Market Trends

Key Emerging Trends in the Acrylonitrile Styrene Acrylate Market

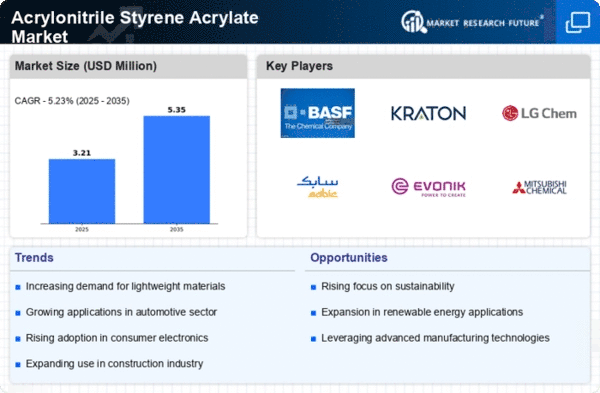

The past few years have seen remarkable trends and developments in the Acrylonitrile Styrene Acrylate (ASA) market, reflecting a highly volatile environment brought about by several factors. A thermoplastic polymer called ASA has grown significantly in its inherent versatility, which provides a range of attributes, including high resistance levels against impact, weatherability, and thermal stability. For example, one notable thing happening within the market is the growing demand for ASA within the construction sector. Another emerging trend is the increased use of ASA within the automobile industry, such as the automotive industry's use of Asa. With a rising focus on lightweight materials to enhance fuel-efficiency, ASA's combination of strength and low weight has made it an attractive option for various automotive applications-"Lightweighting" Drives Automotive Boom In Market For Plastics And Composites Asa For Automotives.Properties such as light weightiness to allow good fuel economy without compromising on safety make it ideal for automakers seeking ways to reduce total vehicle weight per unit length. ASA's ability to withstand exposure to sunlight and chemicals also contributes to its adoption in exterior automotive components, including body panels and trim. Recently, there has been increasing demand for acrylonitrile styrene acrylate (ASA). Moreover, consumer goods now serve as one major driving force behind some ASA-market trends apart from the construction and automobile sectors. For instance, ASA has been used in the production of various household goods and outdoor items that need to be both aesthetically attractive and durable. Similarly, current market trends also suggest a move towards sustainability and eco-friendly alternatives. Due to increased environmental consciousness, the ASA market has turned to bio-based and recyclable materials. Furthermore, manufacturers are now incorporating sustainable sourcing and production processes to meet regulatory requirements as well as consumer preferences. Inclination towards sustainability is expected to impact the ASA market, with companies investing in R&D to produce eco-friendly variants of this material and its manufacturing procedures. The trends in the ASA market differ geographically depending on regional industrial development activities and levels of economic activity. Essentially, developing regions that are experiencing rapid urbanization and infrastructure development can anticipate higher utilization of ASA within construction sector applications. However, fluctuations in raw material prices coupled with laws governing manufacturing may hinder growth prospects for this market segment. In general, diverse evolving trends across different industries characterize Acrylonitrile Styrene Acrylate (ASA) 's marketspace, which ranges from construction through automotive to consumer goods segments, where its unique characteristics come into play.

Leave a Comment