Customization Capabilities

The inherent customization capabilities of 3D Printing Technologies are reshaping consumer expectations across various industries. Businesses are leveraging these capabilities to offer tailored products that meet specific customer needs, from bespoke jewelry to specialized industrial components. This trend is particularly pronounced in the automotive and fashion sectors, where unique designs can be produced without the constraints of traditional manufacturing methods. As consumer demand for personalized products continues to rise, the 3d printing market is expected to expand significantly, with projections indicating a potential increase in market size by 15% annually.

Sustainability Initiatives

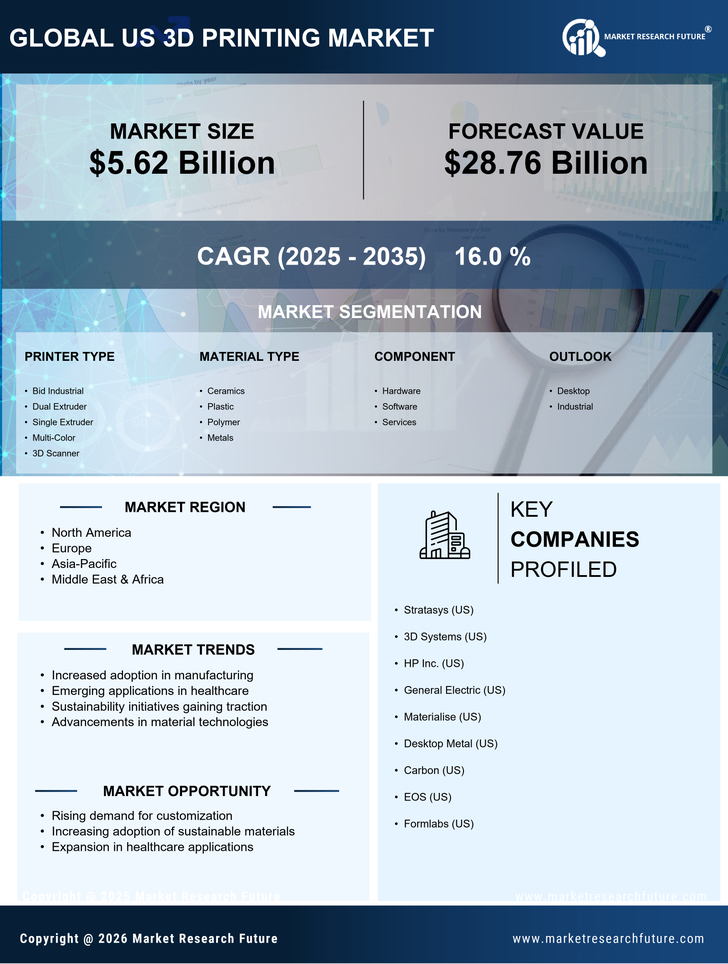

Sustainability is becoming a critical driver in the 3d printing market, as companies strive to reduce waste and energy consumption. The ability to produce items on-demand minimizes excess inventory and lowers material waste, aligning with environmental goals. Furthermore, the development of recyclable and biodegradable materials is gaining traction, appealing to eco-conscious consumers and businesses alike. As organizations increasingly prioritize sustainability, the 3d printing market is likely to see a surge in demand for eco-friendly solutions, potentially leading to a market growth rate of around 20% in the coming years.

Integration with Industry 4.0

The integration of 3d printing technologies with Industry 4.0 principles is driving innovation within the 3d printing market. The convergence of IoT, AI, and automation is enhancing production efficiency and enabling real-time monitoring of manufacturing processes. This synergy allows for smarter supply chains and more agile production systems, which are essential in today’s fast-paced market environment. As companies increasingly adopt these technologies, the 3d printing market is poised for substantial growth, with estimates suggesting a market expansion of approximately 18% over the next few years.

Advancements in Material Science

The 3d printing market is experiencing a notable transformation due to advancements in material science. Innovative materials such as bio-based plastics, metals, and ceramics are being developed, enhancing the capabilities of 3D Printing Technologies. This diversification allows for the production of more complex and durable components, which is particularly beneficial in industries like aerospace and healthcare. For instance, the introduction of high-performance polymers has enabled the creation of lightweight yet strong parts, which can reduce overall production costs. As a result, the market is projected to grow at a CAGR of approximately 25% over the next five years, driven by these material innovations.

Increased Adoption in Healthcare

The healthcare sector is increasingly adopting 3D Printing Technologies, significantly impacting the 3d printing market. Custom prosthetics, dental implants, and even bioprinting of tissues are becoming more prevalent. The ability to create patient-specific solutions enhances treatment outcomes and reduces costs. According to recent data, the healthcare segment is expected to account for over 30% of the total market share by 2026. This trend is likely to continue as hospitals and clinics seek to improve efficiency and patient care through personalized medical solutions, thereby driving further investment in 3d printing technologies.