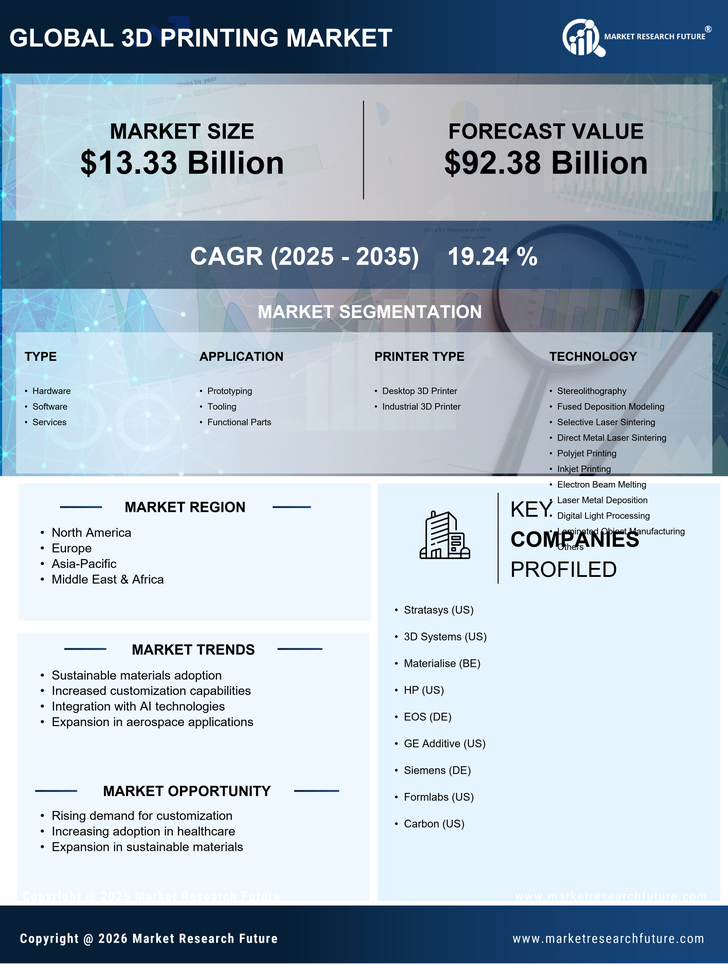

Cost Reduction in Manufacturing

Cost efficiency remains a pivotal driver in the 3D Printing Market, as organizations strive to minimize production expenses. The technology enables manufacturers to produce complex geometries and customized products without the need for extensive tooling or assembly processes. This capability not only reduces material waste but also lowers labor costs, making it an attractive option for businesses. Recent analyses suggest that companies utilizing 3D printing can achieve up to 70% savings in production costs compared to traditional methods. As industries continue to seek ways to enhance profitability, the adoption of 3D printing technologies is expected to grow, reinforcing its significance in the manufacturing landscape.

Advancements in Material Science

The evolution of material science plays a crucial role in the 3D Printing Market, as new materials expand the capabilities of 3D printing technologies. Innovations in polymers, metals, and composites enable the production of stronger, lighter, and more durable components. This diversification of materials allows for applications in sectors such as healthcare, where biocompatible materials are essential for creating medical devices and implants. Furthermore, the introduction of sustainable materials aligns with the growing emphasis on eco-friendly practices. As material options continue to expand, the potential applications of 3D printing are likely to broaden, driving further growth in the market.

Increased Demand for Prototyping

The 3D Printing Market experiences a notable surge in demand for rapid prototyping across various sectors. Industries such as automotive, aerospace, and consumer goods are increasingly adopting 3D printing technologies to accelerate product development cycles. This shift allows companies to create prototypes more efficiently, reducing time-to-market and costs associated with traditional manufacturing methods. According to recent data, the prototyping segment is projected to account for a substantial share of the 3D printing market, indicating a robust growth trajectory. As businesses seek to innovate and respond to consumer needs swiftly, the reliance on 3D printing for prototyping is likely to intensify, further solidifying its role in the market.

Integration of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence and the Internet of Things, is transforming the 3D Printing Industry. These technologies enhance the efficiency and capabilities of 3D printing processes, enabling smarter manufacturing solutions. For instance, AI can optimize design processes and predict maintenance needs, while IoT facilitates real-time monitoring of production. This convergence of technologies is expected to streamline operations and improve product quality, making 3D printing more appealing to manufacturers. As industries increasingly adopt these advanced technologies, the 3D printing market is likely to experience accelerated growth, driven by enhanced operational efficiencies and innovative applications.

Customization and Personalization Trends

The demand for customization and personalization is a significant driver in the 3D Printing Industry. Consumers increasingly seek unique products tailored to their preferences, prompting manufacturers to adopt 3D printing technologies that facilitate bespoke designs. This trend is particularly evident in sectors such as fashion, jewelry, and consumer electronics, where personalized items command premium prices. Market data indicates that the customization segment is expected to witness substantial growth, as businesses leverage 3D printing to meet individual customer needs efficiently. The ability to produce one-of-a-kind products not only enhances customer satisfaction but also fosters brand loyalty, making it a vital aspect of the market.