Market Analysis

In-depth Analysis of Acrylonitrile Styrene Acrylate Market Industry Landscape

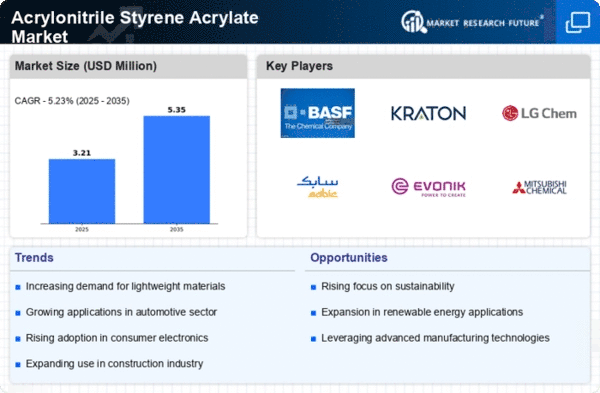

The overall landscape of The Acrylonitrile Styrene Acrylate (ASA) market is influenced by dynamic evolving trends. One such thermoplastic polymer is acrylonitrile-styrene-acrylate, which has wide applications across multiple sectors, including construction, automotive, and consumer goods manufacturing industries, among others. The key drivers behind such growing demand include excellent weather ability properties along with resistance towards UV radiations, making it widely acceptable for outdoor usage only. Also, the automobile industry has a great influence over the dynamics of ASA. High impact strength, chemical resistance, and beauty are some of the reasons why it is used in making exterior car parts. Since there is a growing emphasis on lightweight materials in the automotive industry to increase fuel efficiency, ASA finds value in lightweight yet strong materials for manufacturing components. Consequently, ASA usage in making automotive exterior trims, grilles, and mirror housings has become more popular. Technological advancements and innovations in polymer chemistry also shape the market dynamics of ASA. Manufacturers always try to find out how to enhance the properties of their ASA, such as thermal stability or impact strength. Global economic factors, along with geopolitical events, contribute to the market dynamics within which ASA operates. Price changes for raw materials, regulatory environment, and trade issues may affect overall production costs and supply chain, thus determining the pricing and availability of ASA products. Additionally, these trends reflect regional preferences that dictate the market dynamics of Acrylonitrile Styrene Acrylate (ASA). Industrial activities carried out within these regions vary with infrastructure development coupled with consumer behavior, leading to different levels of demand across nations. The competitive landscape of the ASA market is characterized by key players who are continuously trying to broaden their market shares. In order to strengthen their product portfolios and expand their geographic reach, various companies have been involved in strategic initiatives such as mergers, acquisitions, and collaborations. Thus, the market dynamics of Acrylonitrile Styrene Acrylate (ASA) show an intricate interplay of factors like industry-specific demands, technological advancements, economic conditions, and regional preferences. Nevertheless, this is a dynamic sector that requires constant vigilance from the participants while being adaptable to identify emerging opportunities and overcome challenges.

Leave a Comment