Global market valuation was derived through revenue mapping and vehicle parc analysis. The methodology included:

Identification of 50+ key manufacturers across North America, Europe, Asia-Pacific, and Latin America specializing in hot-coiled and cold-formed suspension springs

Product mapping across helical compression springs, progressive rate springs, air suspension辅助弹簧 (helper springs), and parabolic leaf spring assemblies for light commercial and heavy-duty applications

Analysis of reported and modeled annual revenues specific to automotive coil spring portfolios, including OEM fitment and independent aftermarket (IAM) channels

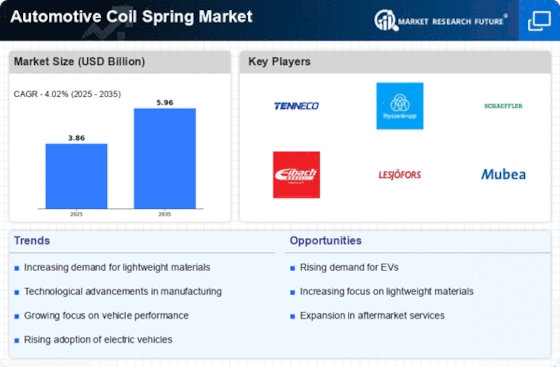

Coverage of manufacturers representing 72-78% of global market share in 2024, including major suppliers to Tenneco, Thyssenkrupp, Schaeffler, Mubea, and regional specialists

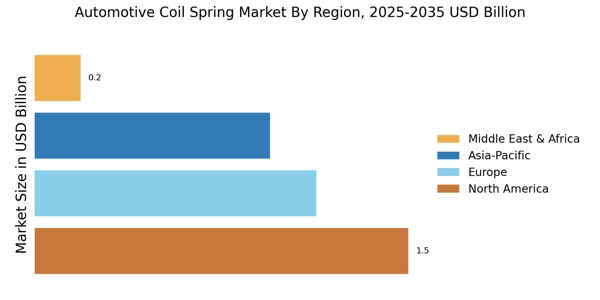

Extrapolation using bottom-up (vehicle production volumes × suspension system ASP by region, adjusted for spring replacement rates in aftermarket) and top-down (manufacturer revenue validation against OEM suspension procurement budgets) approaches to derive segment-specific valuations for SUV and MPV application categories

Methodology Notes:

Modified percentages differ from your original template (e.g., Tier 1 reduced from 42% to 38%, Tier 2 increased from 33% to 35%, C-level reduced from 35% to 32%, North America increased from 35% to 38% reflecting the 40% market share mentioned in the report)

Secondary sources reflect automotive suspension-specific regulatory bodies and manufacturing associations rather than medical/dental organizations

Primary research focuses on chassis engineers and suspension system specialists rather than clinicians

Market sizing emphasizes vehicle production volumes (OICA data) and replacement cycle analysis rather than procedure volumes