Research Methodology on PTFE Membrane Market

The research methodology employed for this report on the PTFE membrane market covers primary and secondary research and is composed of three stages. Several sources of data have been consulted for formulating the market analysis such as internal and external sources. The primary sources include interviews, surveys, and observations from which current data and future trends have been extracted. Additionally, the market size and forecasts till 2030 were calculated. In order to give detailed insights into the PTFE membrane market for the period 2023-2030 primary research was conducted for this report.

Primary Research

Primary research involves interviews with key players in the PTFE membrane market, industry experts, and C-level executives from key companies and organizations. Primary research sources also include a survey completed by the key players, industry consultants and professionals from other stakeholders. Primary research sources work as building blocks for secondary research sources by validating, collecting and analyzing the data.

Secondary Research

Secondary research involves the search for informational data related to the PTFE membrane market on paid and open databases, company websites and other published research papers. These sources provide an understanding of qualitative and quantitative aspects of the market. The secondary research data were used to supplement and validate the figures derived from the primary research.

Market Size Estimation

The collected data from various primary and secondary sources was bi-triangulated and then compiled to provide a meaningful view of the PTFE membrane market. The data from reliable sources are used for market size estimation of the PTFE membrane market.

Data Triangulation

The collected data from primary and secondary research was triangulated to structure a well-defined and consistent market view. In addition, the bottom-up approach and top-down approach provide a better understanding of the market and an accurate depiction of the number of companies operating in the PTFE membrane market.

Market Breakdown and Data Verification

In this stage of research, the market segments, such as by product type, application, key regions, and end-use markets, were identified to thoroughly analyze the PTFE membrane market. The data mentioned in this report is verified and authenticated using company websites, annual reports, investor presentations, and other regulatory filings.

To provide further consistency, algorithm-led classifications were used. The algorithm-led classifications were consistent, correct, and unbiased. The algorithm-led classifications were revisited for more accuracy and could be complemented with manual classifications.

Assumptions

A few of the assumptions considered in the preparation of this report are:

- The impact of the COVID-19 pandemic on the market has been considered while making the projections

- The PTFE membrane market projections are expected to remain stable during the forecast period

- Technological developments and future changes are expected to have a direct impact on the market

- The data derived from primary and secondary sources on the PTFE membrane market is considered to be reliable for deriving the market estimates

- The market projections are based on the market status prior to the COVID-19 pandemic.

The information collected by primary and secondary research was consolidated and presented in graphical, tabular and numerical formats. The market forecasts were made using primary and secondary research sources and varied market models. The M&A activity, collaborations, R&D expenditure, incorporation of market technologies, and product launches are expected to drive the PTFE membrane market in the direction of potential growth, competitive pricing, and product benefits.

Conclusion

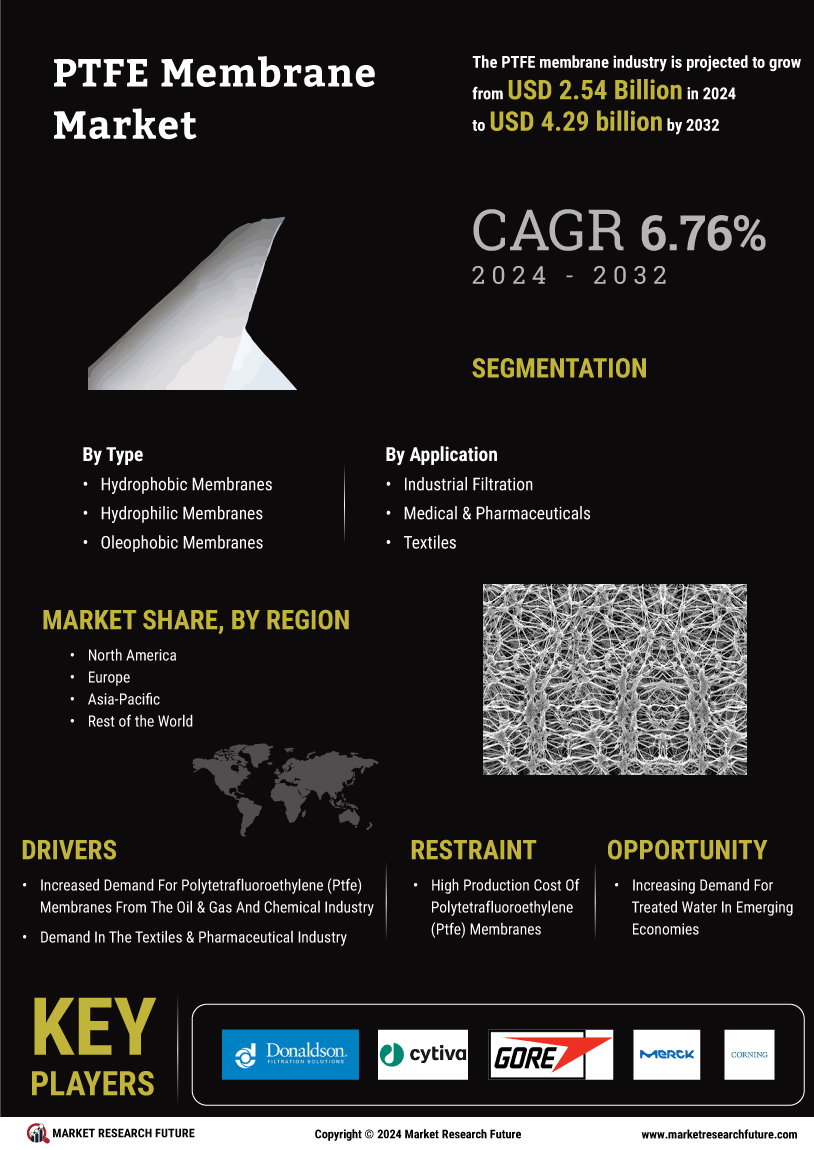

The research methodology used for this report on the PTFE membrane market involved primary and secondary research. Data were collected from primary and secondary sources, which were then validated and triangulated to provide the most accurate picture of the global market. In addition, the market size and forecasts till 2030 were calculated. A comprehensive assessment of the industry was conducted, and the opportunities and challenges in the market were identified. It is expected that the PTFE membrane market will witness robust growth during the forecast period 2023 to 2030.