Cost Efficiency

Cost efficiency remains a pivotal driver in the 3D Printing for Prototyping Market. Traditional prototyping methods often involve high material and labor costs, whereas 3D printing significantly reduces these expenses. The ability to produce prototypes on-demand minimizes waste and lowers inventory costs, making it an attractive option for businesses. Recent studies indicate that companies utilizing 3D printing for prototyping can achieve cost savings of up to 40% compared to conventional methods. As organizations continue to seek ways to optimize their budgets while maintaining quality, the cost advantages of 3D printing are likely to propel its adoption in prototyping applications.

Technological Advancements

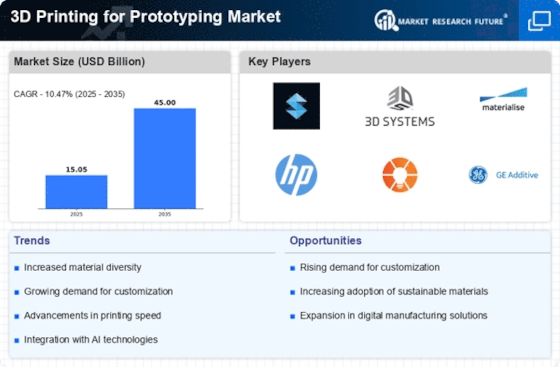

The 3D Printing for Prototyping Market is experiencing rapid technological advancements that enhance the capabilities of 3D printing. Innovations in printing techniques, such as multi-material printing and improved resolution, allow for the creation of more complex prototypes. These advancements not only improve the quality of prototypes but also reduce production time and costs. According to recent data, the adoption of advanced 3D printing technologies is projected to increase by 25% over the next five years, indicating a strong trend towards more sophisticated prototyping solutions. As companies seek to innovate and bring products to market faster, the demand for advanced 3D printing technologies in prototyping is likely to grow significantly.

Customization and Personalization

The demand for customization and personalization in product design is a key driver in the 3D Printing for Prototyping Market. Businesses are increasingly recognizing the value of tailored solutions that meet specific customer needs. 3D printing enables rapid prototyping of customized products, allowing companies to test and iterate designs quickly. This capability is particularly valuable in industries such as consumer goods and healthcare, where personalized products can lead to enhanced customer satisfaction. Market data suggests that the customization trend is expected to drive a 30% increase in the use of 3D printing for prototyping applications over the next few years, as companies strive to differentiate themselves in competitive markets.

Growing Adoption Across Industries

The growing adoption of 3D printing technology across various industries serves as a significant driver for the 3D Printing for Prototyping Market. Sectors such as automotive, aerospace, and healthcare are increasingly integrating 3D printing into their prototyping processes. This trend is driven by the technology's ability to produce lightweight, complex geometries that traditional manufacturing methods cannot achieve. Market analysis indicates that the automotive industry alone is expected to increase its use of 3D printing for prototyping by 35% in the coming years. As more industries recognize the benefits of 3D printing, its role in prototyping is likely to expand, fostering innovation and efficiency.

Shortened Product Development Cycles

The 3D Printing for Prototyping Market is significantly influenced by the need for shortened product development cycles. In an increasingly competitive landscape, companies are under pressure to bring products to market faster. 3D printing facilitates rapid prototyping, allowing for quicker iterations and testing of designs. This acceleration in the development process can lead to a reduction in time-to-market by as much as 50%. As businesses strive to enhance their agility and responsiveness to market demands, the ability to rapidly prototype and refine products through 3D printing is likely to become a critical factor in their success.