-

OVERVIEW

-

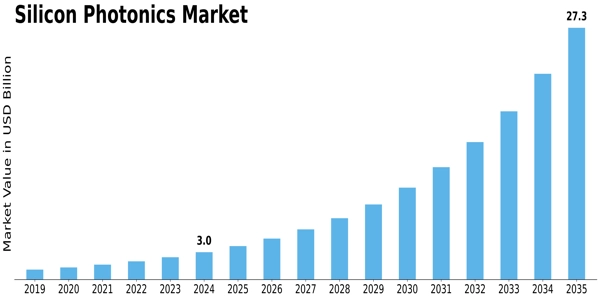

MARKET SYNOPSIS

-

SILICON PHOTONICS MARKET, BY REGION (CAGR)

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

RESEARCH PROCESS

-

PRIMARY RESEARCH

-

SECONDARY RESEARCH

-

MARKET SIZE ESTIMATION

-

FORECAST MODEL

-

LIST OF ASSUMPTIONS

-

MARKET DYNAMICS

-

DRIVER, RESTRAINT, AND OPPORTUNITY OVERVIEW

-

DRIVERS

- INCREASING ADOPTION OF SILICON PHOTONICS-BASED PRODUCTS IN DATA CENTERS

- NEED FOR HIGH BANDWIDTH AND HIGH DATA TRANSFER CAPABILITIES

- DRIVER IMPACT ANALYSIS

-

CHALLENGE

- INEFFICIENT ELECTROLUMINESCENCE

-

OPPORTUNITY

- EMERGING APPLICATIONS OF SILICON PHOTONICS

- INCREASED SUPPORT FROM GOVERNMENT AND STAKEHOLDERS

-

MARKET FACTOR ANALYSIS

-

VALUE CHAIN ANALYSIS

-

OPTICAL COMPONENT PROVIDERS

- LIST OF COMPONENT PROVIDERS

- COMPETITIVE LANDSCAPE

-

ELECTRONIC COMPONENT PROVIDERS

-

LIST OF COMPONENT PROVIDERS

-

COMPETITIVE LANDSCAPE

-

COMPONENT PROVIDERS: PORTERS FIVE FORCES

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF BUYERS

- RIVALRY

-

SOLUTION PROVIDERS: PORTERS FIVE FORCES

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF BUYERS

- RIVALRY

-

GLOBAL SILICON PHOTONICS MARKET, BY PRODUCT

-

OVERVIEW

- TRANSCEIVERS

- ACTIVE OPTICAL CABLE (AOC)

- OPTICAL MULTIPLEXERS

- VARIABLE OPTICAL ATTENUATORS

- OPTICAL ENGINES

-

GLOBAL SILICON PHOTONICS MARKET, BY COMPONENT

-

OVERVIEW

- LASER

- PHOTODETECTORS

- MODULATORS

- MICRO OPTICS

- PASSIVE OPTIC COMPONENTS

-

GLOBAL SILICON PHOTONICS MARKET, BY END USER

-

OVERVIEW

- CONSUMER ELECTRONICS

- IT & TELECOMMUNICATION

- COMMERCIAL

- MILITARY & DEFENSE

- HEALTHCARE

-

GLOBAL SILICON PHOTONICS MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- MARKET ESTIMATE & FORECAST, BY COUNTRY

- MARKET ESTIMATE & FORECAST, BY COMPONENT

- MARKET ESTIMATE & FORECAST, BY PRODUCT

- MARKET ESTIMATE & FORECAST, BY END USER

- US

- CANADA

- MEXICO

-

EUROPE

- MARKET ESTIMATE & FORECAST, BY COUNTRY

- MARKET ESTIMATE & FORECAST, BY COMPONENT

- MARKET ESTIMATE & FORECAST, BY PRODUCT

- MARKET ESTIMATE & FORECAST, BY END USER

- GERMNAY

- UK

- FRANCE

- ITALY

- SPAIN

- REST OF EUROPE

-

ASIA-PACIFIC

- MARKET ESTIMATE & FORECAST, BY COUNTRY

- MARKET ESTIMATE & FORECAST, BY COMPONENT

- MARKET ESTIMATE & FORECAST, BY PRODUCT

- MARKET ESTIMATE & FORECAST, BY END USER

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- SINGAPORE

- REST OF ASIA-PACIFIC

-

MIDDLE EAST & AFRICA

- MARKET ESTIMATE & FORECAST, BY COUNTRY

- MARKET ESTIMATE & FORECAST, BY COMPONENT

- MARKET ESTIMATE & FORECAST, BY PRODUCT

- MARKET ESTIMATE & FORECAST, BY END USER

- UAE

- SAUDI ARABIA

- REST OF MIDDLE EAST & AFRICA

-

SOUTH AMERICA

- MARKET ESTIMATE & FORECAST, BY COUNTRY

- MARKET ESTIMATE & FORECAST, BY COMPONENT

- MARKET ESTIMATE & FORECAST, BY PRODUCT

- MARKET ESTIMATE & FORECAST, BY END USER

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

-

COMPETITIVE LANDSCAPE

-

OVERVIEW

-

MARKET SHARE ANALYSIS

-

COMPETITIVE BENCHMARKING

-

DASHBOARD: THE LEADING PLAYER IN TERMS OF NUMBER OF DEVELOPMENTS IN SILICON PHOTONICS MARKET

-

COMPANY PROFILES

-

STMICROELECTRONICS N.V.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

IBM CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

CISCO SYSTEMS INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

INTEL CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

AIO CORE CO. LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

-

SICOYA

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

-

NKT PHOTONICS A/S

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

IPG PHOTONICS CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

FLIR SYSTEMS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

DAS PHOTONICS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

FINISAR CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

INFINERA CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

MELLANOX TECHNOLOGIES LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

HAMAMATSU PHOTONICS KK

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LIST OF TABLES

-

LIST OF ASSUMPTIONS

-

LIST OF COMPONENT PROVIDERS

-

LIST OF COMPONENT PROVIDERS

-

GLOBAL SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY PRODUCT, AVERAGE SELLING PRICE (ASP), 2023-2030 (USD)

-

GLOBAL SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

US: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

US: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

US: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

US: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

US: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

US: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

CANADA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

CANADA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

CANADA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

CANADA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

CANADA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

CANADA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

MEXICO: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

MEXICO: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

MEXICO: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

MEXICO: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

MEXICO: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

MEXICO: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

GERMANY: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

GERMANY: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

GERMANY: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

GERMANY: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

GERMANY: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

GERMANY: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

UK: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

UK: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

UK: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

UK: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

UK: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

UK: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

FRANCE: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

FRANCE: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

FRANCE: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

FRANCE: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

FRANCE: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

FRANCE: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

ITALY: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

ITALY: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

ITALY: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

ITALY: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

ITALY: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

ITALY: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

SPAIN: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

SPAIN: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

SPAIN: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

SPAIN: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

SPAIN: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

SPAIN: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

REST OF EUROPE: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

REST OF EUROPE: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

REST OF EUROPE: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

REST OF EUROPE: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

REST OF EUROPE: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

REST OF EUROPE: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

CHINA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

CHINA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

CHINA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

CHINA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

CHINA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

CHINA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

JAPAN: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

JAPAN: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

JAPAN: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

JAPAN: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

JAPAN: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

JAPAN: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

INDIA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

INDIA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

INDIA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

INDIA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

INDIA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

INDIA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

SOUTH KOREA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

SOUTH KOREA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

SOUTH KOREA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

SOUTH KOREA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

SOUTH KOREA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

SOUTH KOREA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

SINGAPORE: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

SINGAPORE: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

SINGAPORE: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

SINGAPORE: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

SINGAPORE: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

SINGAPORE: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

UAE: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

UAE: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

UAE: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

UAE: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

UAE: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

UAE: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

SAUDI ARABIA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

SAUDI ARABIA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

SAUDI ARABIA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

SAUDI ARABIA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

SAUDI ARABIA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

SAUDI ARABIA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

BRAZIL: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

BRAZIL: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

BRAZIL: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

BRAZIL: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

BRAZIL: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

BRAZIL: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

ARGENTINA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

ARGENTINA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

ARGENTINA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

ARGENTINA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

ARGENTINA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

ARGENTINA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

REST OF SOUTH AMERICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

REST OF SOUTH AMERICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023-2030 (USD MILLION)

-

REST OF SOUTH AMERICA: SILICON PHOTONICS MARKET, BY PASSIVE OPTIC COMPONENT, 2023-2030 (USD MILLION)

-

REST OF SOUTH AMERICA: SILICON PHOTONICS MARKET, BY SILICON LENS, 2023-2030 (USD MILLION)

-

REST OF SOUTH AMERICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

-

REST OF SOUTH AMERICA: SILICON PHOTONICS MARKET, BY END USER, 2023-2030 (USD MILLION)

-

DASHBOARD: THE MOST ACTIVE PLAYER IN SILICON PHOTONICS MARKET

-

STMICROELECTRONICS NV: PRODUCTS OFFERINGS

-

IBM CORPORATION: PRODUCTS OFFERINGS

-

CISCO SYSTEMS INC: PRODUCTS OFFERINGS

-

CISCO SYSTEMS INC.: KEY DEVELOPMENTS

-

INTEL CORPORATION: PRODUCTS OFFERINGS

-

INTEL CORPORATION: KEY DEVELOPMENTS

-

AIO CORE CO. LTD: PRODUCTS OFFERINGS

-

AIO CORE CO. LTD: KEY DEVELOPMENTS

-

SICOYA: PRODUCTS OFFERINGS

-

SICOYA: KEY DEVELOPMENTS

-

NKT PHOTONICS A/S: PRODUCTS OFFERINGS

-

NKT PHOTONICS A/S: KEY DEVELOPMENTS

-

IPG PHOTONICS CORPORATION: PRODUCTS OFFERINGS

-

IPG PHOTONICS CORPORATION: KEY DEVELOPMENTS

-

FLIR SYSTEMS: PRODUCTS OFFERINGS

-

FLIR SYSTEMS: KEY DEVELOPMENTS

-

DAS PHOTONICS: PRODUCTS OFFERINGS

-

FINISAR CORPORATION: PRODUCTS OFFERINGS

-

ABB LIMITED: KEY DEVELOPMENTS

-

INFINERA CORPORATION: PRODUCTS OFFERINGS

-

INFINERA CORPORATION: KEY DEVELOPMENTS

-

MELLANOX TECHNOLOGIES LTD: PRODUCTS OFFERINGS

-

MELLANOX TECHNOLOGIES LTD: KEY DEVELOPMENTS

-

HAMAMATSU PHOTONICS KK: PRODUCTS OFFERINGS

-

HAMAMATSU PHOTONICS KK: KEY DEVELOPMENTS

-

LIST OF FIGURES

-

MARKET SYNOPSIS

-

MARKET SHARE: SILICON PHOTONICS MARKET, BY REGION, (CAGR %)

-

GLOBAL SILICON PHOTONICS MARKET: MARKET STRUCTURE

-

RESEARCH PROCESS OF MRFR

-

PRIMARY RESEARCH APPROACH

-

SECONDARY RESEARCH APPROACH

-

TOP DOWN & BOTTOM UP APPROACH

-

FORECAST MODEL

-

DRO OVERVIEW OF GLOBAL SILICON PHOTONICS MARKET

-

DRIVER IMPACT ANALYSIS

-

GLOBAL SILICON PHOTONICS MARKET: VALUE CHAIN ANALYSIS

-

COMPONENT PROVIDERS: PORTERS FIVE FORCES ANALYSIS

-

SOLUTION PROVIDERS: PORTERS FIVE FORCES ANALYSIS

-

GLOBAL SILICON PHOTONICS MARKET, BY PRODUCT, 2023 VS 2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY COMPONENT, 2023 VS 2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023 VS 2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY END USER, 2023 VS 2030 (USD MILLION)

-

GLOBAL SILICON PHOTONICS MARKET, BY REGION, 2023 VS 2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023 VS 2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023 VS 2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023 VS 2030 (USD MILLION)

-

NORTH AMERICA: SILICON PHOTONICS MARKET, BY END USER, 2023 VS 2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY COMPONENT, 2023 VS 2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023 VS 2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY PRODUCT, 2023 VS 2030 (USD MILLION)

-

EUROPE: SILICON PHOTONICS MARKET, BY END USER, 2023 VS 2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY COMPONENT, 2023 VS 2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023 VS 2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY PRODUCT, 2023 VS 2030 (USD MILLION)

-

ASIA-PACIFIC: SILICON PHOTONICS MARKET, BY END USER, 2023 VS 2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023 VS 2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023 VS 2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023 VS 2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: SILICON PHOTONICS MARKET, BY END USER, 2023 VS 2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY COMPONENT, 2023 VS 2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY MICRO OPTICS, 2023 VS 2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY PRODUCT, 2023 VS 2030 (USD MILLION)

-

SOUTH AMERICA: SILICON PHOTONICS MARKET, BY END USER, 2023 VS 2030 (USD MILLION)

-

MARKET SHARE ANALYSIS, 2023 (%)

-

COMPETITIVE BENCHMARKING

-

STMICROELECTRONICS NV: FINANCIAL OVERVIEW SNAPSHOT

-

STMICROELECTRONICS NV: SWOT ANALYSIS

-

IBM CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

IBM CORPORATION: SWOT ANALYSIS

-

CISCO SYSTEMS INC: FINANCIAL OVERVIEW SNAPSHOT

-

CISCO SYSTEMS INC: SWOT ANALYSIS

-

INTEL CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

INTEL CORPORATION: SWOT ANALYSIS

-

NKT PHOTONICS A/S: FINANCIAL OVERVIEW SNAPSHOT

-

NKT PHOTONICS A/S: SWOT ANALYSIS

-

IPG PHOTONICS CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

IPG PHOTONICS CORPORATION: SWOT ANALYSIS

-

FLIR SYSTEMS: FINANCIAL OVERVIEW SNAPSHOT

-

FLIR SYSTEMS: SWOT ANALYSIS

-

DAS PHOTONICS: SWOT ANALYSIS

-

FINISAR CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

FINISAR CORPORATION: SWOT ANALYSIS

-

INFINERA CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

INFINERA CORPORATION: SWOT ANALYSIS

-

MELLANOX TECHNOLOGIES LTD: FINANCIAL OVE'

Leave a Comment