ソーダ灰市場 概要

MRFRの分析によると、2024年のソーダ灰市場規模は177.6億米ドルと推定されています。ソーダ灰産業は、2025年に183.2億米ドルから2035年には250.1億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は3.16を示します。

主要な市場動向とハイライト

ソーダ灰市場は、持続可能な慣行と地域の拡大に向けてダイナミックな変化を経験しています。

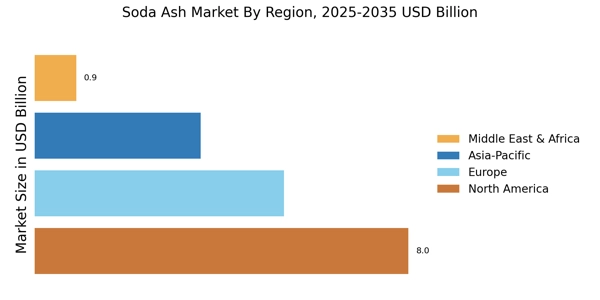

- 北米は、主に堅調なガラス製造業によって、ソーダ灰の最大の市場であり続けています。

- アジア太平洋地域は、化学製品の生産とインフラへの投資が増加しており、最も成長が早い地域として浮上しています。

- ガラス製造セグメントは市場を支配し続けており、洗剤セグメントは消費者の需要の高まりにより急速に成長しています。

- 主要な市場の推進要因には、ガラス製造からの需要の増加と持続可能な生産慣行に対する規制の支援が含まれます。

市場規模と予測

| 2024 Market Size | 17.76 (USD十億) |

| 2035 Market Size | 250.1億ドル |

| CAGR (2025 - 2035) | 3.16% |

主要なプレーヤー

ソルヴェイ(BE)、タタケミカルズ(IN)、OCI(NL)、シナーリソーシズ(US)、FMCコーポレーション(US)、ニルマリミテッド(IN)、山東海華グループ(CN)、元発化学(CN)、クウェート化学工業会社(KW)