-

Executive Summary

-

Market Introduction

-

Market Definition

-

Scope of the Study

-

Assumptions & Limitations

-

Market Structure

-

Key Takeaways

-

Market Insights

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

Market Dynamics

-

Introduction

-

Drivers

-

Restraints

-

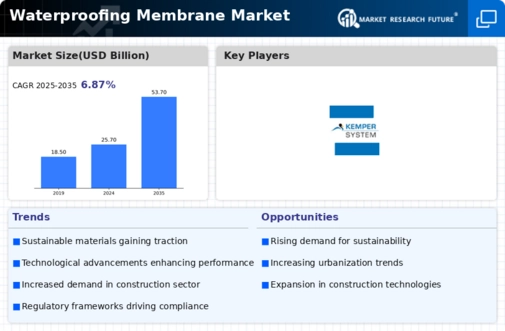

Opportunities

-

Challenges

-

Trends

-

Market Factor Analysis

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce Merchants

- End-users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Intensity of Rivalry

-

Pricing Analysis (USD/Ton)

-

Global Waterproofing Membrane Market, by Product Type

-

Introduction

-

Sheet based

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

- Polyvinyl chloride (PVC)

- Ethylene Propylene Diene Terpolymer (EPDM

- Thermoplastic Polyolefin (TPO)

- Bituminous

-

Liquid Applied

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

- Acrylic

- Bituminous

- Polyurethane

- Others

-

Global Waterproofing Membrane Market, by Application

-

Introduction

-

Roofing

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Building structures

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Water and Waste Management

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Tunnel Liners

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Bridges and Highways

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Others

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

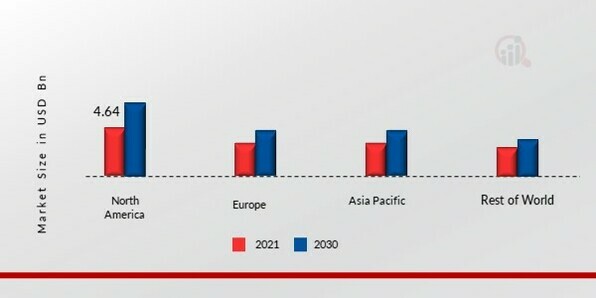

Global Waterproofing Membrane Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Product Type, 2020-2027

- Market Estimates & Forecast, by Application, 2020-2027

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Product Type, 2020-2027

- Market Estimates & Forecast, by Application, 2020-2027

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Poland

-

Asia-Pacific

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Product Type, 2020-2027

- Market Estimates & Forecast, by Application, 2020-2027

- China

- India

- Japan

- Australia

- New Zealand

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Product Type, 2020-2027

- Market Estimates & Forecast, by Application, 2020-2027

- Turkey

- Israel

- South Africa

- GCC

- Rest of the Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Product Type, 2020-2027

- Market Estimates & Forecast, by Application, 2020-2027

- Brazil

- Argentina

- Mexico

- Rest of Latin America

-

Competitive Landscape

-

Introduction

-

Market Strategies

-

Key Development Analysis (Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

Company Profiles

-

Carlisle Companies Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

DOW

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

Firestone Building Products Company, LLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

BASF SE

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

SOPREMA Group

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

Sika AG

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

GAF

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

Johns Manville

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

Minerals Technologies Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

Fosroc, Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategy

-

Appendix

-

-

LIST OF TABLES

-

Global Waterproofing Membrane Market, by Region, 2020-2027

-

North America: Waterproofing Membrane Market, by Country, 2020-2027

-

Europe: Waterproofing Membrane Market, by Country, 2020-2027

-

Asia-Pacific: Waterproofing Membrane Market, by Country, 2020-2027

-

Middle East & Africa: Waterproofing Membrane Market, by Country, 2020-2027

-

Latin America: Waterproofing Membrane Market, by Country, 2020-2027

-

Global Waterproofing Membrane Product Type Market, by Region, 2020-2027

-

North America: Waterproofing Membrane Product Type Market, by Country, 2020-2027

-

Europe: Waterproofing Membrane Product Type Market, by Country, 2020-2027

-

Asia-Pacific: Waterproofing Membrane Product Type Market, by Country, 2020-2027

-

Middle East & Africa: Waterproofing Membrane Product Type Market, by Country, 2020-2027

-

Latin America: Waterproofing Membrane Product Type Market, by Country, 2020-2027

-

Global Waterproofing Membrane Application Market, by Region, 2020-2027

-

North America: Waterproofing Membrane Application Market, by Country, 2020-2027

-

Europe: Waterproofing Membrane Application Market, by Country, 2020-2027

-

Asia-Pacific: Waterproofing Membrane Application Market, by Country, 2020-2027

-

Middle East & Africa: Waterproofing Membrane Application Market, by Country, 2020-2027

-

Latin America: Waterproofing Membrane Application Market, by Country, 2020-2027

-

Global Product Type Market, by Region, 2020-2027

-

Global Application Market, by Region, 2020-2027

-

North America: Waterproofing Membrane Market, by Country, 2020-2027

-

North America: Waterproofing Membrane Product Type Market, 2020-2027

-

North America: Waterproofing Membrane Application Market, 2020-2027

-

Europe: Waterproofing Membrane Market, by Country, 2020-2027

-

Europe: Waterproofing Membrane Product Type Market, 2020-2027

-

Europe: Waterproofing Membrane Application Market, 2020-2027

-

Asia-Pacific: Waterproofing Membrane Market, by Country, 2020-2027

-

Asia-Pacific: Waterproofing Membrane Product Type Market, 2020-2027

-

Asia-Pacific: Waterproofing Membrane Application Market, 2020-2027

-

Middle East & Africa: Waterproofing Membrane Market, by Country, 2020-2027

-

Middle East & Africa: Waterproofing Membrane Product Type Market, 2020-2027

-

Middle East & Africa: Waterproofing Membrane Application Market, 2020-2027

-

Latin America: Waterproofing Membrane Market, by Country, 2020-2027

-

Latin America: Waterproofing Membrane Product Type Market, 2020-2027

-

Latin America: Waterproofing Membrane Application Market, 2020-2027

-

LIST OF FIGURES

-

Global Waterproofing Membrane Market Segmentation

-

Forecast Methodology

-

Porter’s Five Forces Analysis of the Global Waterproofing Membrane Market

-

Supply Chain Analysis of the Global Waterproofing Membrane Market

-

Share of the Global Waterproofing Membrane Market, by Country, 2020 (%)

-

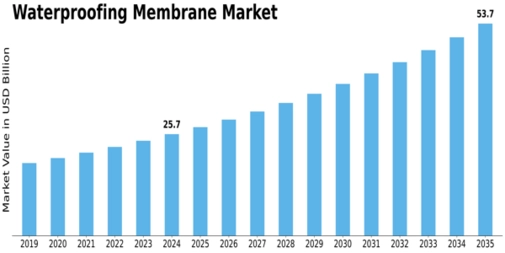

Global Waterproofing Membrane Market, 2020-2027

-

Sub-Segments of Product Type

-

Global Waterproofing Membrane Market Size, by Product Type, 2020 (%)

-

Share of the Global Waterproofing Membrane Market, by Product Type, 2020-2027

-

Sub-Segments of Application

-

Global Waterproofing Membrane Market Size, by Application, 2020 (%)

-

Share of the Global Waterproofing Membrane Market, by Application, 2020-2027

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment