 Petrochemicals9.4.1 Market Estimates & Forecast, 2023-20309.4.2 Market Estimates & Forecast by Region, 2023-20309.5 Others9.5.1 Market Estimates & Forecast, 2023-20309.5.2 Market Estimates & Forecast by Region, 2023-203010. Global Silica Gel Market by Region10.1 Introduction10.2 North America10.2.1 Market Estimates & Forecast, 2023-203010.2.2 Market Estimates & Forecast by Type, 2023-203010.2.3 Market Estimates & Forecast by Application, 2023-203010.2.4 Market Estimates & Forecast by End Use Industry, 2023-203010.2.5 U.S.10.2.5.1 Market Estimates & Forecast, 2023-203010.2.5.2 Market Estimates & Forecast by Type, 2023-203010.2.5.3 Market Estimates & Forecast by Application, 2023-203010.2.5.4 Market Estimates & Forecast by End Use Industry, 2023-203010.2.6 Mexico10.2.6.1 Market Estimates & Forecast, 2023-203010.2.6.2 Market Estimates & Forecast by Type, 2023-203010.2.6.3 Market Estimates & Forecast by Application, 2023-203010.2.6.4 Market Estimates & Forecast by End Use Industry, 2023-203010.2.7 Canada10.2.7.1 Market Estimates & Forecast, 2023-203010.2.7.2 Market Estimates & Forecast by Type, 2023-203010.2.7.3 Market Estimates & Forecast by Application, 2023-203010.2.7.4 Market Estimates & Forecast by End Use Industry, 2023-203010.3 Europe10.3.1 Market Estimates & Forecast, 2023-203010.3.2 Market Estimates & Forecast by Type, 2023-203010.3.3 Market Estimates & Forecast by Application, 2023-203010.3.4 Market Estimates & Forecast by End Use Industry, 2023-203010.3.5 Germany10.3.5.1 Market Estimates & Forecast, 2023-203010.3.5.2 Market Estimates & Forecast by Type, 2023-203010.3.5.3 Market Estimates & Forecast by Application, 2023-203010.3.5.4 Market Estimates & Forecast by End Use Industry, 2023-203010.3.6. France10.3.6.1 Market Estimates & Forecast, 2023-203010.3.6.2 Market Estimates & Forecast by Type, 2023-203010.3.6.3 Market Estimates & Forecast by Application, 2023-203010.3.6.4 Market Estimates & Forecast by End Use Industry, 2023-203010.3.7 Italy10.3.7.1 Market Estimates & Forecast, 2023-203010.3.7.2 Market Estimates & Forecast by Type, 2023-203010.3.7.3 Market Estimates & Forecast by Application, 2023-203010.3.7.4 Market Estimates & Forecast by End Use Industry, 2023-203010.3.8 Spain10.3.8.1 Market Estimates & Forecast, 2023-203010.3.8.2 Market Estimates & Forecast by Type, 2023-203010.3.8.3 Market Estimates & Forecast by Application, 2023-203010.3.8.4 Market Estimates & Forecast by End Use Industry, 2023-203010.3.9 U.K10.3.9.1 Market Estimates & Forecast, 2023-203010.3.9.2 Market Estimates & Forecast by Type, 2023-203010.3.9.3 Market Estimates & Forecast by Application, 2023-203010.3.9.4 Market Estimates & Forecast by End Use Industry, 2023-203010.3.10 Rest of Europe10.3.10.1 Market Estimates & Forecast, 2023-203010.3.10.2 Market Estimates & Forecast by Type, 2023-203010.3.10.3 Market Estimates & Forecast by Application, 2023-203010.3.10.4 Market Estimates & Forecast by End Use Industry, 2023-203010.4 Asia Pacific10.4.1 Market Estimates & Forecast, 2023-203010.4.2 Market Estimates & Forecast by Type, 2023-203010.4.3 Market Estimates & Forecast by Application, 2023-203010.4.4 Market Estimates & Forecast by End Use Industry, 2023-203010.4.5 China10.4.5.1 Market Estimates & Forecast, 2023-203010.4.5.2 Market Estimates & Forecast by Type, 2023-203010.4.5.3 Market Estimates & Forecast by Application, 2023-203010.4.5.4 Market Estimates & Forecast by End Use Industry, 2023-203010.4.6 India10.4.6.1 Market Estimates & Forecast, 2023-203010.4.6.2 Market Estimates & Forecast by Type, 2023-203010.4.6.3 Market Estimates & Forecast by Application, 2023-203010.4.6.4 Market Estimates & Forecast by End Use Industry, 2023-203010.4.7 Japan10.4.7.1 Market Estimates & Forecast, 2023-203010.4.7.2 Market Estimates & Forecast by Type, 2023-203010.4.7.3 Market Estimates & Forecast by Application, 2023-203010.4.7.4 Market Estimates & Forecast by End Use Industry, 2023-203010.4.8 Australia10.4.8.1 Market Estimates & Forecast, 2023-203010.4.8.2 Market Estimates & Forecast by Type, 2023-203010.4.8.3 Market Estimates & Forecast by Application, 2023-203010.4.8.4 Market Estimates & Forecast by End Use Industry 2023-203010.4.9 New Zealand10.4.9.1 Market Estimates & Forecast, 2023-203010.4.9.2 Market Estimates & Forecast by Type, 2023-203010.4.9.3 Market Estimates & Forecast by Application, 2023-203010.4.9.4 Market Estimates & Forecast by End Use Industry, 2023-203010.4.10 Rest of Asia Pacific10.4.10.1 Market Estimates & Forecast, 2023-203010.4.10.2 Market Estimates & Forecast by Type, 2023-203010.4.10.3 Market Estimates & Forecast by Application, 2023-203010.4.10.4 Market Estimates & Forecast by End Use Industry, 2023-203010.5 The Middle East & Africa 10.5.1 Market Estimates & Forecast, 2023-203010.5.2 Market Estimates & Forecast by Type, 2023-203010.5.3 Market Estimates & Forecast by Application, 2023-203010.5.4 Market Estimates & Forecast by End Use Industry, 2023-203010.5.5 Turkey10.5.5.1 Market Estimates & Forecast, 2023-203010.5.5.2 Market Estimates & Forecast by Type, 2023-203010.5.5.3 Market Estimates & Forecast by Application, 2023-203010.5.5.4 Market Estimates & Forecast by End Use Industry, 2023-203010.5.6 Israel 10.5.6.1 Market Estimates & Forecast, 2023-203010.5.6.2 Market Estimates & Forecast by Type, 2023-203010.5.6.3 Market Estimates & Forecast by Application, 2023-203010.5.6.4 Market Estimates & Forecast by End Use Industry, 2023-203010.5.7 North Africa 10.5.7.1 Market Estimates & Forecast, 2023-203010.5.7.2 Market Estimates & Forecast by Type, 2023-203010.5.7.3 Market Estimates & Forecast by Application, 2023-203010.5.7.4 Market Estimates & Forecast by End Use Industry, 2023-203010.5.8 GCC10.5.8.1 Market Estimates & Forecast, 2023-203010.5.8.2 Market Estimates & Forecast by Type, 2023-203010.5.8.3 Market Estimates & Forecast by Application, 2023-203010.5.8.4 Market Estimates & Forecast by End Use Industry, 2023-203010.5.9 Rest of the Middle East & Africa 10.5.9.1 Market Estimates & Forecast, 2023-203010.5.9.2 Market Estimates & Forecast by Type, 2023-203010.5.9.3 Market Estimates & Forecast by Application, 2023-203010.5.9.4 Market Estimates & Forecast by End Use Industry, 2023-203010.6 Latin America10.6.1 Market Estimates & Forecast, 2023-203010.6.2 Market Estimates & Forecast by Type, 2023-203010.6.3 Market Estimates & Forecast by Application, 2023-203010.6.4 Market Estimates & Forecast by End Use Industry, 2023-203010.6.5 Brazil 10.6.5.1 Market Estimates & Forecast, 2023-203010.6.5.2 Market Estimates & Forecast by Type, 2023-203010.6.5.3 Market Estimates & Forecast by Application, 2023-203010.6.5.4 Market Estimates & Forecast by End Use Industry, 2023-203010.6.6 Argentina 10.6.6.1 Market Estimates & Forecast, 2023-203010.6.6.2 Market Estimates & Forecast by Type, 2023-203010.6.6.3 Market Estimates & Forecast by Application, 2023-203010.6.6.4 Market Estimates & Forecast by End Use Industry, 2023-203010.6.7 Rest of Latin America 10.6.7.1 Market Estimates & Forecast, 2023-203010.6.7.2 Market Estimates & Forecast by Type, 2023-203010.6.7.3 Market Estimates & Forecast by Application, 2023-203010.6.7.4 Market Estimates & Forecast by End Use Industry, 2023-203011. Company Landscape12. Company Profiles12.1 Evonik Industries12.1.1 Company Overview12.1.2 Type/Business Segment Overview12.1.3 Financial Updates12.1.4 Key Developments12.2 Clariant12.2.1 Company Overview12.2.2 Type/Business Segment Overview12.2.3 Financial Updates12.2.4 Key Developments12.3 Solvay12.3.1 Company Overview12.3.2 Type/Business Segment Overview12.3.3 Financial Updates12.3.4 Key Developments12.4 Merck Group12.4.1 Company Overview12.4.2 Type/Business Segment Overview12.4.3 Financial Updates12.4.4 Key Developments12.5 China National Bluestar Company Limited12.5.1 Company Overview12.5.2 Type/Business Segment Overview12.5.3 Financial Updates12.5.4 Key Developments12.6 Fuji Silysia Chemical.12.6.1 Company Overview12.6.2 Type/Business Segment Overview12.6.3 Financial Updates12.6.4 Key Developments12.7 Nissan Chemical Industries12.7.1 Company Overview12.7.2 Type/Business Segment Overview12.7.3 Financial Updates12.7.4 Key Developments12.8 DuPont, Dow Chemical12.8.1 Company Overview12.8.2 Type/Business Segment Overview12.8.3 Financial Updates12.8.4 Key Developments12.9 Qingdao Haiyang Chemical 12.9.1 Company Overview12.9.2 Type/Business Segment Overview12.9.3 Financial Updates12.9.4 Key Developments12.10 Millennium Chemicals 12.10.1 Company Overview12.10.2 Type/Business Segment Overview12.10.3 Financial Updates12.10.4 Key Developments13 ConclusionList of Tables:Table 1 World Population by Major Regions (2020 To 2027) Table 2 Global Silica Gel Market: By Region, 2023-2030Table 3 North America Silica Gel Market: By Country, 2023-2030Table 4 Europe Silica Gel Market: By Country, 2023-2030Table 5 Asia-Pacific Silica Gel Market: By Country, 2023-2030Table 6 Middle East & Africa Silica Gel Market: By Country, 2023-2030Table 7 Latin America Silica Gel Market: By Country, 2023-2030Table 8 Global Silica Gel by Type Market: By Regions, 2023-2030Table 9 North America Silica Gel by Type Market: By Country, 2023-2030Table10 Europe Silica Gel by Type Market: By Country, 2023-2030Table11 Asia-Pacific Silica Gel by Type Market: By Country, 2023-2030Table12 Middle East & Africa Silica Gel by Type Market: By Country, 2023-2030Table13 Latin America Silica Gel by Type Market: By Country, 2023-2030Table14 Global Silica Gel by Application Market: By Regions, 2023-2030Table15 North America Silica Gel by Application Market: By Country, 2023-2030Table16 Europe Silica Gel by Application Market: By Country, 2023-2030Table17 Asia-Pacific Silica Gel by Application Market: By Country, 2023-2030Table18 Middle East & Africa Silica Gel by Application Market: By Country, 2023-2030Table19 Latin America Silica Gel by Application Market: By Country, 2023-2030Table20 Global Silica Gel by Application Market: By Regions, 2023-2030Table21 North America Silica Gel for End Use Industry Market: By Country, 2023-2030Table22 Europe Silica Gel for End Use Industry Market: By Country, 2023-2030Table23 Asia-Pacific Silica Gel for End Use Industry Market: By Country, 2023-2030Table24 Middle East & Africa Silica Gel for End Use Industry Market: By Country, 2023-2030Table25 Latin America Silica Gel for End Use Industry Market: By Country, 2023-2030 Table26 Global Type Market: By Region, 2023-2030Table27 Global Application Market: By Region, 2023-2030Table28 Global End Use Industry Market: By Region, 2023-2030Table29 North America Silica Gel Market, By Country Table30 North America Silica Gel Market, By TypeTable31 North America Silica Gel Market, By Application Table32 North America Silica Gel Market, By End Use IndustryTable33 Europe: Silica Gel Market, By Country Table34 Europe: Silica Gel Market, By TypeTable35 Europe: Silica Gel Market, By ApplicationTable36 Europe: Silica Gel Market, By End Use IndustryTable37 Asia-Pacific: Silica Gel Market, By Country Table38 Asia-Pacific: Silica Gel Market, By TypeTable39 Asia-Pacific: Silica Gel Market, By ApplicationTable40 Asia-Pacific: Silica Gel Market, By End Use IndustryTable41 Middle East & Africa: Silica Gel Market, By Country Table42 Middle East & Africa Silica Gel Market, By TypeTable43 Middle East & Africa Silica Gel Market, By ApplicationTable44 Middle East & Africa: Silica Gel Market, By End Use IndustryTable45 Latin America: Silica Gel Market, By Country Table46 Latin America Silica Gel Market, By TypeTable47 Latin America Silica Gel Market, By ApplicationTable48 Latin America: Silica Gel Market, By End Use IndustryList of Figures:FIGURE 1 Global Silica Gel Market SegmentationFIGURE 2 Forecast MethodologyFIGURE 3 Five Forces Analysis of Global Silica Gel MarketFIGURE 4 Value Chain of Global Silica Gel MarketFIGURE 5 Share of Global Silica Gel Market in 2022, by country (in %)FIGURE 6 Global Silica Gel Market, 2023-2030,FIGURE 7 Sub segments of TypeFIGURE 8 Global Silica Gel Market size by Type, 2022FIGURE 9 Share of Global Silica Gel Market by Type, 2023-2030FIGURE 10 Global Silica Gel Market size by Application, 2022FIGURE 11 Share of Global Silica Gel Market by Application, 2023-2030FIGURE 12 Global Silica Gel Market size by End Use Industry, 2022FIGURE 13 Share of Global Silica Gel Market by End Use Industry, 2023-2030

Silica Gel Market Segmentation

Silica Gel Market Application Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Silica Gel Market Type Outlook (USD Billion, 2019-2032)

Type A

Type B

Type C

Silica Alumina Gel

Others

Silica Gel Market End-User Outlook (USD Billion, 2019-2032)

Oil & Gas

Pharmaceuticals

Petrochemicals

Others

Silica Gel Market Regional Outlook (USD Billion, 2019-2032)

North America Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

North America Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

North America Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

US Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

US Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

US Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

CANADA Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

CANADA Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

CANADA Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Europe Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Europe Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Europe Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Germany Outlook (USD Billion, 2019-2032)

Germany Silica Gel Market by ApplicationDesiccant

Chromatography

Food Additives

Water Filtration

Others

Germany Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Germany Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

France Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

France Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

France Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

UK Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

UK Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

UK Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

ITALY Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

ITALY Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

ITALY Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

SPAIN Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Spain Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Spain Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Rest Of Europe Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

REST OF EUROPE Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Rest Of Europe Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Asia-Pacific Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Asia-Pacific Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Asia-Pacific Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

China Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

China Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

China Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Japan Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Japan Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Japan Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

India Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

India Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

India Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Australia Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Australia Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Australia Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Rest of Asia-Pacific Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Rest of Asia-Pacific Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Rest of Asia-Pacific Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Rest of the World Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Rest of the World Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Rest of the World Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Middle East Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Middle East Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Middle East Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Africa Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Africa Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Africa Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Latin America Outlook (USD Billion, 2019-2032)

Desiccant

Chromatography

Food Additives

Water Filtration

Others

Latin America Silica Gel Market by TypeType A

Type B

Type C

Silica Alumina Gel

Others

Latin America Silica Gel Market by End-UserOil & Gas

Pharmaceuticals

Petrochemicals

Others

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment