Packaging Tape Printing Market Summary

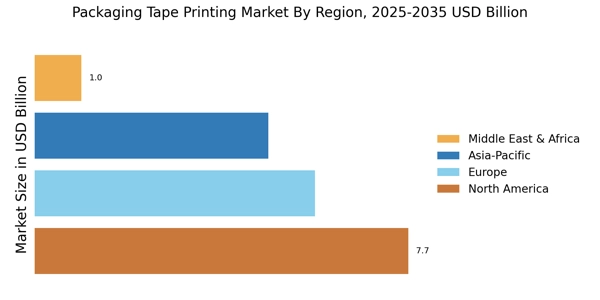

As per Market Research Future analysis, the Packaging Tape Printing Market Size was estimated at 19.33 USD Billion in 2024. The Packaging Tape Printing industry is projected to grow from 20.38 USD Billion in 2025 to 34.59 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.43% during the forecast period 2025 - 2035

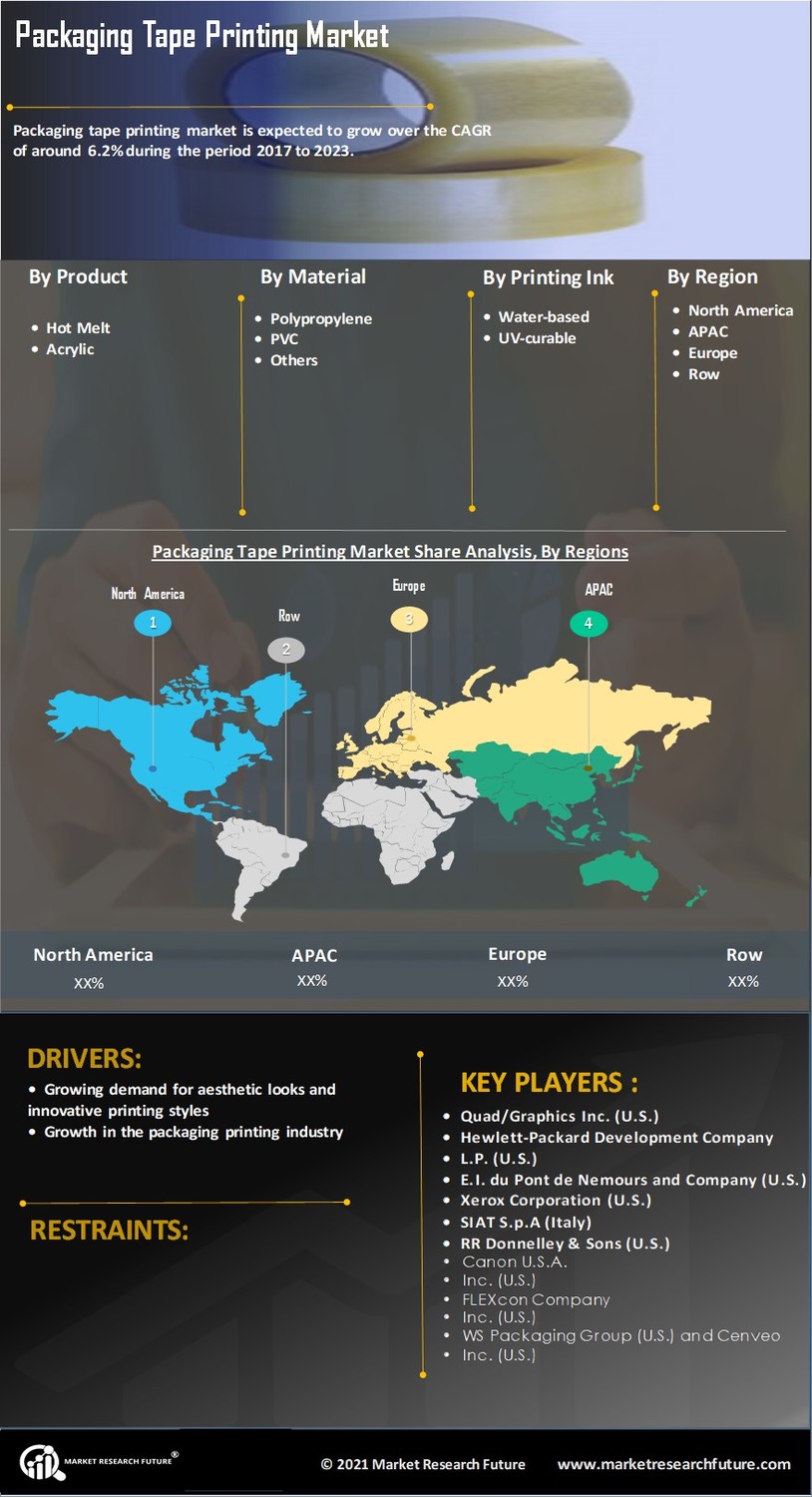

Key Market Trends & Highlights

The Packaging Tape Printing Market is experiencing a dynamic shift towards sustainability and technological innovation.

- Sustainability in packaging solutions is becoming a pivotal trend, particularly in North America, where environmental concerns drive consumer preferences.

- Technological advancements in printing are enhancing production efficiency, with automation playing a crucial role in both North America and Asia-Pacific.

- The hot melt segment remains the largest in the market, while acrylic tape is emerging as the fastest-growing segment due to its versatility and performance.

- Rising demand for customization and e-commerce growth are key drivers, propelling the need for innovative packaging solutions across various segments.

Market Size & Forecast

| 2024 Market Size | 19.33 (USD Billion) |

| 2035 Market Size | 34.59 (USD Billion) |

| CAGR (2025 - 2035) | 5.43% |

Major Players

3M (US), Avery Dennison (US), Intertape Polymer Group (CA), Shurtape Technologies (US), Tesa SE (DE), Scotch (US), Nitto Denko Corporation (JP), Duck Brand (US), Pro Tapes & Specialties (US)