Growing Aging Population

The growing aging population is a crucial factor influencing the 3D Printed Medical Implants Market. As individuals age, they often experience a higher incidence of chronic conditions that necessitate surgical interventions, including joint replacements and dental implants. The demand for customized and effective solutions is rising, as older patients require implants that accommodate their specific health needs. Market projections indicate that the number of orthopedic surgeries is expected to increase significantly in the coming years, driven by the aging demographic. This trend underscores the importance of 3D printed implants, which can be tailored to enhance the quality of life for elderly patients, thereby propelling the growth of the 3D Printed Medical Implants Market.

Technological Advancements

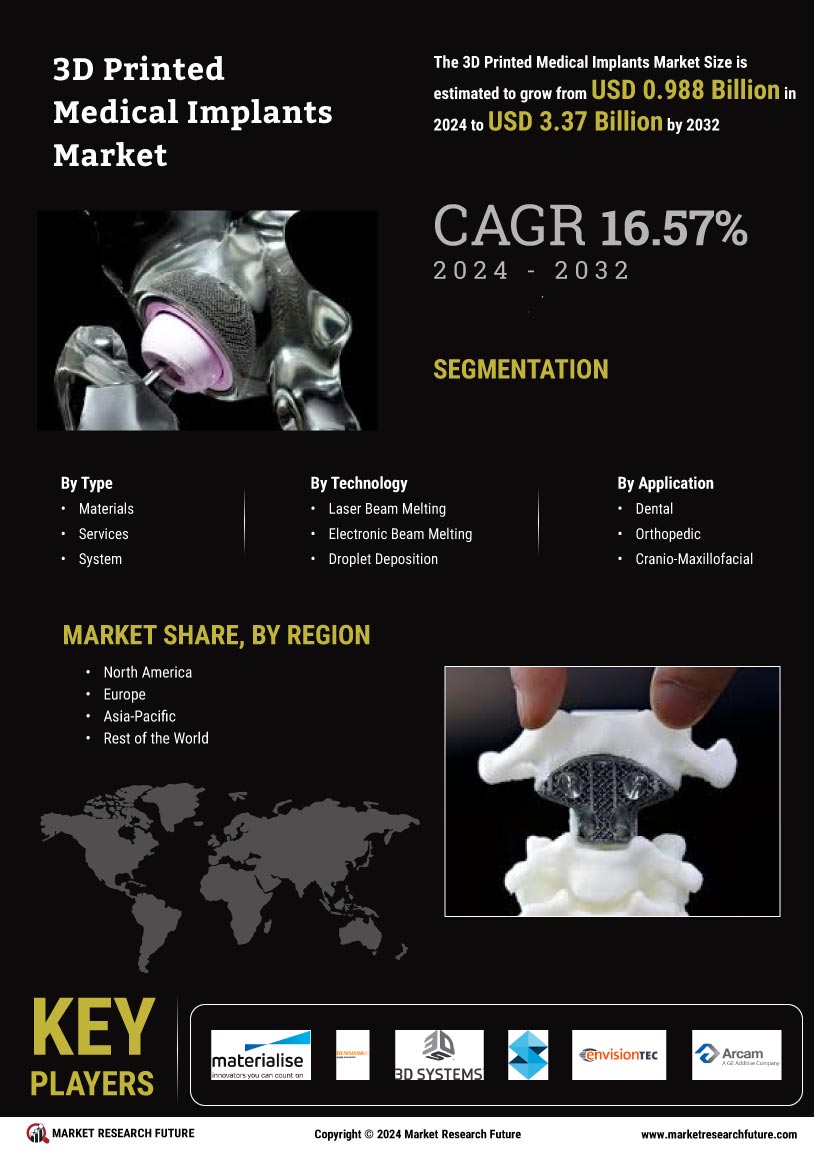

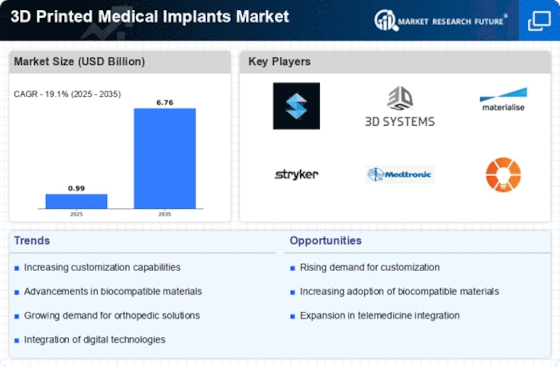

The 3D Printed Medical Implants Market is experiencing rapid technological advancements that enhance the precision and efficiency of implant production. Innovations in 3D printing technologies, such as bioprinting and metal additive manufacturing, allow for the creation of complex geometries that are tailored to individual patient anatomies. This customization not only improves the fit and functionality of implants but also reduces the risk of complications. According to recent data, the market for 3D printed implants is projected to grow at a compound annual growth rate of over 20% in the coming years, driven by these technological improvements. As manufacturers adopt more sophisticated printing techniques, the overall quality and performance of medical implants are likely to improve, further propelling the growth of the 3D Printed Medical Implants Market.

Regulatory Support and Standards

Regulatory support and the establishment of standards are vital drivers for the 3D Printed Medical Implants Market. As the technology matures, regulatory bodies are increasingly recognizing the potential of 3D printing in medical applications. The development of clear guidelines and standards for the production and use of 3D printed implants is fostering confidence among manufacturers and healthcare providers. This regulatory clarity is likely to encourage investment and innovation within the industry. Furthermore, as more 3D printed implants receive regulatory approval, the market is expected to expand, with a growing number of healthcare facilities adopting these advanced solutions. The alignment of regulatory frameworks with technological advancements is essential for the sustained growth of the 3D Printed Medical Implants Market.

Cost-Effectiveness of 3D Printing

Cost-effectiveness is emerging as a significant driver for the 3D Printed Medical Implants Market. Traditional manufacturing methods for medical implants often involve high material waste and lengthy production times. In contrast, 3D printing minimizes waste and allows for rapid prototyping, which can lead to reduced costs for manufacturers and healthcare providers. As hospitals and clinics seek to optimize their budgets while maintaining high-quality care, the adoption of 3D printed implants is likely to increase. Recent studies suggest that the cost savings associated with 3D printing can be substantial, potentially reducing implant production costs by up to 30%. This economic advantage positions the 3D Printed Medical Implants Market favorably in a competitive healthcare landscape.

Rising Demand for Personalized Medicine

The increasing emphasis on personalized medicine is a key driver for the 3D Printed Medical Implants Market. Patients are increasingly seeking treatments that are tailored to their unique biological and anatomical characteristics. 3D printing technology facilitates the production of customized implants that can be designed to meet specific patient needs, thereby enhancing treatment outcomes. Market data indicates that the demand for personalized medical solutions is expected to rise significantly, with a notable increase in the adoption of 3D printed implants in orthopedic and dental applications. This trend is likely to continue as healthcare providers recognize the benefits of personalized approaches, leading to a more substantial market presence for the 3D Printed Medical Implants Market.