Growth in Emerging Economies

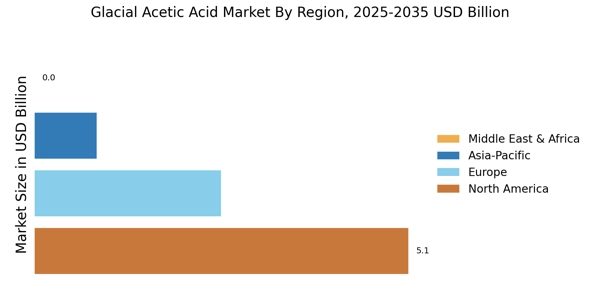

The Glacial Acetic Acid Market is poised for growth in emerging economies, where industrialization and urbanization are accelerating. Countries in Asia-Pacific and Latin America are witnessing a surge in demand for glacial acetic acid, driven by the expansion of manufacturing sectors and increasing consumer markets. The rise of middle-class populations in these regions is leading to higher consumption of products that utilize glacial acetic acid, such as plastics and textiles. Market projections suggest that the Asia-Pacific region alone could account for over 40% of the total acetic acid consumption by 2025, underscoring the potential for significant market expansion. This trend indicates that emerging economies will play a crucial role in shaping the future of the glacial acetic acid market.

Expansion of End-Use Industries

The Glacial Acetic Acid Market is significantly influenced by the expansion of end-use industries such as food and beverage, pharmaceuticals, and personal care. In the food sector, glacial acetic acid is utilized as a preservative and flavoring agent, which is becoming increasingly important as consumer preferences shift towards natural and organic products. The pharmaceutical industry also relies on glacial acetic acid for the synthesis of various active pharmaceutical ingredients. As these industries continue to grow, the demand for glacial acetic acid is expected to follow suit. Market analysis indicates that the food and beverage sector alone accounted for over 25% of the total acetic acid consumption in 2023, highlighting the critical role of glacial acetic acid in these applications.

Rising Demand in Chemical Synthesis

The Glacial Acetic Acid Market is experiencing a notable increase in demand due to its essential role in chemical synthesis. This compound serves as a key building block for various chemicals, including acetic anhydride and acetate esters, which are crucial in the production of plastics, textiles, and solvents. As industries expand, particularly in the manufacturing of synthetic fibers and plastics, the need for glacial acetic acid is projected to rise. Recent data indicates that the global consumption of acetic acid reached approximately 16 million metric tons in 2023, with a significant portion attributed to glacial acetic acid. This trend suggests a robust growth trajectory for the market, driven by the ongoing industrialization and the increasing complexity of chemical processes.

Technological Innovations in Production

The Glacial Acetic Acid Market is benefiting from technological innovations that enhance production efficiency and reduce costs. Recent advancements in catalytic processes and reactor designs have led to improved yields and lower energy consumption in the production of glacial acetic acid. These innovations not only make production more economically feasible but also contribute to a decrease in the environmental footprint of manufacturing processes. As companies invest in research and development, the market is likely to see a proliferation of new technologies that could redefine production standards. It is estimated that these technological advancements could lead to a 15% reduction in production costs by 2026, thereby stimulating further growth in the glacial acetic acid market.

Increasing Focus on Sustainable Practices

The Glacial Acetic Acid Market is witnessing a shift towards sustainable production practices, driven by environmental concerns and regulatory pressures. Manufacturers are increasingly adopting bio-based methods for producing glacial acetic acid, which not only reduces carbon emissions but also aligns with the global push for sustainability. This transition is supported by advancements in biotechnology and fermentation processes, which are becoming more economically viable. As a result, the market is likely to see a rise in the availability of sustainably produced glacial acetic acid, appealing to environmentally conscious consumers and businesses. The potential for bio-based acetic acid to capture a significant market share is evident, as it could account for up to 30% of the total production by 2030, reshaping the landscape of the glacial acetic acid market.

.png)