Technological Innovations

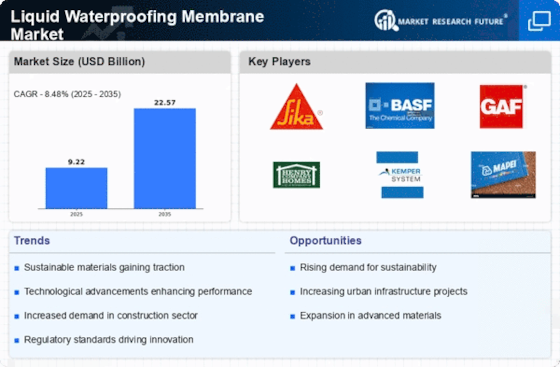

Technological advancements are playing a pivotal role in shaping the Liquid Waterproofing Membrane Market. Innovations in formulation and application techniques are enhancing the performance and efficiency of these membranes. For instance, the introduction of advanced polymer-based membranes offers superior adhesion, flexibility, and resistance to environmental factors. In 2025, the market is likely to witness a shift towards smart waterproofing solutions that incorporate sensors for real-time monitoring of moisture levels. Such innovations not only improve the effectiveness of waterproofing systems but also contribute to sustainability by reducing material waste. As technology continues to evolve, the Liquid Waterproofing Membrane Market is expected to benefit from enhanced product offerings that meet the diverse needs of consumers.

Rising Construction Activities

The Liquid Waterproofing Membrane Market is experiencing a surge in demand due to increasing construction activities across various sectors. Urbanization and infrastructure development projects are driving the need for effective waterproofing solutions. In 2025, the construction sector is projected to grow at a rate of approximately 5.5%, leading to a heightened requirement for liquid waterproofing membranes. These membranes are essential in protecting structures from water damage, thereby enhancing their longevity and durability. As more buildings are constructed, the demand for reliable waterproofing solutions is likely to escalate, positioning the Liquid Waterproofing Membrane Market for substantial growth. Furthermore, the trend towards high-rise buildings and complex architectural designs necessitates advanced waterproofing technologies, further fueling market expansion.

Increased Awareness of Water Damage

Awareness regarding the detrimental effects of water damage on buildings is significantly influencing the Liquid Waterproofing Membrane Market. Property owners and builders are increasingly recognizing that water intrusion can lead to severe structural issues, mold growth, and costly repairs. This awareness is prompting a shift towards preventive measures, including the adoption of liquid waterproofing membranes. In 2025, it is estimated that the cost of water damage in residential and commercial properties could reach billions, underscoring the importance of effective waterproofing solutions. As a result, the demand for liquid waterproofing membranes is expected to rise, as stakeholders seek to mitigate risks associated with water damage and ensure the integrity of their investments.

Regulatory Standards and Compliance

The Liquid Waterproofing Membrane Market is significantly influenced by regulatory standards and compliance requirements. Governments and regulatory bodies are increasingly implementing stringent building codes aimed at improving water resistance in construction. These regulations often mandate the use of high-quality waterproofing solutions, thereby driving demand for liquid waterproofing membranes. In 2025, it is anticipated that compliance with these standards will become more rigorous, compelling builders and contractors to invest in reliable waterproofing systems. This trend not only ensures the safety and durability of structures but also positions the Liquid Waterproofing Membrane Market as a critical component in the construction supply chain, fostering growth opportunities.

Sustainability and Eco-Friendly Solutions

The growing emphasis on sustainability is reshaping the Liquid Waterproofing Membrane Market. Consumers and businesses are increasingly seeking eco-friendly waterproofing solutions that minimize environmental impact. Liquid waterproofing membranes that are solvent-free and made from sustainable materials are gaining traction. In 2025, the market is expected to see a rise in demand for products that align with green building practices, as more construction projects aim for certifications such as LEED. This shift towards sustainability not only addresses environmental concerns but also enhances the marketability of properties. As a result, the Liquid Waterproofing Membrane Market is likely to experience growth driven by the increasing preference for environmentally responsible products.