In order to gather both qualitative and quantitative insights, supply-side and demand-side stakeholders were interviewed during the primary research phase. Supply-side sources included CEOs, VPs of Manufacturing, regulatory affairs heads, and commercial directors from dicalcium phosphate producers, phosphate mining firms, and chemical processors. Demand-side sources comprised procurement directors from animal feed manufacturers, food & beverage formulators, pharmaceutical excipient buyers, and agricultural fertilizer distributors, along with quality assurance managers from nutrition companies and regulatory compliance officers from end-use industries. Primary research validated market segmentation, confirmed production capacity expansion timetables, and gathered information on raw material sourcing patterns, pricing tactics, and regulatory compliance dynamics.

Primary Respondent Breakdown:

By Designation: C-level Primaries (32%), Director Level (31%), Others (37%)

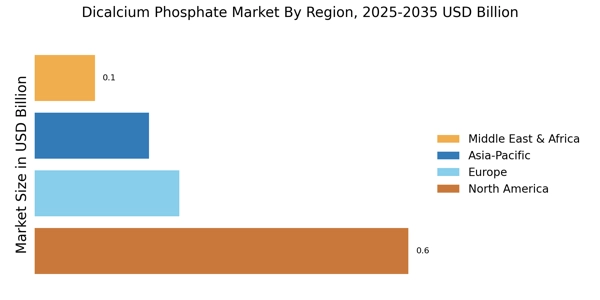

By Region: North America (32%), Europe (30%), Asia-Pacific (28%), Rest of World (10%)

Global market valuation was calculated using revenue mapping and production volume research. The methods included:

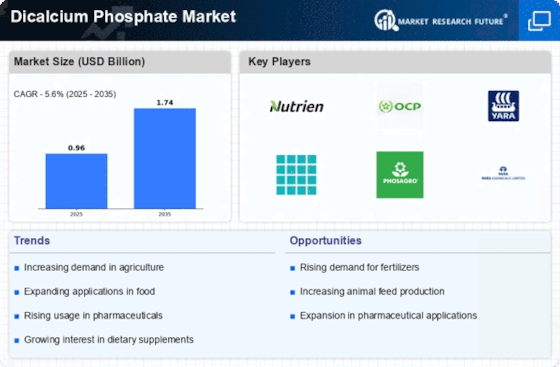

Identification of 40+ significant manufacturers in North America, Europe, Asia-Pacific, and Latin America

Product mapping between phosphoric acid-based and hydrochloric acid-based manufacturing methods End-use segmentation includes food & beverage, animal feed, medicinal, agricultural, and other industrial applications

Analysis of reported and estimated yearly revenues specific to dicalcium phosphate portfolios

Coverage of manufacturers with 70-75% of global market share in 2024

Extrapolation employing bottom-up (production volume × ASP by region/application) and top-down (manufacturer revenue validation) methodologies to derive segment-specific values