Advancements in Motor Technology

Technological advancements in motor design and control systems are significantly influencing the AC Servo Motors And Drives Market. Innovations such as improved feedback systems, enhanced algorithms, and the integration of artificial intelligence are enabling more efficient and responsive motor performance. These advancements not only enhance the operational efficiency of machines but also reduce energy consumption, aligning with the industry's focus on sustainability. The introduction of next-generation servo drives is expected to contribute to a market growth rate of around 7% annually, indicating a robust future for the AC Servo Motors And Drives Market.

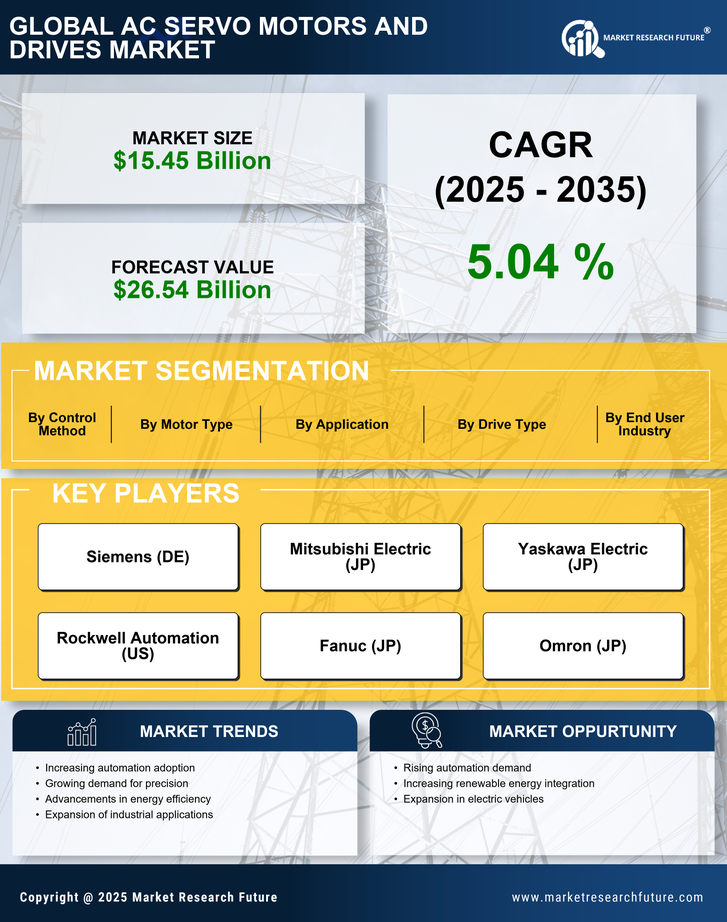

Rising Demand for Precision Control

The AC Servo Motors And Drives Market is experiencing a notable increase in demand for precision control in various applications, particularly in robotics and CNC machinery. This demand is driven by the need for enhanced accuracy and repeatability in manufacturing processes. As industries strive for higher productivity and lower operational costs, the adoption of AC servo motors, known for their precise control capabilities, is likely to rise. According to recent data, the market for precision machinery is projected to grow at a compound annual growth rate of approximately 6% over the next five years, further fueling the AC Servo Motors And Drives Market.

Growth in Electric Vehicle Production

The surge in electric vehicle (EV) production is a pivotal driver for the AC Servo Motors And Drives Market. As automotive manufacturers increasingly adopt electric drivetrains, the demand for high-performance AC servo motors is likely to escalate. These motors are essential for various applications within EVs, including power steering and traction control systems. Recent statistics suggest that the electric vehicle market is set to expand at a staggering rate, with projections indicating a growth of over 20% annually. This trend is expected to significantly bolster the AC Servo Motors And Drives Market as manufacturers seek reliable and efficient motor solutions.

Regulatory Push for Energy Efficiency Standards

Regulatory frameworks aimed at promoting energy efficiency are significantly impacting the AC Servo Motors And Drives Market. Governments worldwide are implementing stringent energy efficiency standards for industrial equipment, encouraging manufacturers to adopt more efficient motor technologies. AC servo motors, known for their energy-saving capabilities, are well-positioned to meet these regulations. As industries strive to comply with these standards, the demand for energy-efficient solutions is expected to rise. Market analysis indicates that compliance with energy efficiency regulations could drive a growth rate of around 5% in the AC Servo Motors And Drives Market over the next few years.

Increased Focus on Automation in Various Sectors

The ongoing trend towards automation across multiple sectors, including manufacturing, healthcare, and logistics, is a key driver for the AC Servo Motors And Drives Market. As companies seek to enhance operational efficiency and reduce labor costs, the integration of automated systems becomes imperative. AC servo motors play a crucial role in these systems, providing the necessary precision and reliability. The automation market is anticipated to grow at a compound annual growth rate of approximately 8%, which will likely lead to increased investments in AC servo technologies, thereby propelling the AC Servo Motors And Drives Market forward.