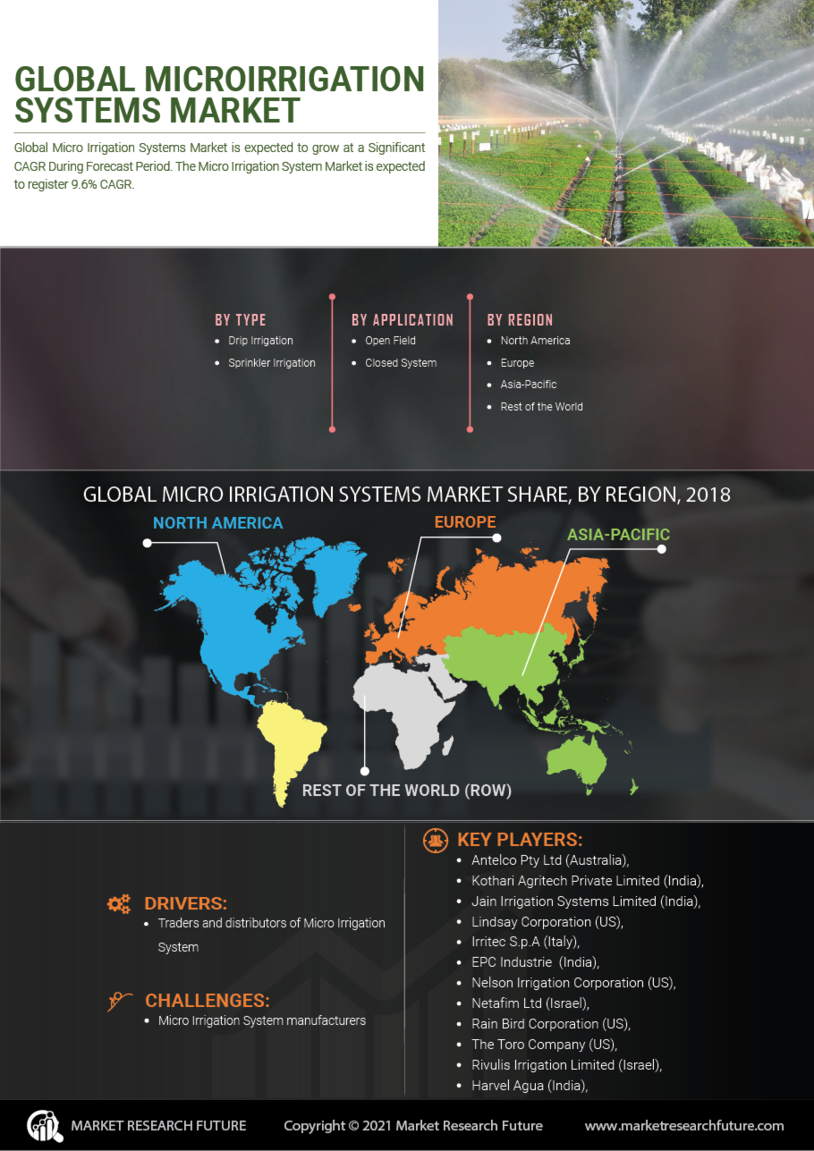

マイクロ灌漑システム市場 概要

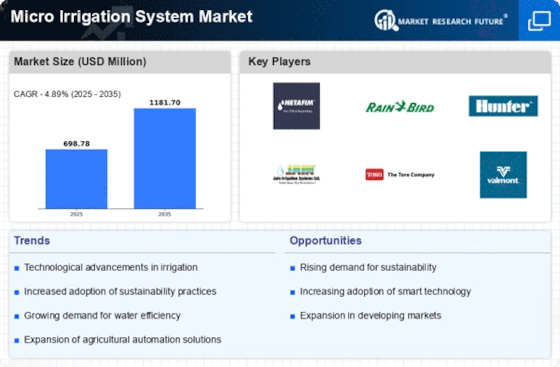

MRFRの分析によると、マイクロ灌漑システム市場の規模は2024年に698.78億米ドルと推定されました。マイクロ灌漑システム業界は、2025年に732.96億米ドルから2035年には1,181.7億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は4.89を示します。

主要な市場動向とハイライト

マイクロ灌漑システム市場は、技術の進歩と持続可能性の取り組みによって大幅な成長が見込まれています。

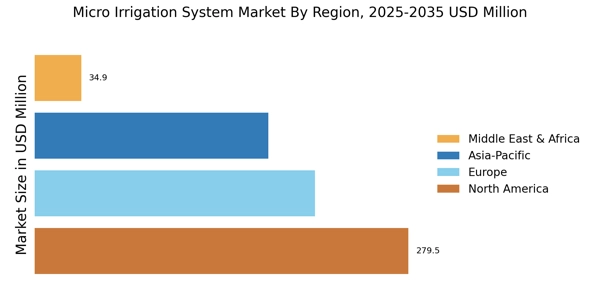

- 北米はマイクロ灌漑システムの最大市場であり、高度な農業慣行の強い採用を反映しています。

- アジア太平洋地域は、農業投資の増加と近代化の取り組みにより、最も成長が早い市場として浮上しています。

- 点滴灌漑は市場を支配し続けており、スプリンクラー灌漑は多様な用途における効率性から急速に成長しています。

- 水不足の高まりと世界的な食料需要の増加は、マイクロ灌漑システムの採用を促進する主要な要因です。

市場規模と予測

| 2024 Market Size | 698.78 (USD百万) |

| 2035 Market Size | 1181.7 (USD百万) |

| CAGR (2025 - 2035) | 4.89% |

主要なプレーヤー

ネタフィム(IL)、レインバードコーポレーション(US)、ハンターインダストリーズ(US)、ジャイン灌漑システムズリミテッド(IN)、トロカンパニー(US)、バルモントインダストリーズ(US)、イリテック(IT)、マヒンドラアグリソリューションズリミテッド(IN)、バウアーGmbH(AT)