Cost-Effectiveness

Cost-effectiveness remains a pivotal driver for the Acrylic Fiber Market. Acrylic fibers are generally less expensive to produce compared to natural fibers, making them an attractive option for manufacturers seeking to optimize production costs. The affordability of acrylic fibers allows for competitive pricing in the textile market, which is particularly appealing in price-sensitive regions. Additionally, the durability and low maintenance requirements of acrylic fibers contribute to their cost-effectiveness over time. As manufacturers continue to seek ways to reduce costs while maintaining quality, the Acrylic Fiber Market is expected to thrive, driven by the economic advantages offered by acrylic fibers.

Sustainability Initiatives

The Acrylic Fiber Market is experiencing a notable shift towards sustainability initiatives. As consumers become increasingly aware of environmental issues, manufacturers are compelled to adopt eco-friendly practices. This includes the development of bio-based acrylic fibers, which are derived from renewable resources. The market for sustainable textiles is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend not only aligns with consumer preferences but also enhances brand reputation, thereby driving demand within the Acrylic Fiber Market. Companies that invest in sustainable production methods may find themselves at a competitive advantage, as they cater to a growing segment of environmentally conscious consumers.

Technological Advancements

Technological advancements play a crucial role in shaping the Acrylic Fiber Market. Innovations in fiber production techniques, such as the use of advanced spinning technologies, have led to the creation of high-performance acrylic fibers. These fibers exhibit superior properties, including enhanced durability and moisture-wicking capabilities, making them increasingly popular in various applications, from apparel to home textiles. The market is witnessing a surge in research and development activities aimed at improving fiber quality and production efficiency. As a result, the Acrylic Fiber Market is likely to benefit from reduced production costs and increased output, which could further stimulate market growth.

Versatility in Applications

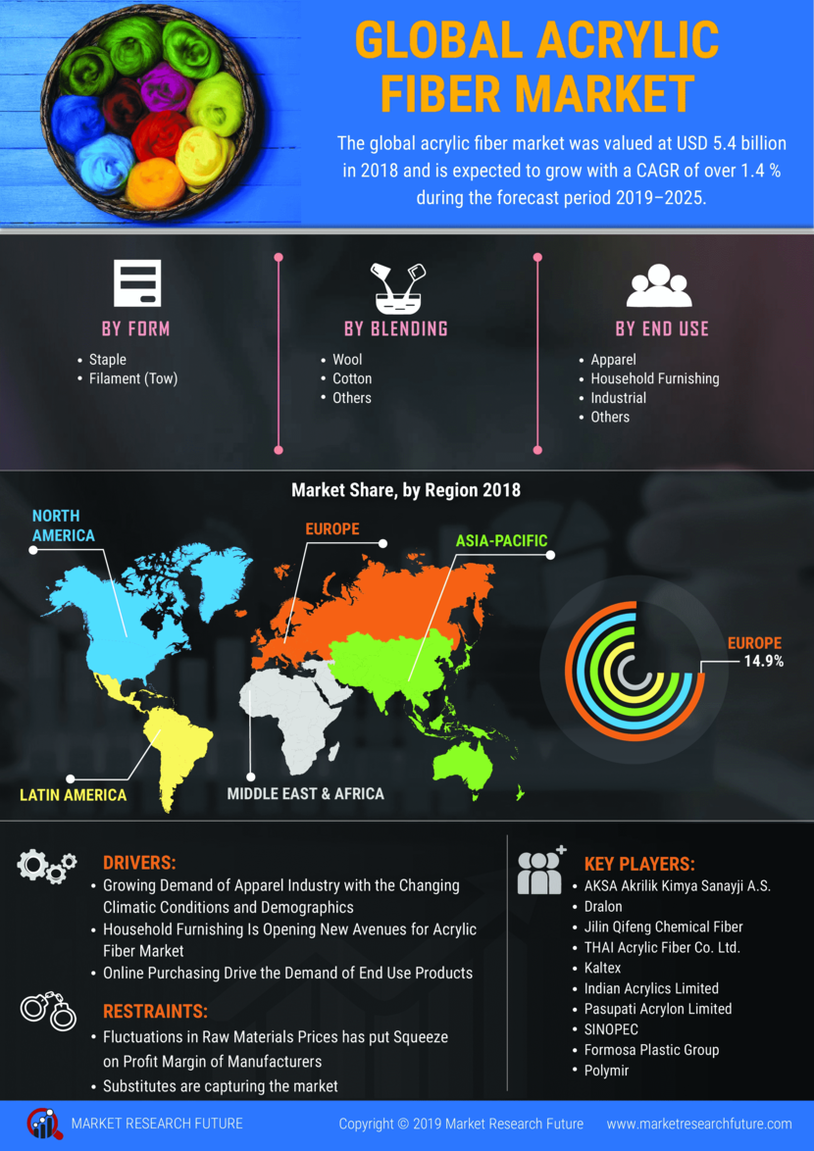

The versatility of acrylic fibers is a significant driver for the Acrylic Fiber Market. These fibers are utilized in a wide range of applications, including clothing, upholstery, and industrial textiles. Their lightweight nature, coupled with excellent color retention and resistance to fading, makes them an attractive choice for manufacturers. The increasing trend of blending acrylic fibers with other materials, such as cotton and wool, further enhances their appeal in the fashion industry. As consumer preferences evolve towards multifunctional textiles, the Acrylic Fiber Market is likely to see sustained demand across various sectors, thereby bolstering its growth.

Rising Demand in Emerging Markets

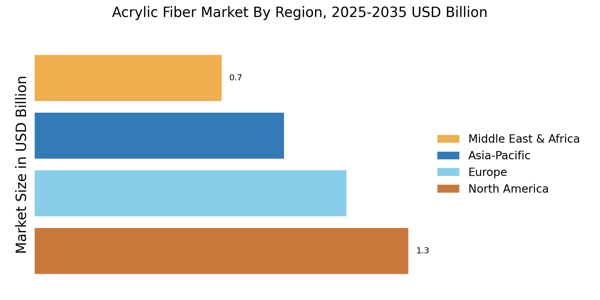

The Acrylic Fiber Market is witnessing a surge in demand from emerging markets, particularly in Asia and Latin America. Rapid urbanization and increasing disposable incomes in these regions are driving the consumption of acrylic fibers in textiles and apparel. For instance, the demand for acrylic fibers in the textile sector is projected to grow at a rate of approximately 6% annually over the next five years. This growth is fueled by the rising popularity of synthetic fibers due to their affordability and versatility. As manufacturers expand their operations to cater to these burgeoning markets, the Acrylic Fiber Market is poised for substantial growth.