Sustainability Focus

The Liquid Applied Membrane Market is increasingly influenced by a growing emphasis on sustainability and eco-friendly construction practices. As environmental regulations become more stringent, manufacturers are compelled to develop membranes that are not only effective but also environmentally responsible. This shift is evident in the rising demand for water-based and solvent-free formulations, which minimize harmful emissions during application. Additionally, the market is witnessing a trend towards the use of recycled materials in membrane production, aligning with the circular economy principles. According to recent estimates, the sustainable segment of the market is expected to account for over 30% of total sales by 2026, reflecting a significant shift in consumer preferences towards greener solutions.

Technological Advancements

The Liquid Applied Membrane Market is experiencing a surge in technological advancements that enhance product performance and application efficiency. Innovations in polymer chemistry and application techniques are leading to the development of membranes that offer superior waterproofing, durability, and flexibility. For instance, the introduction of advanced spray technologies allows for quicker application and better adhesion, which is crucial in construction and infrastructure projects. As a result, the market is projected to grow at a compound annual growth rate of approximately 7% over the next five years, driven by these technological improvements. Furthermore, the integration of smart technologies, such as sensors that monitor membrane integrity, is likely to revolutionize the industry, providing real-time data and enhancing maintenance protocols.

Regulatory Support and Standards

The Liquid Applied Membrane Market is significantly influenced by regulatory support and the establishment of industry standards that promote the use of high-performance waterproofing solutions. Governments and regulatory bodies are increasingly recognizing the importance of building codes that mandate the use of effective liquid applied membranes in construction projects. This regulatory framework not only ensures safety and quality but also encourages innovation among manufacturers to meet stringent performance criteria. As a result, the market is likely to see a boost in demand as compliance with these regulations becomes a prerequisite for construction projects. It is projected that adherence to new standards will drive a 6% increase in market growth over the next few years, as more projects incorporate advanced membrane technologies.

Rising Demand in Emerging Markets

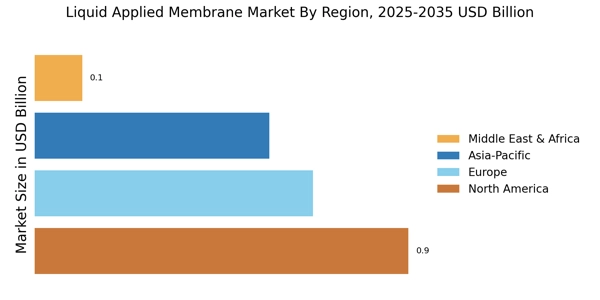

The Liquid Applied Membrane Market is benefiting from the rising demand in emerging markets, where rapid urbanization and infrastructure development are driving the need for effective waterproofing solutions. Countries in Asia-Pacific and Latin America are witnessing significant investments in construction and renovation projects, which in turn fuels the demand for liquid applied membranes. For example, the construction sector in India is projected to grow at a rate of 8% annually, creating substantial opportunities for membrane manufacturers. This trend is further supported by government initiatives aimed at improving infrastructure resilience against climate change, thereby increasing the adoption of advanced waterproofing technologies. As a result, the market is likely to expand significantly in these regions over the coming years.

Increased Awareness of Building Protection

The Liquid Applied Membrane Market is experiencing heightened awareness regarding the importance of building protection against water ingress and environmental damage. This awareness is largely driven by the increasing frequency of extreme weather events, which has prompted both consumers and builders to prioritize waterproofing solutions. Educational campaigns and industry standards are emphasizing the necessity of using high-quality membranes to ensure long-term durability and safety of structures. Consequently, this trend is expected to propel the market forward, as more stakeholders recognize the value of investing in reliable liquid applied membranes. It is estimated that the demand for these products will increase by approximately 5% annually as awareness continues to grow.