In order to gather both qualitative and quantitative insights, supply-side and demand-side stakeholders were interviewed during the primary research phase. Supply-side sources included CEOs, VPs of Manufacturing Operations, R&D chiefs, and commercial directors from polycarbonate resin makers, compounders, and masterbatch producers. Demand-side sources comprised procurement directors from automobile OEMs, electrical & electronics manufacturers, construction materials suppliers, medical device businesses, and packaging converters. Primary research validated market segmentation, confirmed capacity development timetables, and gathered information on raw material sourcing strategies, price dynamics, sustainability initiatives, and replacement patterns with competing engineering plastics.

Primary Respondent Breakdown:

By Designation: C-level Primaries (32%), Director Level (31%), Others (37%)

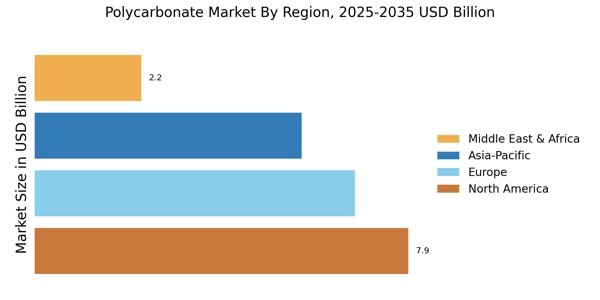

By Region: North America (32%), Europe (30%), Asia-Pacific (33%), Rest of World (5%)

Global market valuation was calculated by production capacity mapping and consumption volume analysis. The methods included:

Identification of 40+ significant manufacturers in North America, Europe, Asia-Pacific, and Middle East

Product mapping spanning extrusion-grade, injection molding-grade, optical-grade, and specialty flame-retardant polycarbonate formulations Examination of annual sales for polycarbonate resin portfolios, both reported and modeled Coverage of manufacturers comprising 75-80% of global production capacity in 2024 Extrapolation employing bottom-up (end-use consumption volume × ASP by area) and top-down (manufacturer revenue validation) techniques to create segment-specific valuations