-

Report Prologue

-

Market Introduction

-

Definition

-

Scope Of The Study

-

List Of Assumptions

-

Limitations

-

Market Structure

-

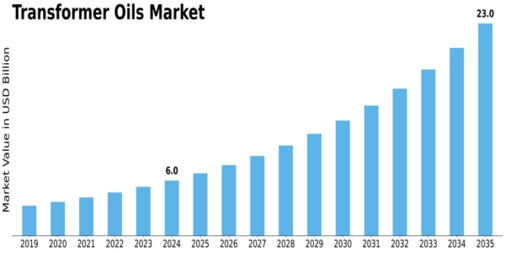

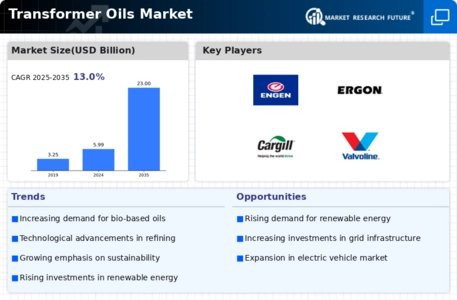

Market Insights

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

Market Dynamics

-

Introduction

- Market Dynamic Overview

-

Drivers

- Electricity Grid Expansion Owing To Increasing Energy Demand In Developing Countries Of Asia Pacific

- Continuous Transition Towards Renewable Energy Sources

- Power Grid Upgrade In Europe And North America

-

Restraints

- Fluctuating Raw Material Prices

- Increasing Demand For Dry-Type Transformers

-

Opportunities

- New Power Grid Projects In Brazil And Middle East Markets

-

Trends

- Increasing Use Of Bio-Based Transformer Oil

- Growing Demand For Silicone-Based Transformer Oil Owing To Its Fire-Resistant Properties

-

Market Factor Analysis

-

Supply Chain Analysis

- Raw Material Suppliers

- Transformer Oil Manufacturers

- Distributor/Supplier

- End-Users

-

Porter’s Five Forces Analysis

- The Threat Of New Entrants

- Bargaining Power Of Buyers

- Bargaining Power Of Supplier

- Threat Of Substitutes

- Threat Of Rivalry

-

Global Transformer Oil Market, By Type

-

Introduction

-

Naphthenic

-

Paraffinic

-

Silicone Based Transformer Oil

-

Bio Based Transformer Oil

-

Global Transformer Oil Market, By Application

-

Introduction

-

Large Transformers

-

Small Transformer

-

Utility & Others

-

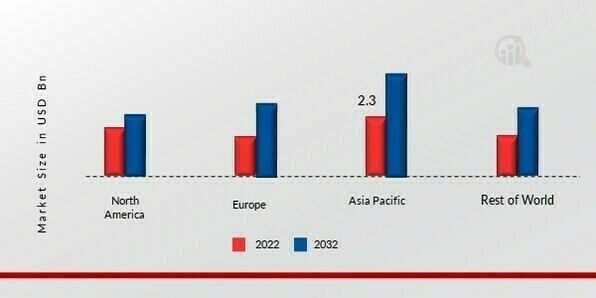

Global Transformer Oil Market, By Region

-

Introduction

-

North America

- The U.S.

- Canada

-

Europe

- Germany

- UK

- Russia

- France

- Belgium

- Spain

- Italy

- Rest Of The Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest Of The Asia Pacific

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest Of The Latin America

-

Middle East & Africa

- UAE

- South Africa

- Saudi Arabia

- Rest Of The Middle East & Africa

-

Competitive Landscape

-

Introduction

-

Leading Player Analysis

-

Expansion

-

Acquisition

-

Agreement, Partnership And Joint Venture

-

Company Profiles

-

Nynas AB

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Ergon Inc.

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Calumet Specialty Products

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

APAR Industries Limited

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

PetroChina Company

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Sinopec Group

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Hydrodec Group Plc.

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Cargill Inc.

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Engen Petroleum Limited

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Valvoline Inc.

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

San Joaquin Refining

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Gandhar Oil Refinery

- Company Overview

- Financials

- Products

- Strategy

- Key Developments

-

Conclusion

-

List Of Tables

-

GLOBAL TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET FOR NAPTHENIC (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET FOR NAPTHENIC (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET FOR PARAFFINIC (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET FOR PARAFFINIC (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET FOR SILICON BASED TRANSFORMER OIL (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET FOR SILICON BASED TRANSFORMER OIL TYPE (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET FOR BIO BASED TRANSFORMER OIL (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET FOR BIO BASED TRANSFORMER OIL (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET FOR LARGE TRANSFORMER (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET FOR LARGE TRANSFORMER (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET FOR SMALLTRANSFORMER (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET FOR SMALL TRANSFORMER (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET FOR UTILITY & OTHERS LARGE TRANSFORMER (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET FOR UTILITY & OTHERS (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET BY REGION (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET BY REGION (2022-2030) (MILLION LITER)

-

NORTH AMERICA TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (USD MILLION)

-

NORTH AMERICA TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (MILLION LITER)

-

NORTH AMERICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

NORTH AMERICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

NORTH AMERICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

NORTH AMERICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

THE U.S. TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

THE U.S. TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

THE U.S. TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

THE U.S. TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

CANADA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

CANADA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

CANADA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

CANADA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

EUROPE TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (USD MILLION)

-

EUROPE TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (MILLION LITER)

-

EUROPE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

EUROPE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

EUROPE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

EUROPE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

GERMANY TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

GERMANY TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

GERMANY TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

GERMANY TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

UK TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

UK TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

UK TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

UK TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

RUSSIA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

RUSSIA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

RUSSIA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

RUSSIA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

FRANCE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

FRANCE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

FRANCE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

FRANCE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

BELGIUM TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

BELGIUM TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

BELGIUM TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

BELGIUM TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

SPAIN TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

SPAIN TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

SPAIN TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

SPAIN TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

ITALY TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

ITALY TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

ITALY TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

ITALY TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

REST OF THE EUROPE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

REST OF THE EUROPE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

REST OF THE EUROPE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

REST OF THE EUROPE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

ASIA PACIFIC TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (USD MILLION)

-

ASIA PACIFIC TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (MILLION LITER)

-

ASIA PACIFIC TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

ASIA PACIFIC TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

ASIA PACIFIC TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

ASIA PACIFIC TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

CHINA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

CHINA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

CHINA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

CHINA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

INDIATRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

INDIATRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

INDIATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

INDIATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

JAPANTRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

JAPANTRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

JAPANTRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

JAPANTRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

SOUTH KOREATRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

SOUTH KOREATRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

SOUTH KOREATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

SOUTH KOREATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

REST OF THE ASIA PACIFIC TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

REST OF THE ASIA PACIFIC TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

REST OF THE ASIA PACIFIC TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

REST OF THE ASIA PACIFIC TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

LATIN AMERICATRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (USD MILLION)

-

LATIN AMERICATRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (MILLION LITER)

-

LATIN AMERICATRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

LATIN AMERICATRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

LATIN AMERICATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

LATIN AMERICATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

BRAZILTRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

BRAZILTRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

BRAZILTRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

BRAZILTRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

MEXICOTRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

MEXICOTRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

MEXICOTRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

MEXICOTRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

ARGENTINATRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

ARGENTINATRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

ARGENTINATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

ARGENTINATRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

REST OF THE LATIN AMERICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

REST OF THE LATIN AMERICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

REST OF THE LATIN AMERICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

REST OF THE LATIN AMERICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (USD MILLION)

-

MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY COUNTRIES (2022-2030) (MILLION LITER)

-

MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

UAE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

UAE TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

UAE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

UAE TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

SOUTH AFRICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

SOUTH AFRICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

SOUTH AFRICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

SOUTH AFRICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

SAUDI ARABIA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

SAUDI ARABIA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

SAUDI ARABIA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

SAUDI ARABIA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

REST OF THE MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

REST OF THE MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

EXPANSION, 2022-2030

-

ACQUISITION,

-

AGREEMENT, PARTNERSHIP AND JOINT VENTURE, 2022-2030

-

List Of Figures

-

NORTH AMERICA MARKET SIZE BY COUNTRY & SHARE (2022-2030)

-

EUROPE MARKET SIZE BY COUNTRY & SHARE (2022-2030)

-

ASIA PACIFIC MARKET SIZE BY COUNTRY & SHARE (2022-2030)

-

LATIN AMERICA MARKET SIZE BY COUNTRY & SHARE (2022-2030)

-

MIDDLE EAST & AFRICA MARKET SIZE BY COUNTRY & SHARE (2022-2030)

-

RESEARCH PROCESS OF MRFR

-

TOP DOWN & BOTTOM UP APPROACH

-

GLOBAL TRANSFORMER OIL MARKET BY TYPE (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET BY TYPE (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET BY APPLICATION (2022-2030) (MILLION LITER)

-

GLOBAL TRANSFORMER OIL MARKET BY REGION (2020) (%)

-

GLOBAL TRANSFORMER OIL MARKET BY REGION (2022-2030) (USD MILLION)

-

GLOBAL TRANSFORMER OIL MARKET BY REGION (2022-2030) (MILLION LITER)

-

EXPANSION WAS THE KEY GROWTH STARTERGY ADOPTED BY TRANSFORMER OIL PLAYERS, 2022-2030 117

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment