Market Share

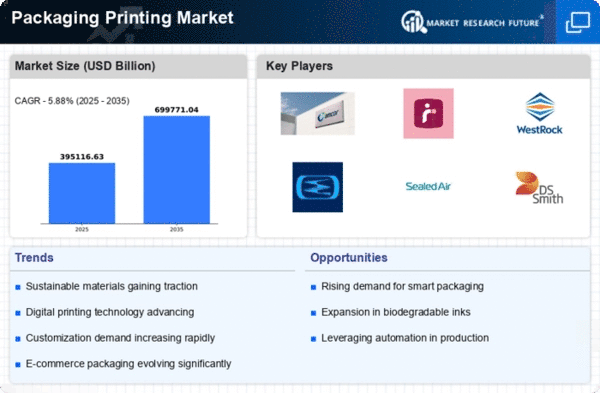

Packaging Printing Market Share Analysis

In the dynamic and competitive landscape of the packaging printing market, companies employ various strategies to establish their presence and secure a significant market share. Differentiation is a primary strategy where companies emphasize unique features or capabilities of their packaging printing solutions. This could involve offering innovative printing techniques, such as digital printing or UV printing, that provide high-quality, vibrant, and durable prints on packaging materials. By positioning themselves as providers of distinctive and visually appealing packaging printing, companies can attract clients seeking eye-catching and effective branding solutions for their products, thus gaining a competitive edge in the market.

The advent of technologies in the industries has increased production with minimal energy and time. A Company has launched its new plant to serve its diversified clients ranging from FMCA, lubricants, paints, and others. With the help of extrusion blow molding technology, the company was able to drive the production in varied applications including plastic containers, shampoo bottles, toilets, and surface cleaners. Such techniques have increased the market value.

Cost leadership is another critical strategy in the packaging printing market. Companies strive to offer cost-effective printing solutions without compromising on quality or performance. Achieving cost leadership involves optimizing printing processes, sourcing materials efficiently, and leveraging economies of scale. By positioning themselves as providers of affordable packaging printing options, companies can appeal to cost-conscious clients, particularly in industries where budget constraints are significant. However, it's crucial to ensure that cost savings do not compromise the print quality or durability of the packaging to maintain customer satisfaction and trust in the long run.

Niche positioning strategies are also prevalent in the packaging printing market. Companies often specialize in providing printing solutions tailored to specific industries or applications. For example, a company may focus on packaging printing for the food and beverage industry, offering options that meet stringent regulatory requirements for food safety and labeling. Alternatively, a company might specialize in printing for luxury goods packaging, addressing requirements for premium finishes and customization. By positioning themselves as experts in a particular niche, companies can cater to the unique needs of customers in that segment, gaining a competitive advantage and a larger market share.

Distribution and channel strategies play a vital role in market share positioning within the packaging printing market. Companies must establish efficient distribution channels to reach customers effectively. This may involve collaborating with packaging manufacturers, distributors, or directly supplying printed packaging materials to brand owners and retailers. Additionally, leveraging digital platforms and e-commerce channels can enhance accessibility and reach a global customer base. By optimizing distribution channels, companies can increase market share and competitiveness in the packaging printing market.

Branding and marketing efforts are essential components of market share positioning strategies in the packaging printing market. Companies must develop strong and recognizable brands that resonate with their target audience. This involves investing in branding initiatives that communicate the company's values, commitment to quality, and innovation in printing technology. Marketing efforts should focus on showcasing the unique features and benefits of the company's packaging printing solutions, along with demonstrating how they address specific industry challenges and customer needs. By effectively branding and marketing their products, companies can differentiate themselves from competitors and gain a larger market share.

Customer experience and service are critical factors in market share positioning strategies within the packaging printing market. Providing excellent customer service, offering personalized solutions, and ensuring reliable post-sales support are essential for building strong relationships with clients. Companies must prioritize responsiveness, flexibility, and transparency to meet the diverse needs of customers and ensure their satisfaction. By positioning themselves as dependable partners who prioritize customer success, companies can enhance their reputation and gain a competitive edge in the packaging printing market.

Leave a Comment