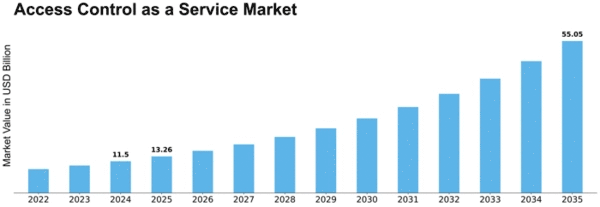

Access Control As A Service Size

Access Control as a Service Market Growth Projections and Opportunities

Access Control as a Service (ACaaS) has turned into a pivotal arrangement in the scope of security, offering an adaptable and scalable approach to access control frameworks. Several market factors add to the development and dynamics of the ACaaS market. One key driver is the increasing awareness among organizations about the importance of strong safety efforts. With the rising threat landscape, organizations are actively looking for advanced access control answers for safeguard their premises and sensitive data. This increased awareness impels the demand for ACaaS, as it gives a cutting edge and creative alternative to traditional access control frameworks. Another significant factor impacting the ACaaS market is the rapid development of innovation. As advancements in distributed computing, IoT (Internet of Things), and AI (Artificial Intelligence) proceed, ACaaS suppliers are integrating these innovations into their solutions. Cloud-based access control not just eliminates the requirement for on-premises hardware yet additionally enables far off management and checking. This technological combination enhances the overall efficacy of access control frameworks, making ACaaS an attractive choice for organizations aiming to stay at the cutting edge of safety innovation. The scalability and cost-adequacy of ACaaS also add to its market development. Traditional access control frameworks often require substantial forthright ventures and can be challenging to scale according to advancing business needs. ACaaS, then again, operates on a membership-based model, allowing organizations to pay for the services they need and scale up or down as required. This adaptability appeals to organizations of all sizes, particularly small and medium enterprises (SMEs), which may find traditional access control frameworks financially restrictive. Interoperability is another crucial market factor for ACaaS. As organizations send a variety of safety arrangements from various sellers, the requirement for seamless integration becomes paramount. ACaaS suppliers are addressing this demand by guaranteeing compatibility with different hardware and software environments. This interoperability improves on the arrangement interaction as well as enhances the overall proficiency of the security infrastructure. Organizations can integrate ACaaS seamlessly with existing frameworks, lessening interruptions and enhancing security conventions.

Leave a Comment