Sustainability and Eco-Friendly Solutions

The growing emphasis on sustainability is influencing the Commercial Restoration Waterproofing Membrane Market. As environmental concerns rise, there is a shift towards eco-friendly waterproofing solutions that minimize environmental impact. Manufacturers are increasingly developing membranes made from recycled materials and those that are energy-efficient. This trend aligns with the broader movement towards sustainable construction practices, which is gaining momentum across various sectors. The market for eco-friendly waterproofing membranes is projected to grow significantly, with estimates suggesting a potential increase of 20% in market share over the next five years as more companies adopt sustainable practices.

Growing Awareness of Water Damage Prevention

Awareness regarding the prevention of water damage is significantly influencing the Commercial Restoration Waterproofing Membrane Market. Water intrusion can lead to severe structural damage and costly repairs, prompting property owners to invest in effective waterproofing solutions. The market is witnessing a shift towards proactive measures, with an increasing number of businesses and homeowners recognizing the importance of waterproofing in maintaining property value. This trend is reflected in the rising sales of waterproofing membranes, which are expected to reach a valuation of over $2 billion by 2026. The focus on preventive maintenance is likely to sustain the growth of this market.

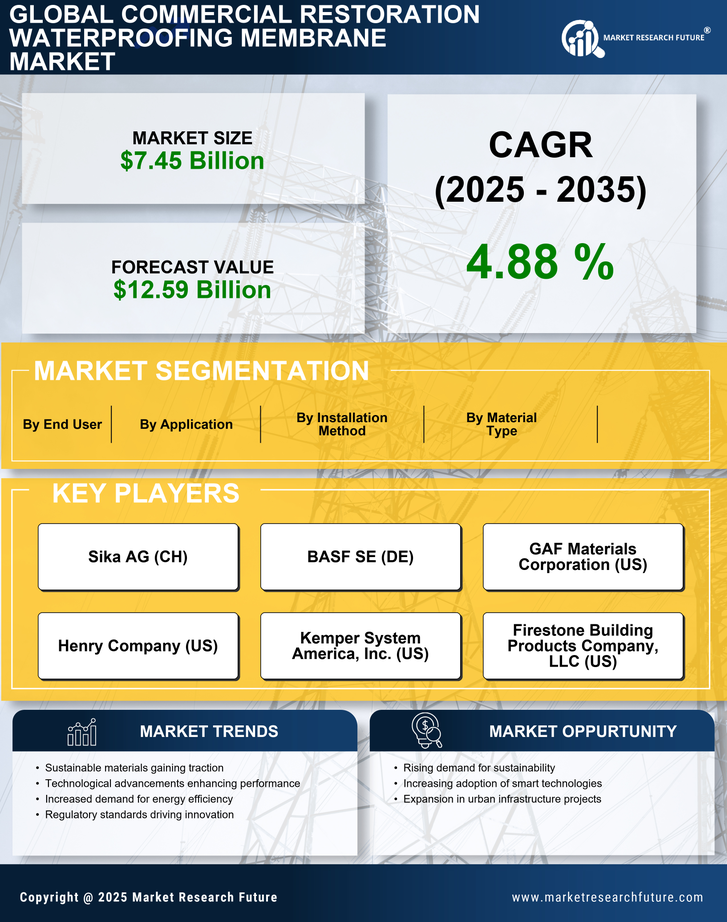

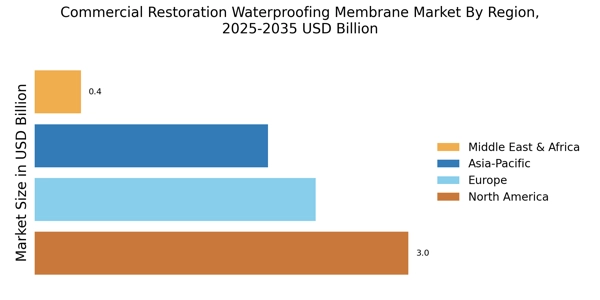

Rising Demand for Infrastructure Development

The increasing demand for infrastructure development is a primary driver for the Commercial Restoration Waterproofing Membrane Market. As urbanization accelerates, the need for durable and reliable waterproofing solutions becomes paramount. Governments and private sectors are investing heavily in infrastructure projects, including roads, bridges, and commercial buildings. This trend is expected to continue, with the market projected to grow at a compound annual growth rate of approximately 6% over the next five years. The emphasis on long-lasting materials that can withstand environmental challenges further propels the demand for advanced waterproofing membranes, making it a critical component in construction and restoration projects.

Increased Regulatory Standards for Building Safety

The implementation of stricter regulatory standards for building safety is a significant driver for the Commercial Restoration Waterproofing Membrane Market. Governments are enforcing regulations that mandate the use of high-quality waterproofing materials to ensure the safety and longevity of structures. Compliance with these regulations is becoming essential for construction companies, leading to a surge in demand for certified waterproofing membranes. This trend is likely to continue, as regulatory bodies emphasize the importance of safety in construction practices. The market is expected to see a steady increase in demand for compliant waterproofing solutions, potentially reaching a market size of $3 billion by 2027.

Technological Innovations in Waterproofing Solutions

Technological advancements are reshaping the Commercial Restoration Waterproofing Membrane Market. Innovations such as self-healing membranes and advanced polymer formulations are enhancing the performance and longevity of waterproofing solutions. These technologies not only improve the effectiveness of waterproofing but also reduce installation time and costs. The introduction of smart membranes that can monitor moisture levels and provide real-time data is also gaining traction. As these technologies become more accessible, they are expected to drive market growth, with an estimated increase in market share of around 15% for high-tech waterproofing solutions over the next few years.