Market Share

Introduction: Navigating the Competitive Landscape of Steel Processing

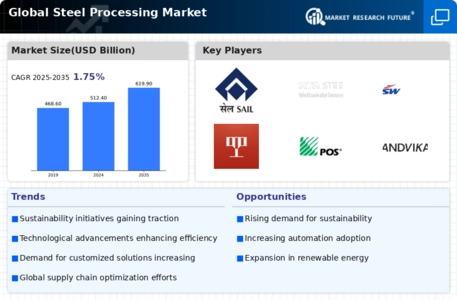

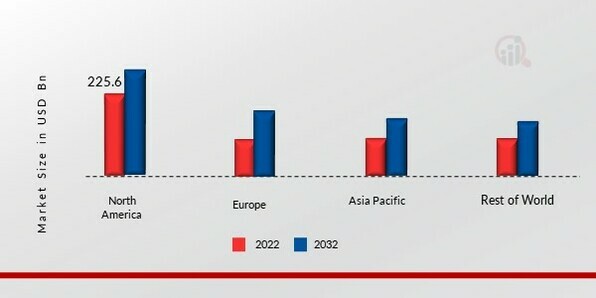

The competitive momentum within the global steel processing market is being reshaped by rapid technology adoption, stringent regulatory frameworks, and evolving consumer expectations for sustainability and efficiency. Key players, including OEMs, IT integrators, and infrastructure providers, are vying for leadership through strategic partnerships and innovative solutions. OEMs are leveraging AI-based analytics and automation to enhance production efficiency, while IT integrators focus on IoT connectivity to optimize supply chain management. Emerging disruptors, particularly green technology startups, are challenging traditional practices by introducing biometrics and eco-friendly processes that resonate with environmentally conscious consumers. As regional markets, particularly in Asia-Pacific and Europe, present significant growth opportunities, companies are strategically deploying resources to capitalize on local demand trends and regulatory incentives. The interplay of these dynamics will define competitive positioning and market share in the coming years.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across the steel processing value chain, integrating various technologies and services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Steel Authority of India Limited (SAIL) | Strong government backing and infrastructure | Integrated steel production | India, Asia |

| TATA Steel Ltd. | Diverse product portfolio and sustainability focus | Steel manufacturing and processing | Global, with strong presence in Europe and India |

| JSW Steel | Innovative technology and operational efficiency | Flat and long steel products | India, USA, Europe |

| POSCO | Advanced technology and global reach | Steel production and processing | Asia, Americas, Europe |

| Baosteel Group Corporation | Leading in production capacity and technology | Steel manufacturing | China, global markets |

| Angang Steel Company | Strong domestic market presence | Steel production | China |

Specialized Technology Vendors

These vendors focus on specific technologies and solutions that enhance steel processing efficiency and quality.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Sandvik AB | Innovative materials and cutting-edge technology | Tooling and materials for steel processing | Global |

| Nippon Steel & Sumitomo Metal Corporation | High-quality steel products and R&D | Specialty steel and advanced materials | Asia, global markets |

| Hudson Tool Steel Corporation | Expertise in tool steel solutions | Tool steel products | North America |

Infrastructure & Equipment Providers

These vendors supply essential equipment and infrastructure necessary for steel processing operations.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| NSK Limited | Precision engineering and reliability | Bearings and motion control solutions | Global |

Emerging Players & Regional Champions

- SteelTech Innovations (USA): Specializes in advanced steel processing technologies, including automation and AI-driven quality control systems. Recently secured a contract with a major automotive manufacturer to supply high-strength steel components, challenging traditional suppliers by offering faster turnaround times and lower costs.

- GreenSteel Solutions (Germany): Focuses on sustainable steel processing methods, utilizing renewable energy sources and recycling technologies. Recently implemented a pilot project in collaboration with a leading European steel mill, positioning itself as a competitor to established players by promoting eco-friendly practices.

- Asia Steel Dynamics (India): Offers customized steel processing solutions tailored for the construction and infrastructure sectors. Recently expanded its operations to Southeast Asia, providing competitive pricing and localized services that challenge larger multinational corporations.

- Innovative Metalworks (Canada): Provides niche solutions in precision steel processing for aerospace applications. Recently partnered with a Canadian aerospace company to develop lightweight steel components, complementing established vendors by filling a specific market gap.

Regional Trends: In 2024, there is a notable trend towards sustainability and automation in the Global Steel Processing Market. Regions like Europe and North America are increasingly adopting green technologies, while Asia-Pacific is focusing on cost-effective and localized solutions. The integration of AI and IoT in steel processing is becoming prevalent, enhancing efficiency and quality control across the industry.

Collaborations & M&A Movements

- ArcelorMittal and Nippon Steel entered into a joint venture to enhance their production capabilities in Asia, aiming to increase their market share in the region amidst rising demand for high-strength steel.

- Tata Steel acquired a 60% stake in a local steel processing firm in Brazil to expand its footprint in South America and leverage local expertise in the growing automotive sector.

- POSCO and Hyundai Steel announced a strategic partnership to develop eco-friendly steel production technologies, positioning themselves as leaders in sustainable practices within the industry.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Advanced Processing Technology | ArcelorMittal, Nippon Steel | ArcelorMittal has implemented cutting-edge automation in its steel processing plants, enhancing efficiency and reducing waste. Nippon Steel is known for its innovative use of AI in optimizing production processes, leading to significant cost savings. |

| Sustainability Initiatives | Thyssenkrupp, POSCO | Thyssenkrupp has made strides in carbon-neutral steel production, utilizing hydrogen in its processes. POSCO is recognized for its eco-friendly practices, including recycling and energy-efficient technologies, setting industry benchmarks. |

| Supply Chain Optimization | Tata Steel, United States Steel Corporation | Tata Steel has adopted advanced analytics for real-time supply chain management, improving responsiveness. United States Steel Corporation leverages blockchain technology to enhance transparency and traceability in its supply chain. |

| Product Diversification | JSW Steel, Steel Authority of India Limited (SAIL) | JSW Steel has expanded its product range to include high-strength steel for automotive applications, catering to evolving market demands. SAIL has diversified into specialty steels, enhancing its competitive edge. |

| Customer-Centric Solutions | Nucor Corporation, Cleveland-Cliffs | Nucor Corporation focuses on customized steel solutions for various industries, enhancing customer satisfaction. Cleveland-Cliffs has developed a robust customer service platform that integrates feedback for continuous improvement. |

Conclusion: Navigating the Steel Processing Landscape

The Global Steel Processing Market in 2024 is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a shift towards localized production and supply chains, driven by geopolitical factors and sustainability mandates. Vendors must strategically position themselves by leveraging advanced capabilities such as AI, automation, and sustainable practices to enhance operational efficiency and meet evolving customer demands. As the market evolves, flexibility in production processes will be crucial for adapting to changing market conditions. Companies that successfully integrate these capabilities will likely emerge as leaders, while those that fail to innovate may struggle to maintain relevance in this rapidly changing landscape.

Leave a Comment