Market Analysis

Waste To Energy (Global, 2025)

Introduction

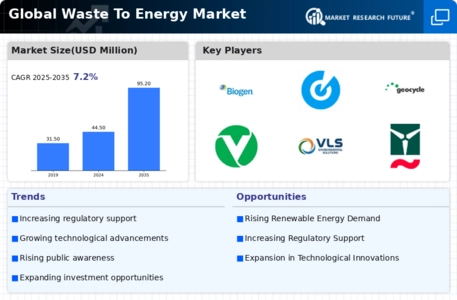

Waste to Energy (WtE) is becoming an increasingly important part of the world's transition to sustainable waste management and renewable energy. Urbanization continues to accelerate and waste volumes rise. The need for innovation in waste management and energy production becomes ever more urgent. Waste to Energy (WtE) plants convert municipal solid waste into electricity and heat, and are thus not only reducing the impact of burying waste but also contributing to energy security and resource recovery. This report examines the evolving Waste to Energy market, focusing on the regulatory framework, technological developments and public awareness, and examining the challenges and opportunities ahead. WtE is set to transform, reflecting a commitment to sustainable development and the circular economy.

PESTLE Analysis

- Political

- By 2025, government policy is increasingly in favour of renewable energy sources, including waste-to-energy (WtE) initiatives. In Europe, for example, the EU has set a target of reusing 65% of municipal waste by 2035. This is a direct incentive to WtE plants. Also, in the USA, the government has allocated approximately $1.5 billion to promote the development of WtE technology, which reflects the political will to reduce the amount of waste deposited in landfills and to increase energy production from waste.

- Economic

- The economic conditions for the waste-to-energy industry in 2025 are favourable. Rising energy prices and the rising costs of traditional waste management favour the waste-to-energy industry. The average cost of electricity produced by waste-to-energy plants is estimated at around 100 cnk/kWh, which is comparable with the cost of electricity from fossil fuels. Waste-to-energy investment is expected to reach 30 billion dollars, as both the public and private sectors seek to invest in sustainable energy solutions and waste management improvements.

- Social

- In 2025, public awareness and acceptance of waste-to-energy technology is growing, and it is estimated that about 70% of the population in urban areas support the introduction of waste-to-energy plants. Moreover, a public education campaign has been launched, demonstrating the benefits of reducing waste and generating clean energy. The WtE industry is expected to create about 50,000 jobs, contributing to local economies and increasing community involvement in sustainable practices.

- Technological

- By 2025, the efficiency of waste-to-energy processes will be improved and emissions reduced. Advances in gasification and anaerobic digestion technology are expected to increase the energy recovered by up to 20 per cent. Further, the integration of smart grids into waste-to-energy plants will optimize the distribution of energy. In the first pilot projects, the efficiency of the smart grid has been estimated to be 30 per cent higher.

- Legal

- In 2025, the regulatory framework for the waste-to-energy industry is tightened by the introduction of new emission standards. For example, the U.S. Environmental Protection Agency (EPA) sets a limit of 1,000 tons per year on the amount of greenhouse gases that can be emitted by a waste-to-energy plant. This means that the operators of waste-to-energy plants have to meet these legal requirements and, in order to comply with them, they have to invest in cleaner technology and monitoring systems.

- Environmental

- Waste-to-energy plants have an important role to play in 2025, since they reduce the need for land filling and thus lower greenhouse gas emissions. It is estimated that the amount of waste going to the WtE plants will be as much as ninety per cent lower than today, and the amount of methane produced by the decomposition of organic matter will be reduced. In addition, the carbon footprint of the energy produced from waste-to-energy is approximately 50 per cent lower than that of traditional fossil fuels, and this will contribute to the international efforts to combat climate change.

Porter's Five Forces

- Threat of New Entrants

- The Waste to Energy market in 2025 will be moderately threatened by new entrants. There are significant barriers to entry to this industry, both in terms of capital requirements and regulatory frameworks. However, the growing demand for sustainable energy solutions may lure new entrants. Competition will be strong, as established players will have the advantage of existing technology and customer relationships.

- Bargaining Power of Suppliers

- The suppliers of waste-to-energy generally have little bargaining power. The industry depends on a wide variety of raw materials, such as waste materials, which are often plentiful and abundant and which come from many suppliers. This limits the influence of a single supplier on prices and conditions and allows companies in the market to negotiate favorable conditions.

- Bargaining Power of Buyers

- The Waste-to-Energy market is characterized by medium-term buyer power. Municipalities and industries are looking for sustainable waste management solutions, and they have a choice of suppliers. However, the specialized nature of the Waste-to-Energy solutions limits the buyer's options, which reduces their bargaining power.

- Threat of Substitutes

- The threat of substitutes in the Waste to Energy market is high. The alternative energy sources such as wind, solar and traditional fossil fuels compete strongly. Furthermore, the development of new waste-reduction and recycling methods will further reduce the attractiveness of Waste to Energy solutions as consumers and businesses become more and more interested in sustainable solutions.

- Competitive Rivalry

- Competition in the waste-to-energy market is expected to be high in 2025. There are many established and new players in the market, and the growth in the market is driven by the increasing importance of both the waste and the green energy sectors. This competition can lead to price wars, technological innovations and aggressive marketing strategies as companies try to differentiate themselves and attract consumers.

SWOT Analysis

Strengths

- Reduces landfill waste and promotes sustainable waste management.

- Generates renewable energy, contributing to energy security.

- Supports circular economy initiatives by converting waste into valuable resources.

- Technological advancements improving efficiency and reducing emissions.

- Government incentives and policies favoring renewable energy projects.

Weaknesses

- High initial capital investment and operational costs.

- Public opposition due to perceived environmental risks.

- Limited availability of suitable waste feedstock in some regions.

- Complex regulatory frameworks and permitting processes.

- Technological dependency on specific waste types for optimal energy conversion.

Opportunities

- Growing demand for renewable energy sources amid climate change concerns.

- Expansion into emerging markets with increasing waste generation.

- Partnerships with municipalities for integrated waste management solutions.

- Innovations in waste sorting and processing technologies.

- Potential for carbon credits and other environmental financial incentives.

Threats

- Competition from other renewable energy sources like solar and wind.

- Economic downturns affecting investment in infrastructure projects.

- Changing regulations and policies that may impact operational viability.

- Public perception and misinformation about waste-to-energy processes.

- Technological failures or inefficiencies leading to financial losses.

Summary

Waste to Energy (WtE) in 2025 is characterized by its strengths in terms of reducing waste and generating energy, but faces challenges in the form of high costs and public opposition. Opportunities to grow are seen in emerging markets and technological development. Threats are seen in competition and regulatory changes. The strategic focus on innovation, public education and collaboration is crucial for the exploitation of strengths and opportunities and the mitigation of weaknesses and threats.

Leave a Comment