Market Analysis

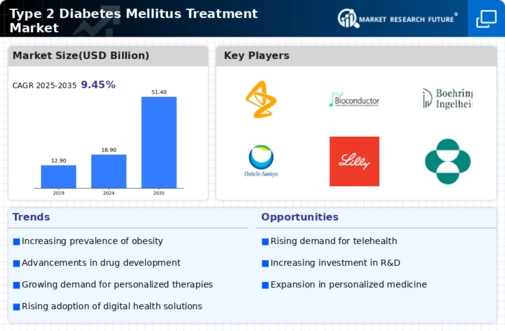

Type 2 Diabetes Mellitus Treatment Market (Global, 2024)

Introduction

Type 2 diabetes treatment market is set to witness a number of transformations as the global health care system prepares to cope with the rising prevalence of this chronic condition. The burgeoning focus on precision medicine and innovation is leading to a proliferation of new treatment options, including new pharmacological agents, digital health solutions, and lifestyle intervention programs. Awareness of the importance of early diagnosis and treatment is generating demand for effective treatment options. Moreover, the increasing use of technology, such as continuous glucose monitoring and telehealth, is transforming patient engagement and adherence to treatment. As pharmaceutical companies, physicians, and policymakers attempt to cope with the evolving landscape, an understanding of the dynamics of the type 2 diabetes treatment market will be critical to improving patient outcomes and addressing the global diabetes epidemic.

PESTLE Analysis

- Political

- In 2024, the government's policy against diabetes led to the increase of research and treatment. The United States government gave $ 1.5 billion to the National Institutes of Health for diabetes research. This showed a strong commitment to the increasing occurrence of Type 2 diabetes. Various countries also tightened up regulations on sugar in food. The British government introduced a sugar tax that has raised more than £400 million since it came into effect. The money has been reinvested in public health.

- Economic

- In the U.S., the total spending on health care is expected to reach $ 4 Trillion by 2024. This increase is partly due to the rising costs of diabetes care, which includes medications, hospitalization and outpatient care. The average annual cost of diabetes per patient is $16,750, with about $ 9,600 going toward direct medical costs. This imposes a heavy burden on both the individual and the health care system.

- Social

- Type II diabetes has been a major concern of the public for some time. As of 2024, 342 million adults in the United States were diabetic. The government has focused on a public health campaign, stressing the importance of a healthy lifestyle. There has been a significant increase in participation in diabetes prevention programs. The increase in enrollment was about 25 percent. Also, the stigma of diabetes is gradually being reduced as more people speak out about their experiences and advocate for better management and treatment.

- Technological

- In the field of diabetes, technological progress is rapidly developing, and the world market for diabetes devices is expected to reach $26 billion by 2024. Glucose monitors and devices for injecting insulin are becoming more and more accessible. There are already more than three million users of continuous monitors in the United States. And telehealth services have increased in diabetes care, with a reported increase of 60 percent in the number of virtual consultations for patients with diabetes.

- Legal

- The legal framework regulating the treatment of diabetes is becoming stricter. In 2024 the Food and Drug Administration (FDA) approved twelve new diabetes drugs, thereby showing a premeditated concern for the safety and effectiveness of these drugs. The Affordable Care Act, which requires that diabetes screening and preventive services be covered by health insurance plans without co-payments, has benefited millions of people. It is important for pharmaceutical companies and health care institutions to abide by these regulations to avoid fines.

- Environmental

- Environmental factors are becoming increasingly important in the treatment of type 2 diabetes mellitus, particularly in relation to the sustainable management of medical waste. In 2024, it is estimated that the health care sector will generate about 5.9 million tons of medical waste, of which a significant proportion will consist of diabetes-related items such as syringes and test strips. Efforts are being made to reduce this waste, and initiatives are being launched to encourage the reuse and proper disposal of medical waste and the development of biodegradable medical products.

Porter's Five Forces

- Threat of New Entrants

- The barriers to entry in the treatment of type 2 diabetes are moderate, as the market requires significant investment in research and development, regulatory approvals, and the establishment of distribution channels. However, the growing demand for innovation and the high potential returns may attract new players to the market, resulting in a moderate threat level.

- Bargaining Power of Suppliers

- The power of suppliers on the market is relatively weak, as there are many suppliers of raw materials and pharmaceuticals. There are many suppliers, and the companies can easily change the supplier, which reduces the power of the supplier.

- Bargaining Power of Buyers

- The buyers in the Type 2 diabetes treatment market, that is, the hospitals and the patients, have high bargaining power. The treatment options are many and the demand for cost-effectiveness is high. The increasing availability of generics and the increasing demand for individualized treatment make the buyers’ power even greater.

- Threat of Substitutes

- The threat of substitutes is moderate. Several treatment options are available, such as lifestyle changes, dietary changes and non-pharmaceutical treatments. However, the effectiveness and acceptance of these alternatives may vary, which may limit their impact on the market.

- Competitive Rivalry

- Competition is High - The competition in the Type 2 diabetes mellitus treatment market is high because of the presence of a large number of established pharmaceutical companies and the constant introduction of new therapies. The companies compete with each other through aggressive marketing, product differentiation, and innovation in order to gain market share.

SWOT Analysis

Strengths

- Increasing prevalence of Type 2 diabetes driving demand for treatment options.

- Advancements in technology leading to innovative treatment solutions.

- Strong pipeline of new drugs and therapies under development.

Weaknesses

- High cost of new treatments may limit accessibility for some patients.

- Complexity of treatment regimens can lead to poor patient adherence.

- Limited awareness and education about Type 2 diabetes management.

Opportunities

- Growing focus on preventive healthcare and lifestyle management.

- Expansion of telemedicine and digital health solutions for diabetes care.

- Potential for partnerships with tech companies to enhance treatment delivery.

Threats

- Regulatory challenges and lengthy approval processes for new therapies.

- Intense competition among pharmaceutical companies in the diabetes market.

- Economic downturns affecting healthcare budgets and patient spending.

Summary

The type-2 diabetes treatment market in 2024 is characterized by a strong demand, owing to the rising prevalence of the disease and the technological advancements in the treatment. Nevertheless, there are still some obstacles to overcome, such as high costs and the lack of patient compliance. Opportunities exist in the field of preventive care and digital solutions, while regulatory barriers and competition may impact the market dynamics. Strategically, education and partnership building may strengthen market positions.

Leave a Comment