Supportive Regulatory Environment

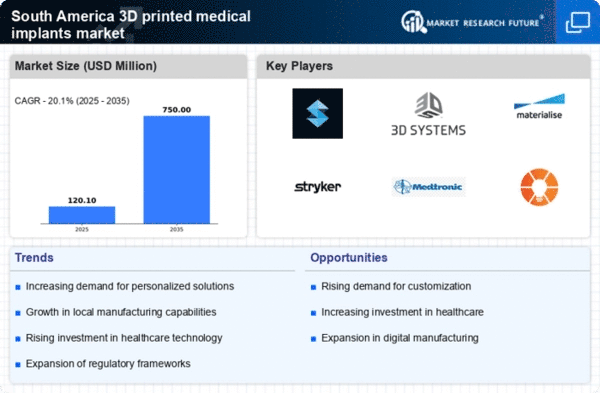

A supportive regulatory environment is emerging as a key driver for the 3d printed-medical-implants market in South America. Regulatory bodies are beginning to establish clearer guidelines for the approval and use of 3D printed medical devices, which is fostering innovation and investment in the sector. Countries like Chile and Colombia are actively working to streamline their regulatory processes, making it easier for manufacturers to bring new products to market. This regulatory clarity is likely to encourage more companies to invest in 3D printing technologies, thereby expanding the market. As the regulatory landscape continues to evolve, it is expected that the market will grow at a compound annual growth rate (CAGR) of around 20% over the next few years.

Technological Advancements in 3D Printing

The rapid evolution of 3D printing technologies is a pivotal driver for the 3d printed-medical-implants market in South America. Innovations such as bioprinting and the development of advanced materials are enhancing the capabilities of medical implants. For instance, the introduction of bio-compatible polymers and metals is enabling the production of implants that better integrate with human tissue. This technological progress is expected to lead to a market growth rate of approximately 25% annually, as healthcare providers increasingly adopt these advanced solutions. Furthermore, the ability to produce complex geometries that traditional manufacturing cannot achieve is likely to expand the applications of 3D printed implants, thereby attracting more investment into the sector.

Rising Investment in Healthcare Infrastructure

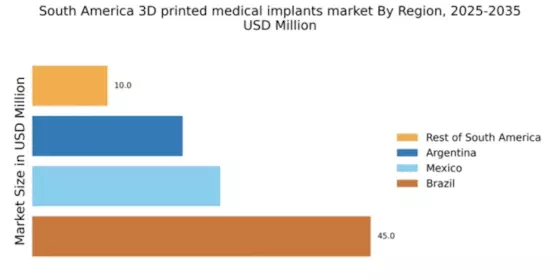

Investment in healthcare infrastructure across South America is a crucial driver for the 3d printed-medical-implants market. Governments and private entities are increasingly allocating funds to modernize healthcare facilities, which includes the integration of advanced technologies like 3D printing. For example, Brazil and Argentina have initiated programs to enhance their medical technology sectors, potentially increasing the adoption of 3D printed implants. This investment is expected to create a more conducive environment for innovation and collaboration, thereby accelerating market growth. The overall healthcare expenditure in the region is projected to rise by 10% annually, further supporting the expansion of the 3D printed medical implants sector.

Growing Awareness of Advanced Surgical Techniques

The increasing awareness and acceptance of advanced surgical techniques among healthcare professionals and patients are driving the 3d printed-medical-implants market in South America. Surgeons are becoming more familiar with the benefits of 3D printed implants, such as improved fit and functionality. Educational initiatives and workshops are being organized to promote the advantages of these technologies, which could lead to a higher adoption rate. As more healthcare providers recognize the potential of 3D printing in enhancing surgical outcomes, the market is likely to experience a surge in demand. This trend may result in a market valuation exceeding $300 million by 2026, reflecting the growing confidence in these innovative solutions.

Increasing Demand for Personalized Healthcare Solutions

The growing emphasis on personalized healthcare is significantly influencing the 3d printed-medical-implants market in South America. Patients are increasingly seeking customized implants tailored to their specific anatomical needs, which 3D printing can readily provide. This trend is reflected in the rising number of orthopedic and dental procedures utilizing 3D printed implants, with estimates suggesting that the market could reach $500 million by 2027. The ability to create patient-specific solutions not only enhances surgical outcomes but also reduces recovery times, making it a compelling option for healthcare providers. As the demand for personalized solutions continues to rise, the market is likely to see sustained growth.