To gather both qualitative and quantitative information, the primary research process involved interviewing players from both the supply and demand sides. Aquafeed producers, suppliers of hatchery technology, providers of genetics/broodstock, integrators of RAS systems, and CEOs, Managing Directors, VPs of business development, and heads of research and development from aquaculture equipment manufacturers (cage systems, feeding automation, water quality monitoring) made up the supply side. Procurement directors from seafood processing companies, aquaculture consultants, sustainability officers from integrated aquaculture corporations, hatchery managers, nursery operators, and commercial aquaculture farm owners and operators (salmon, shrimp, tilapia, and carp operations) made up the demand-side sources.

Primary research validated market segmentation across culture environments (freshwater, marine, brackish water), confirmed product pipeline timelines for smart feeding systems and IoT-based monitoring equipment, and gathered insights on species-specific farming adoption patterns, feed conversion ratios, pricing dynamics for aeration and pumping equipment, and regulatory compliance costs.

Primary Respondent Breakdown:

By Designation: C-level Primaries (28%), Director Level (32%), Others (40%)

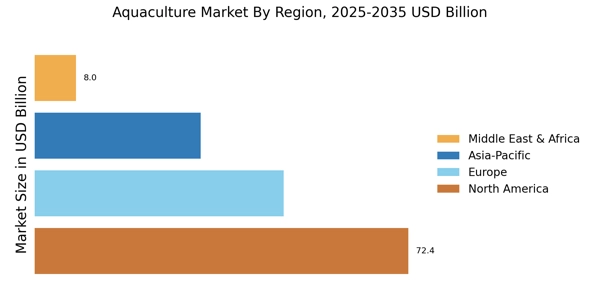

By Region: North America (32%), Europe (30%), Asia-Pacific (28%), Rest of World (10%)

Global market valuation was derived through production volume mapping and equipment revenue analysis. The methodology included:

Identification of 55+ key manufacturers across aquaculture equipment, feed, chemicals, and technology segments covering Norway, China, USA, Chile, Vietnam, India, and key European markets

Product mapping across aeration systems, feeding systems, water quality monitoring, cages and net accessories, land-based RAS equipment, and healthcare/chemical products (vaccines, probiotics, water treatment)

Analysis of reported and modeled annual revenues specific to aquaculture portfolios

Coverage of manufacturers representing 68-72% of global market share in 2024

Extrapolation using bottom-up (production volume × equipment intensity by farm type × ASP by region) and top-down (manufacturer revenue validation) approaches to derive segment-specific valuations for finfish, crustacean, and mollusk farming operations