Rising Focus on Energy Efficiency

The 3D 25D TSV Interconnect For Advanced Packaging Market is increasingly driven by a rising focus on energy efficiency in electronic devices. As environmental concerns grow, manufacturers are under pressure to develop solutions that minimize energy consumption while maximizing performance. TSV interconnects contribute to energy efficiency by reducing the distance data must travel within a device, thereby lowering power requirements. Market Research Future indicates that energy-efficient packaging solutions are becoming a priority for many companies, with a projected increase in demand for such technologies. This emphasis on sustainability is likely to propel the adoption of 3D and 25D TSV interconnects, as they align with the industry's goals of reducing the carbon footprint of electronic devices.

Emergence of Internet of Things (IoT) Devices

The proliferation of Internet of Things (IoT) devices is a key driver for the 3D 25D TSV Interconnect For Advanced Packaging Market. As IoT applications continue to expand across various sectors, the need for compact, efficient, and reliable packaging solutions becomes paramount. TSV interconnects facilitate the miniaturization of devices while maintaining high performance, making them ideal for IoT applications. Recent estimates suggest that the number of connected IoT devices could reach over 30 billion by 2030, creating a substantial market opportunity for advanced packaging technologies. This growth trajectory highlights the critical role of 3D and 25D TSV interconnects in supporting the evolving landscape of IoT.

Growing Demand for High-Performance Computing

The 3D 25D TSV Interconnect For Advanced Packaging Market is significantly influenced by the rising demand for high-performance computing (HPC) applications. As industries such as artificial intelligence, machine learning, and big data analytics expand, the need for faster and more efficient processing capabilities becomes critical. The integration of 3D and 25D TSV interconnects allows for improved data transfer rates and reduced latency, which are essential for HPC systems. Market analysis indicates that the HPC segment is expected to witness substantial growth, with investments in advanced packaging technologies playing a crucial role in meeting these demands. This trend underscores the importance of TSV interconnects in enhancing the performance of next-generation computing systems.

Advancements in Semiconductor Manufacturing Processes

The 3D 25D TSV Interconnect For Advanced Packaging Market is benefiting from ongoing advancements in semiconductor manufacturing processes. Innovations such as extreme ultraviolet lithography and advanced etching techniques are enabling the production of more complex and efficient interconnects. These advancements not only enhance the performance of semiconductor devices but also reduce manufacturing costs, making advanced packaging solutions more accessible. As the semiconductor industry continues to evolve, the integration of 3D and 25D TSV interconnects is likely to become a standard practice. This trend is expected to drive market growth, as manufacturers increasingly adopt these technologies to remain competitive in a rapidly changing landscape.

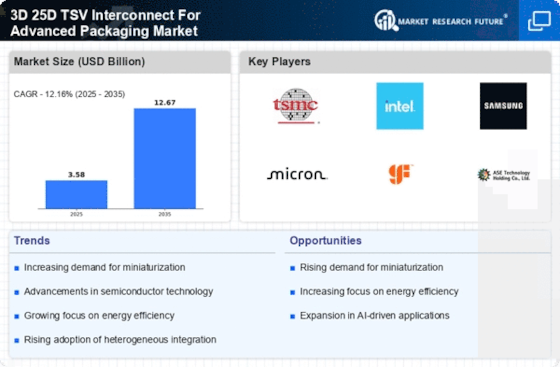

Increasing Adoption of Advanced Packaging Technologies

The 3D 25D TSV Interconnect For Advanced Packaging Market is experiencing a notable shift towards advanced packaging technologies. This trend is driven by the need for higher performance and efficiency in semiconductor devices. As manufacturers seek to enhance device capabilities, the adoption of 3D and 25D packaging solutions is becoming more prevalent. According to recent data, the market for advanced packaging is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is indicative of the industry's response to the increasing demand for compact and efficient electronic devices, which necessitates the integration of advanced packaging solutions such as TSV interconnects.