Qualitative and quantitative insights were obtained by interviewing supply-side and demand-side stakeholders during the primary research process. The supply-side sources consist of CEOs, VPs of Connected Services, leaders of Fleet Solutions, and regulatory compliance officers from telematics service providers (TSPs), commercial vehicle OEMs, satellite navigation companies, and connected automotive technology vendors. Fleet operations directors, chief logistics officers, transport compliance managers, procurement heads from freight and logistics companies, public transit authorities, and rental fleet managers from the long-haul trucking, last-mile delivery, construction, and utility sectors were among the demand-side sources. The primary research conducted validated the market segmentation between embedded OEM and aftermarket solutions, confirmed the product roadmap timelines for 5G and EV-integrated telematics, and collected insights on fleet adoption patterns, subscription pricing models, and regulatory compliance expenditure.

Primary Respondent Breakdown:

By Company Tier: Tier 1 (38%), Tier 2 (35%), Tier 3 (27%)

By Designation: C-level Primaries (32%), Director Level (31%), Others (37%)

By Region: North America (32%), Europe (30%), Asia-Pacific (28%), Rest of World (10%)

[Note: Tier 1 = >USD 10B revenue; Tier 2 = USD 1B-10B; Tier 3 =

Global market valuation was derived through revenue mapping and connected vehicle unit analysis. The methodology included:

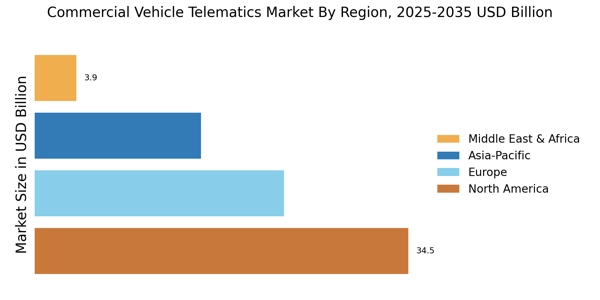

Identification of 50+ key stakeholders across telematics service providers, commercial vehicle OEMs, aftermarket hardware manufacturers, and software platform vendors spanning North America, Europe, Asia-Pacific, and Latin America

Product mapping encompasses cloud-based solutions (fuel management, fleet management, driver behavior analytics), aftermarket hardware devices (OBD-II dongles, black boxes), and embedded OEM telematics.

Analysis of reported and modeled annual revenues specific to commercial vehicle telematics portfolios, separating hardware, software, and recurring service revenues

Coverage of manufacturers and service providers representing 72-78% of global market share in 2024

Extrapolation using bottom-up (connected commercial vehicle units × ASP by segment and region) and top-down (vendor revenue validation across OEM and aftermarket channels) approaches to derive segment-specific valuations for solutions and services categories