水耕栽培市場 概要

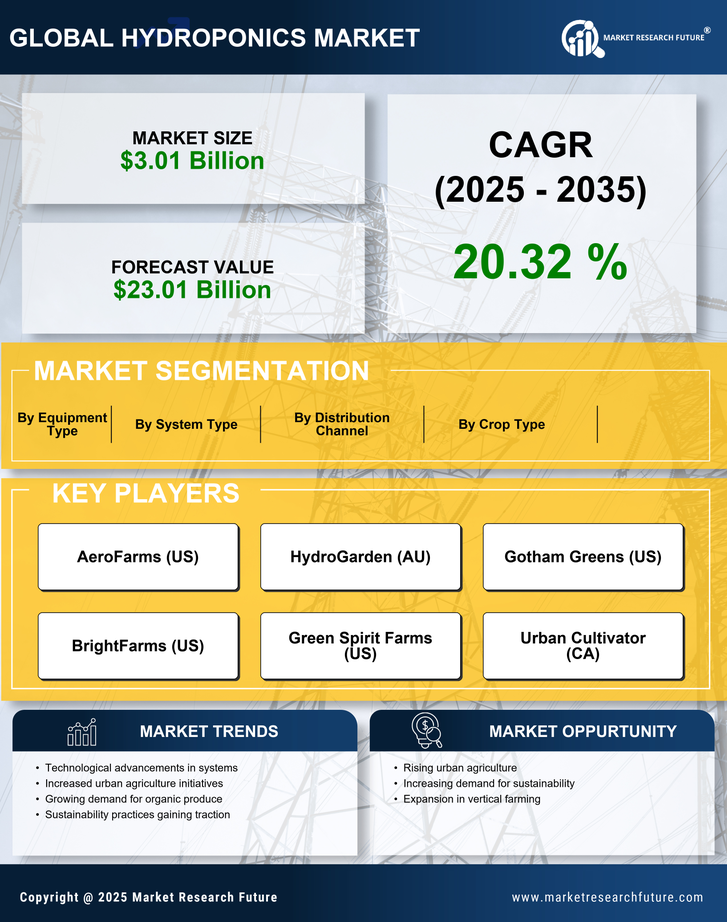

MRFRの分析によると、2024年の水耕栽培市場規模は30.07億米ドルと推定されています。水耕栽培業界は、2025年に36.18億米ドルから2035年には230.1億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は20.32を示します。

主要な市場動向とハイライト

水耕栽培市場は、技術の進歩と新鮮な農産物に対する消費者の需要の増加により、堅調な成長を遂げています。

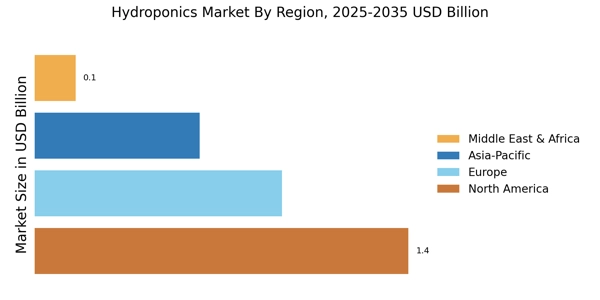

- "北米は水耕栽培の最大市場であり、革新的な農業手法への強い好みを示しています。

- アジア太平洋地域は、都市化と人口増加により、最も成長が早い市場として浮上しています。

- 栄養フィルム技術が市場を支配しており、ディープウォーターカルチャーは新しい栽培者の間で急速に支持を得ています。

- 持続可能性の取り組みと健康意識が水耕栽培市場を前進させる重要な要因です。"

市場規模と予測

| 2024 Market Size | 3.007 (米ドル十億) |

| 2035 Market Size | 23.01 (米ドル十億) |

| CAGR (2025 - 2035) | 20.32% |

主要なプレーヤー

AeroFarms(米国)、HydroGarden(オーストラリア)、Gotham Greens(米国)、BrightFarms(米国)、Green Spirit Farms(米国)、Urban Cultivator(カナダ)、NutraGreen(米国)、Vertical Harvest(米国)