Top Industry Leaders in the Waterproofing Membrane Market

Global waterproofing membrane market is deluge of opportunity attracts players big and small, all vying for a piece of the market by employing diverse strategies and battling it out against the elements. Let's dive into the tactics they use, the factors that determine dominance, and the recent developments keeping this market afloat.

Strategies to Weather the Competition:

-

Material Maneuvers: Leading players like Siplast and Carlisle Companies aren't just focused on traditional asphalt or PVC membranes. They're innovating with high-performance materials like TPO, EPDM, and HDPE, catering to specific needs like green roofs and extreme weather conditions. -

Application Focus: Understanding where the leaks lurk is crucial. Saint-Gobain Weber targets roofing applications, while Soprema specializes in bridges and tunnels, each leveraging their expertise to secure market share. -

Regional Prowess: Adapting to local needs is key. Firestone Building Products caters to the price-sensitive North American market with affordable options, while Sika targets high-tech solutions for the demanding European market. -

Sustainability Drive: Green credentials matter. Companies like GCP Applied Technologies are developing eco-friendly membranes made from recycled materials, attracting environmentally conscious consumers and complying with strict regulations. -

Vertical Integration: Gaining control over the supply chain is a power move. IKO Industries expands its presence by acquiring quarries for raw materials, ensuring quality and cost-effectiveness.

Factors Dictating Market Share:

-

Brand Reputation and Expertise: Established players like Alwitra and Elastizell, with their proven track record and extensive technical knowledge, inspire trust and command premium prices. -

Product Portfolio Breadth: Offering a diverse range of membranes with varying thickness, material properties, and installation methods, like W.R. Grace & Co. does, caters to varied customer needs and applications. -

Technical Expertise and Customer Support: Deep knowledge of waterproofing systems and their applications, like GAF's training programs and installation guides, provide value beyond the product itself. -

Regulatory Compliance and Certifications: Adherence to safety and environmental regulations, like LEED certification for green buildings, opens doors to new markets and builds trust. -

Sustainability Savvy: Eco-conscious customers favor bio-based and low-VOC membranes. Players like Bauder, with their green initiatives, attract this growing segment.

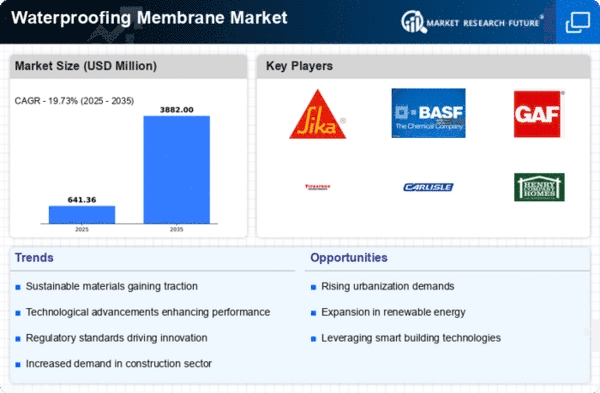

Key Players:

BASF SE (Germany)

Sika AG (Switzerland)

Mapei SpA (Italy)

Fosroc Inc (UK)

Kemper System America, Inc.

GAF Materials Corporation

Paul Bauder GmbH & Co

Recent Developments:

-

September 2023: A major infrastructure project in India mandates the use of self-healing membranes for all bridge decks, highlighting the growing popularity of this technology. -

October 2023: The American Society of Civil Engineers updates its specifications for waterproofing membranes, raising the bar for quality and performance. -

November 2023: Startups emerge offering innovative spray-on waterproofing solutions, disrupting the traditional market with their ease of application and rapid curing times. -

December 2023: Concerns about the potential environmental impact of traditional waterproofing materials spark public debate, prompting industry leaders to call for responsible development and research into environmentally friendly alternatives.