Research Methodology on Silica Gel Market

Introduction

Research methodology refers to the systematic framework used to undertake a research study. Different types of research methodologies have been developed to conduct a meaningful and organized study in a cost-effective manner starting from conceptualizing the research to drawing meaningful and accurate conclusions in the end.

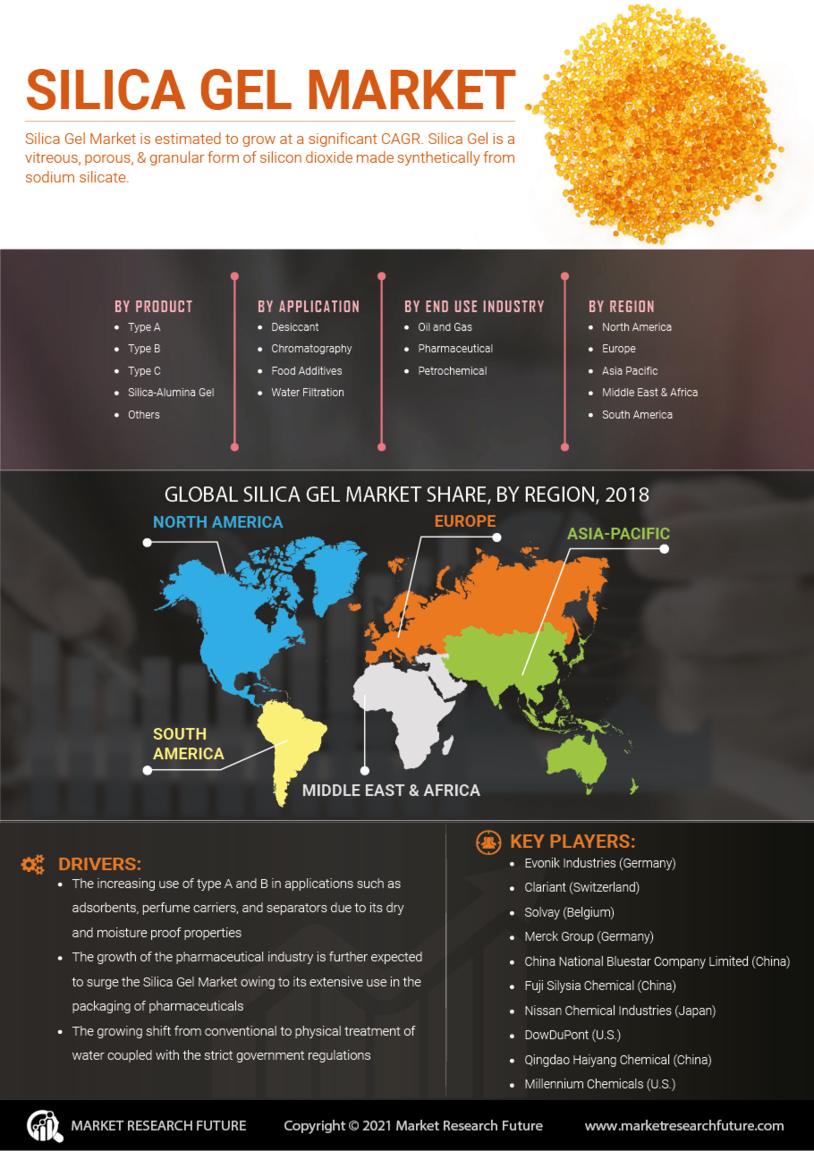

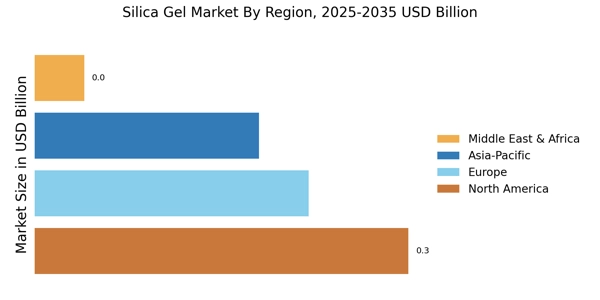

The research methodology for the Market Research Future report on Silica Gel Market Global Market Analysis, Share, Size, Trends, Growth and Forecast 2023-2030 enables the study of various trends and characteristics associated with the silica gel market. It provides an overview of the market size, growth rate, and drivers, as well as examines the role of the silica gel market in different industries and geographies.

1. Research Design:

The research design will be a descriptive analysis that brings an analysis of the Silica Gel market and quantitative research that is characterized by the use of numbers and statistics to study trends and patterns. Both types of research will be combined to provide an inclusive and in-depth view of the Silica Gel market. The research design adopted for this study seeks to identify and quantify the factors driving and restraining the growth of the Silica Gel market.

2. Scope of the Study:

The scope of this study is to evaluate the global Silica Gel market and provide market projections of the market up to the year 2030. The research report involves a detailed study of market size, current trends, growth rate, regional share, and various competitors and their business strategies.

3. Sources of Data Collection:

Qualitative data and quantitative data will be obtained from trusted primary and secondary sources. Primary data will be collected from online surveys and in-depth interviews conducted with suppliers, and stakeholders in the silica gel industry. Secondary data will be collected from published documents, industry databases, and government reports. The collected data will then be validated by expert opinions.

4. Research Approach:

In this research, a desk-based research approach will be adopted to gather and analyse the data. This approach includes collecting information from secondary sources such as reports from industry analysis firms, industry journals and publications, and websites of individual companies, as well as from primary sources such as interviews conducted with key stakeholders, industry experts, and market players in the silica gel industry.

5. Research Tools:

The study will use the triangulation process for data collection and analysis of primary and secondary data. A top-down approach will be used to analyze and forecast the Silica Gel market size at an overall level based on sub-segments such as technology, applications, and regions.

6. Sampling Method and Size:

The research methodology adopted by this study uses probability sampling methods to sample relevant information. Stratified random sampling will be used to get data from potential respondents. A sample size of 200 respondents will be adopted, which will consist of silica gel industry players, suppliers, and end users.

7. Model Construction and Validation:

The construction and validation of inferential models are critical tasks in a research study. These models integrate quantitative and qualitative variables to identify relationship patterns between variables. Multiple linear regression and multiple logistic regression analyses will be used to construct and validate the inferential models which will quantify the effect of independent variables on the dependent variables.

8. Data Analysis and Interpretation:

The collected data will be analyzed using descriptive statistical techniques. Descriptive analysis will help to provide an overview of the data and to identify the important relationships between the various variables. In addition, inferential statistics such as multivariate analysis, cluster analysis, and regression analysis will be used to identify and quantify the various trends in the Silica Gel market.

Conclusion

The research methodology for the MarketResearchFuture.com report on Silica Gel Market Global Market Analysis, Share, Size, Trends, Growth and Forecast 2023-2030 outlines a descriptive and quantitative approach to study the market trends, drivers, and dynamics in the silica gel industry. Qualitative and quantitative data will be collected from both primary and secondary sources and analyzed using descriptive statistics, inferential statistics, and regression analysis. The research methodology is expected to enable a comprehensive understanding of the Silica Gel market, its size, and projections up to the year 2030.