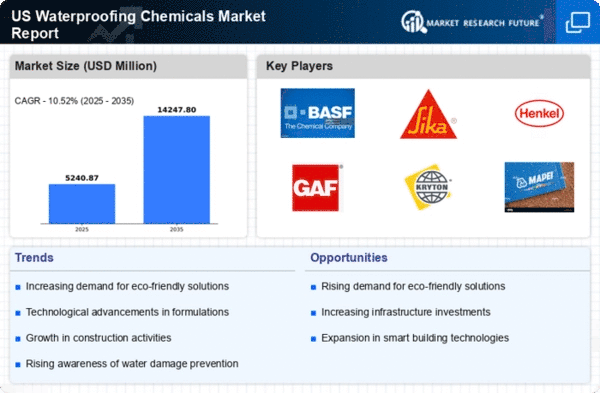

The waterproofing chemicals market in the US is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as BASF SE (Germany), Sika AG (Switzerland), and Dow Inc. (US) are actively pursuing strategies that emphasize product development and market expansion. For instance, BASF SE (Germany) focuses on enhancing its product portfolio through sustainable solutions, while Sika AG (Switzerland) is known for its aggressive acquisition strategy, which has allowed it to broaden its market reach and technological capabilities. Dow Inc. (US) is also investing in digital transformation initiatives to optimize its operations and improve customer engagement, thereby collectively influencing the competitive dynamics of the market.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the waterproofing chemicals market appears moderately fragmented, with several key players holding substantial market shares. This fragmentation allows for a diverse range of products and solutions, fostering innovation and competition among the leading firms.

In October Sika AG (Switzerland) announced the acquisition of a regional waterproofing solutions provider, which is expected to strengthen its market position in North America. This strategic move not only enhances Sika's product offerings but also expands its geographical footprint, allowing for better service delivery and customer engagement in a competitive market. The acquisition aligns with Sika's long-term strategy of growth through targeted acquisitions, indicating a robust approach to market consolidation.

In September Dow Inc. (US) launched a new line of eco-friendly waterproofing products designed to meet the growing demand for sustainable construction materials. This initiative reflects Dow's commitment to sustainability and innovation, positioning the company favorably in a market that increasingly values environmentally responsible solutions. The introduction of these products is likely to attract environmentally conscious consumers and contractors, thereby enhancing Dow's competitive edge.

In November BASF SE (Germany) unveiled a digital platform aimed at streamlining the customer experience in the waterproofing sector. This platform is designed to provide customers with real-time access to product information, technical support, and order tracking. By leveraging digital technology, BASF aims to enhance customer satisfaction and loyalty, which is crucial in a market where customer experience is becoming a key differentiator.

As of November the competitive trends in the waterproofing chemicals market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances among key players are shaping the landscape, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and deliver sustainable solutions.