Market Trends

Introduction

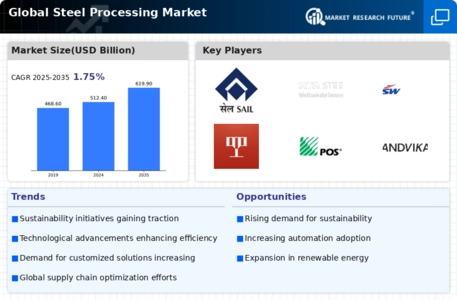

As we enter 2024, the Global Steel Processing Market is poised for significant transformation driven by a confluence of macro factors. Technological advancements, particularly in automation and digitalization, are reshaping production processes, enhancing efficiency, and reducing waste. Concurrently, regulatory pressures aimed at sustainability are compelling manufacturers to adopt greener practices, thereby influencing operational strategies. Additionally, shifts in consumer behavior, with a growing preference for high-quality and sustainable steel products, are prompting stakeholders to innovate and adapt. Understanding these trends is crucial for industry players, as they not only dictate competitive positioning but also align with broader economic and environmental goals.

Top Trends

-

Sustainability Initiatives

The steel industry is increasingly adopting sustainable practices, with major players committing to carbon neutrality by 2050. For instance, TATA Steel aims to reduce its carbon emissions by 20% by 2025. This shift is driven by regulatory pressures and consumer demand for greener products, leading to innovations in electric arc furnace technology. The operational impact includes increased investment in renewable energy sources, which may reshape supply chains and production processes. -

Digital Transformation

The integration of Industry 4.0 technologies is revolutionizing steel processing, with companies like JSW Steel implementing IoT and AI for predictive maintenance. A report indicates that digital technologies can enhance productivity by up to 30%. This trend is expected to streamline operations, reduce downtime, and improve quality control, ultimately leading to more efficient production cycles and cost savings. -

Increased Automation

Automation in steel processing is on the rise, with firms investing in robotics and automated systems to enhance efficiency. For example, Baosteel has implemented automated guided vehicles in its operations, resulting in a 15% increase in throughput. This trend is likely to reduce labor costs and improve safety, while also addressing the skilled labor shortage in the industry. -

Circular Economy Practices

The adoption of circular economy principles is gaining traction, with companies focusing on recycling and reusing materials. POSCO has initiated programs to recycle steel scrap, aiming for a 50% increase in recycled content by 2025. This trend not only reduces waste but also lowers raw material costs, positioning companies favorably in a resource-constrained environment. -

Advanced Steel Alloys Development

Research into advanced steel alloys is accelerating, driven by demand for high-performance materials in automotive and construction sectors. Nippon Steel has developed new high-strength steel grades that improve safety and reduce weight. This trend is expected to enhance product offerings and open new markets, particularly in electric vehicle manufacturing. -

Global Supply Chain Resilience

The COVID-19 pandemic highlighted vulnerabilities in global supply chains, prompting companies to diversify suppliers and localize production. Steel Authority of India Limited is exploring partnerships with local suppliers to mitigate risks. This trend is likely to lead to more robust supply chains, reducing dependency on single sources and enhancing operational flexibility. -

Focus on Quality Control

Quality control measures are becoming more stringent, with companies investing in advanced testing and monitoring technologies. Sandvik AB has implemented real-time quality monitoring systems, resulting in a 20% reduction in defects. This trend is crucial for maintaining competitiveness and meeting regulatory standards, potentially leading to higher customer satisfaction and loyalty. -

Emergence of New Markets

Emerging economies are becoming significant players in the steel processing market, with countries like India and Brazil increasing production capacities. For instance, Angang Steel Company is expanding its operations to meet rising domestic demand. This trend is expected to shift market dynamics, creating new opportunities for investment and collaboration in these regions. -

Investment in R&D

Increased investment in research and development is shaping the future of steel processing, with companies focusing on innovative production techniques. Hudson Tool Steel Corporation has allocated significant resources to develop new manufacturing processes. This trend is likely to drive technological advancements, enhancing competitiveness and enabling companies to meet evolving market demands. -

Regulatory Compliance and Standards

Stricter regulations regarding emissions and safety standards are influencing operational practices in the steel industry. Governments are enforcing compliance measures, prompting companies to invest in cleaner technologies. This trend is expected to increase operational costs initially but will ultimately lead to more sustainable practices and improved public perception of the industry.

Conclusion: Navigating the Steel Processing Landscape

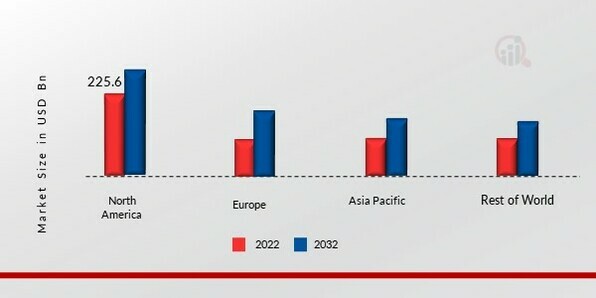

The Global Steel Processing Market in 2024 is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a shift towards localized production and supply chains, driven by geopolitical factors and sustainability mandates. Vendors must strategically position themselves by leveraging advanced capabilities such as AI, automation, and sustainable practices to enhance operational efficiency and meet evolving customer demands. As the market evolves, flexibility in production processes will be crucial for leadership, enabling companies to adapt swiftly to changing market conditions and consumer preferences. Decision-makers should focus on these strategic imperatives to navigate the complexities of the market effectively.

Leave a Comment