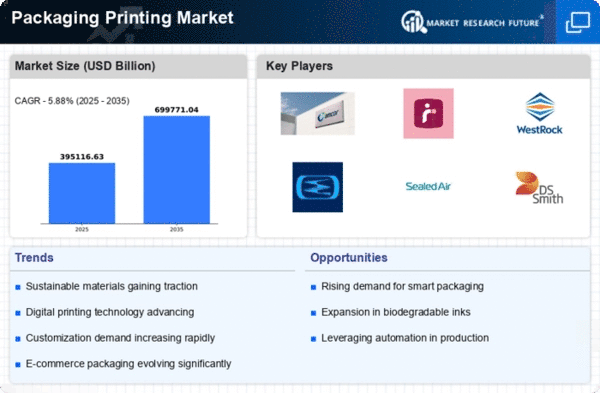

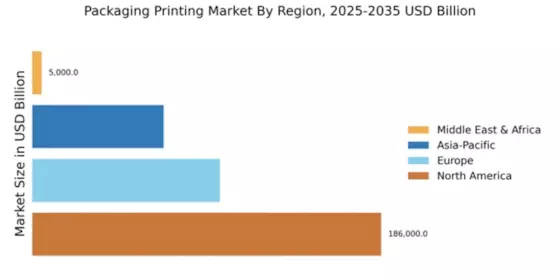

North America : Market Leader in Packaging

North America continues to lead The Packaging Printing, holding a significant share of 186,000.0. The region's growth is driven by increasing consumer demand for sustainable packaging solutions and advancements in printing technologies. Regulatory support for eco-friendly practices further catalyzes market expansion, as companies adapt to stringent environmental standards. The shift towards e-commerce has also amplified the need for innovative packaging solutions, enhancing market dynamics. The competitive landscape in North America is robust, featuring key players such as WestRock, International Paper, and Graphic Packaging Holding Company. These companies are investing heavily in R&D to develop sustainable materials and improve printing efficiency. The U.S. remains the largest market, with Canada and Mexico also contributing to growth. The presence of established firms and a focus on innovation position North America as a formidable player in the packaging printing sector.

Europe : Emerging Sustainability Focus

Europe's Packaging Printing Market is valued at 100,000.0, driven by a strong emphasis on sustainability and regulatory frameworks promoting eco-friendly practices. The European Union's Green Deal aims to make packaging recyclable or reusable by 2030, significantly influencing market trends. This regulatory push is fostering innovation in sustainable materials and processes, aligning with consumer preferences for environmentally responsible products. across the Germany packaging printing market and the UK packaging printing market Leading countries in this region include Germany, France, and the UK, where companies like Mondi Group and DS Smith are at the forefront of sustainable packaging solutions. The competitive landscape is characterized by a mix of established players and innovative startups, all striving to meet the growing demand for sustainable packaging. The focus on circular economy principles is reshaping the market, making Europe a key player in the global packaging printing landscape.

Asia-Pacific : Rapid Growth and Innovation

The Asia-Pacific packaging printing market, valued at 70,000.0, is experiencing rapid growth driven by urbanization and rising disposable incomes. The demand for packaged goods is surging, particularly in countries like China and India, where a growing middle class is influencing consumption patterns. Regulatory initiatives aimed at reducing plastic waste are also shaping market dynamics, pushing companies to innovate in sustainable packaging solutions. China stands out as a key player in the region, with significant investments in advanced printing technologies. Other notable markets include Japan and India, where local firms are increasingly competing with global giants. The competitive landscape is evolving, with a mix of traditional and digital printing methods being adopted to meet diverse consumer needs. This dynamic environment positions Asia-Pacific as a promising region for future growth in packaging printing.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa packaging printing market, valued at 5,000.0, is on the rise, driven by increasing consumer demand and economic development. The region is witnessing a shift towards modern retail and e-commerce, which is boosting the need for innovative packaging solutions. Regulatory frameworks are gradually evolving to support sustainable practices, although challenges remain in terms of infrastructure and technology adoption. Countries like South Africa and the UAE are leading the charge, with local and international players investing in the market. Key companies are focusing on enhancing their product offerings to cater to the growing demand for packaged goods. The competitive landscape is characterized by a mix of established firms and new entrants, creating opportunities for growth and innovation in the packaging printing sector.