Regulatory Standards and Building Codes

The Integral Waterproofing Compound Market is significantly influenced by evolving regulatory standards and building codes. Governments and regulatory bodies are increasingly implementing stringent guidelines to ensure the safety and durability of construction materials. These regulations often mandate the use of effective waterproofing solutions in various types of construction projects. Recent data suggests that compliance with these standards can enhance the marketability of properties, as buyers are more inclined to invest in buildings that meet or exceed safety regulations. Consequently, manufacturers of integral waterproofing compounds are likely to benefit from increased demand as builders seek compliant materials. This trend indicates that adherence to regulatory standards will play a crucial role in shaping the future of the integral waterproofing compound market.

Increased Awareness of Water Damage Risks

The Integral Waterproofing Compound Market is also being driven by heightened awareness of the risks associated with water damage. Homeowners and builders are increasingly recognizing the long-term costs and structural issues that can arise from inadequate waterproofing. This awareness is prompting a shift towards proactive measures, including the use of integral waterproofing compounds during construction and renovation projects. Industry expert's indicates that the cost of water damage restoration can exceed thousands of dollars, making preventive solutions more appealing. As a result, the demand for integral waterproofing compounds is likely to grow, as they provide a reliable barrier against moisture intrusion. This trend underscores the importance of education and marketing efforts aimed at informing consumers about the benefits of investing in quality waterproofing solutions.

Urbanization and Infrastructure Development

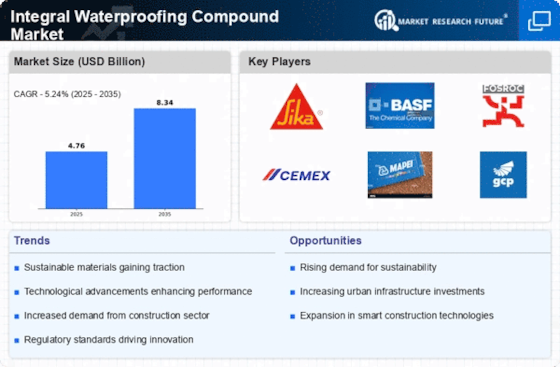

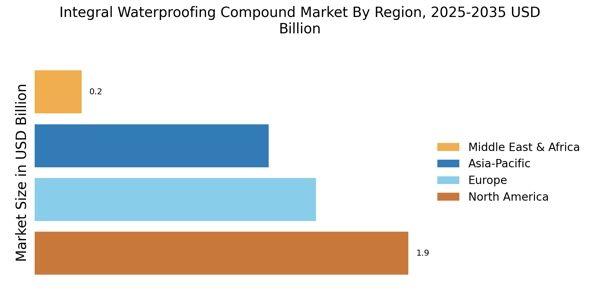

The Integral Waterproofing Compound Market is poised for growth due to rapid urbanization and infrastructure development. As urban areas expand, the demand for residential and commercial buildings increases, necessitating effective waterproofing solutions to protect structures from water damage. Recent statistics reveal that urban populations are expected to rise by 2.5 billion by 2050, leading to a surge in construction activities. This trend creates a substantial market opportunity for integral waterproofing compounds, which are essential for ensuring the longevity and safety of buildings. Furthermore, government initiatives aimed at improving infrastructure, such as roads, bridges, and public facilities, are likely to further drive the demand for these compounds. Consequently, the integral waterproofing compound market is expected to benefit from the ongoing urbanization trends.

Rising Demand for Sustainable Construction Materials

The Integral Waterproofing Compound Market is experiencing a notable shift towards sustainable construction practices. As environmental concerns gain prominence, builders and contractors are increasingly seeking materials that minimize ecological impact. Integral waterproofing compounds, which enhance the durability and longevity of structures, align with this trend. According to recent data, the market for sustainable construction materials is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by regulatory frameworks promoting green building practices and the increasing awareness among consumers regarding the benefits of sustainable materials. Consequently, the demand for integral waterproofing compounds is likely to rise, as they contribute to energy efficiency and resource conservation in construction projects.

Technological Innovations in Waterproofing Solutions

Technological advancements are significantly influencing the Integral Waterproofing Compound Market. Innovations in formulation and application techniques are enhancing the performance and effectiveness of waterproofing compounds. For instance, the introduction of nanotechnology in waterproofing solutions has improved their ability to repel water and resist chemical degradation. Market data indicates that the adoption of advanced technologies in construction materials is expected to increase by 15% in the coming years. This trend suggests that manufacturers who invest in research and development of innovative waterproofing solutions may gain a competitive edge. As a result, the integral waterproofing compound market is likely to witness an influx of new products that offer superior performance, thereby attracting a broader customer base.