Innovation in Food Products

Innovation within the food industry serves as a significant catalyst for the acetic acid in food application Market. As manufacturers strive to differentiate their products, the incorporation of acetic acid in novel food formulations has gained traction. This includes its use in unique flavor profiles and as a natural preservative in gourmet and artisanal foods. The trend towards innovative food products is supported by market data indicating that specialty food sales are expected to grow by approximately 8% annually. This growth presents opportunities for acetic acid to be utilized in diverse applications, from sauces to snacks, thereby enhancing its market presence and appeal to a broader consumer base.

Growing Health Consciousness

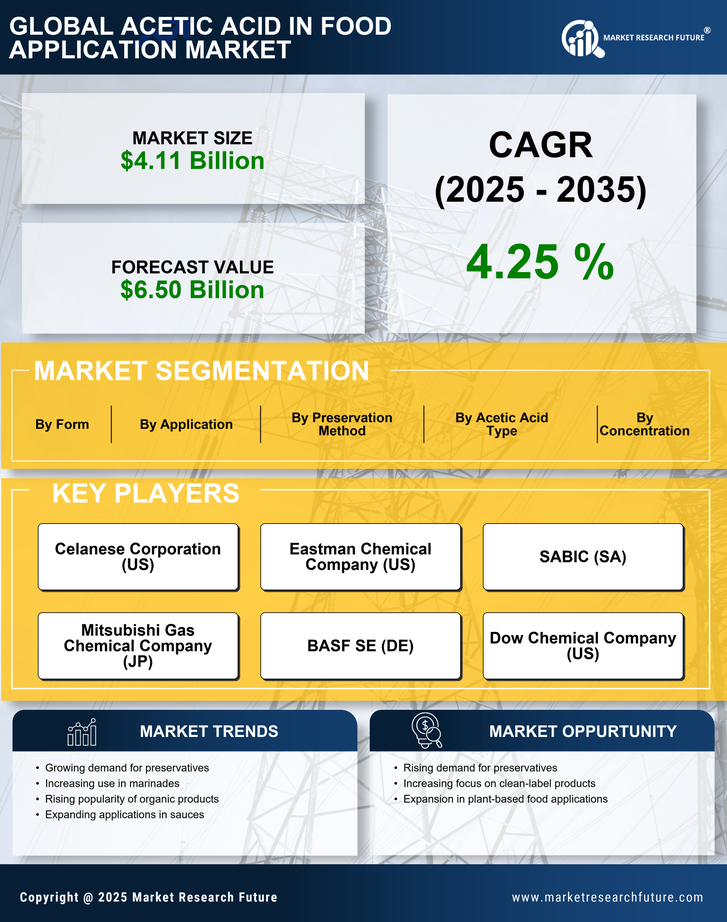

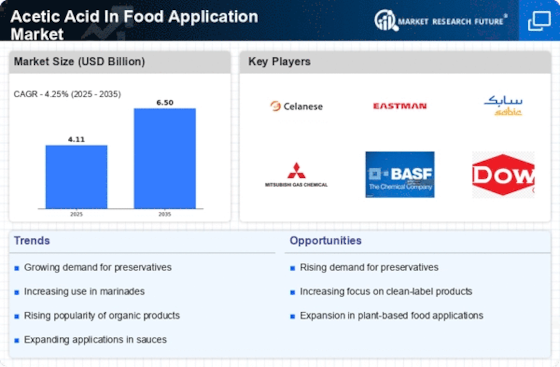

The increasing awareness of health and wellness among consumers appears to be a pivotal driver for the Acetic Acid In Food Application Market. As individuals become more discerning about their dietary choices, the demand for natural preservatives and flavor enhancers rises. Acetic acid, known for its antimicrobial properties, serves as a viable alternative to synthetic additives. This shift towards healthier eating habits has led to a notable increase in the use of acetic acid in various food products, including dressings and sauces. Market data indicates that the segment of food products utilizing acetic acid is projected to grow at a compound annual growth rate of approximately 5% over the next five years, reflecting the broader trend of health-oriented consumer preferences.

Expansion of the Food Processing Sector

The ongoing expansion of the food processing sector significantly influences the Acetic Acid In Food Application Market. As food manufacturers seek to enhance product shelf life and safety, acetic acid emerges as a crucial ingredient in various applications, including pickling and preservation. The food processing industry has witnessed substantial growth, with projections suggesting an increase in market size by over 10% in the coming years. This growth is driven by the rising demand for convenience foods and ready-to-eat meals, where acetic acid plays a vital role in maintaining flavor and freshness. Consequently, the integration of acetic acid in food processing not only meets consumer expectations but also aligns with industry standards for food safety.

Regulatory Support for Natural Preservatives

Regulatory frameworks increasingly favor the use of natural preservatives, which bolsters the Acetic Acid In Food Application Market. Authorities are progressively recognizing the benefits of natural ingredients over synthetic alternatives, leading to favorable regulations that promote the use of acetic acid in food products. This shift is evident in various regions, where guidelines are being established to encourage the adoption of safer, more natural food preservation methods. As a result, food manufacturers are more inclined to incorporate acetic acid into their formulations, aligning with consumer demand for clean label products. The regulatory support not only enhances the credibility of acetic acid as a food additive but also stimulates market growth.

Rising Popularity of Ethnic and Gourmet Foods

The rising popularity of ethnic and gourmet foods significantly impacts the Acetic Acid In Food Application Market. As consumers increasingly seek diverse culinary experiences, the demand for authentic flavors and preservation methods rises. Acetic acid, often used in traditional recipes for pickling and flavor enhancement, aligns well with this trend. Market analysis suggests that the ethnic food segment is expected to grow by over 6% annually, driven by consumer interest in global cuisines. This growth presents opportunities for acetic acid to be featured prominently in various ethnic dishes, thereby reinforcing its role as a key ingredient in enhancing flavor and extending shelf life.