Global Market Growth Projections

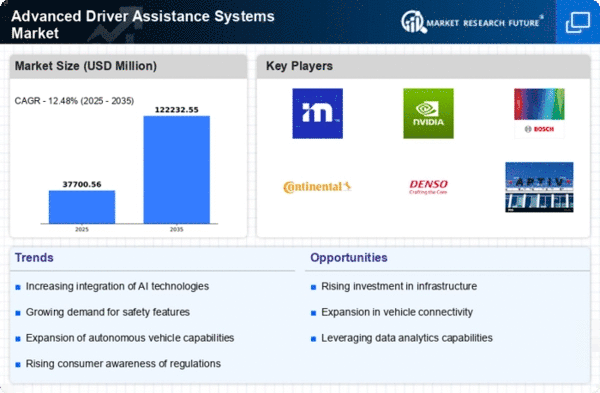

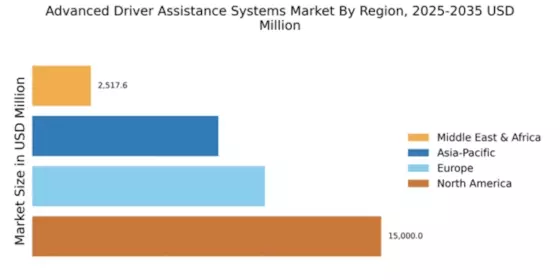

The Global Advanced Driver Assistance Systems Industry is poised for substantial growth, with projections indicating a market value of 33.5 USD Billion in 2024 and an impressive 122.3 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 12.48% from 2025 to 2035. Factors contributing to this expansion include increasing safety regulations, technological advancements, and rising consumer demand for enhanced driving experiences. As the automotive industry continues to evolve, the integration of advanced driver assistance systems will play a crucial role in shaping the future of vehicle safety and functionality.

Increasing Vehicle Safety Regulations

The Advanced Driver Assistance Systems Industry is experiencing growth driven by stringent vehicle safety regulations imposed by governments worldwide. Regulatory bodies are mandating the integration of safety features such as automatic emergency braking and lane departure warnings in new vehicles. For instance, the European Union has proposed regulations that require all new cars to be equipped with advanced safety technologies by 2024. This regulatory push not only enhances vehicle safety but also propels the adoption of advanced driver assistance systems, contributing to the projected market value of 33.5 USD Billion in 2024.

Rise in Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is a pivotal driver for the Advanced Driver Assistance Systems Sector. As manufacturers transition towards electric vehicles, the integration of advanced driver assistance systems becomes essential for enhancing safety and functionality. Autonomous vehicles, which rely heavily on ADAS technologies, are gaining traction in the automotive market. This trend is expected to contribute to the market's growth, with projections suggesting a market value of 122.3 USD Billion by 2035. The synergy between electric mobility and advanced driver assistance systems is likely to shape the future landscape of the automotive industry.

Consumer Demand for Enhanced Driving Experience

There is a growing consumer demand for enhanced driving experiences, which is propelling the Advanced Driver Assistance Systems Landscape. Modern drivers increasingly seek features that provide convenience, safety, and connectivity. Systems such as adaptive cruise control and parking assistance are becoming standard expectations rather than luxury add-ons. This shift in consumer preferences is likely to drive market growth, as manufacturers respond by incorporating more advanced driver assistance systems into their vehicles. The anticipated compound annual growth rate of 12.48% from 2025 to 2035 reflects this trend, indicating a robust future for the industry.

Technological Advancements in Sensor Technology

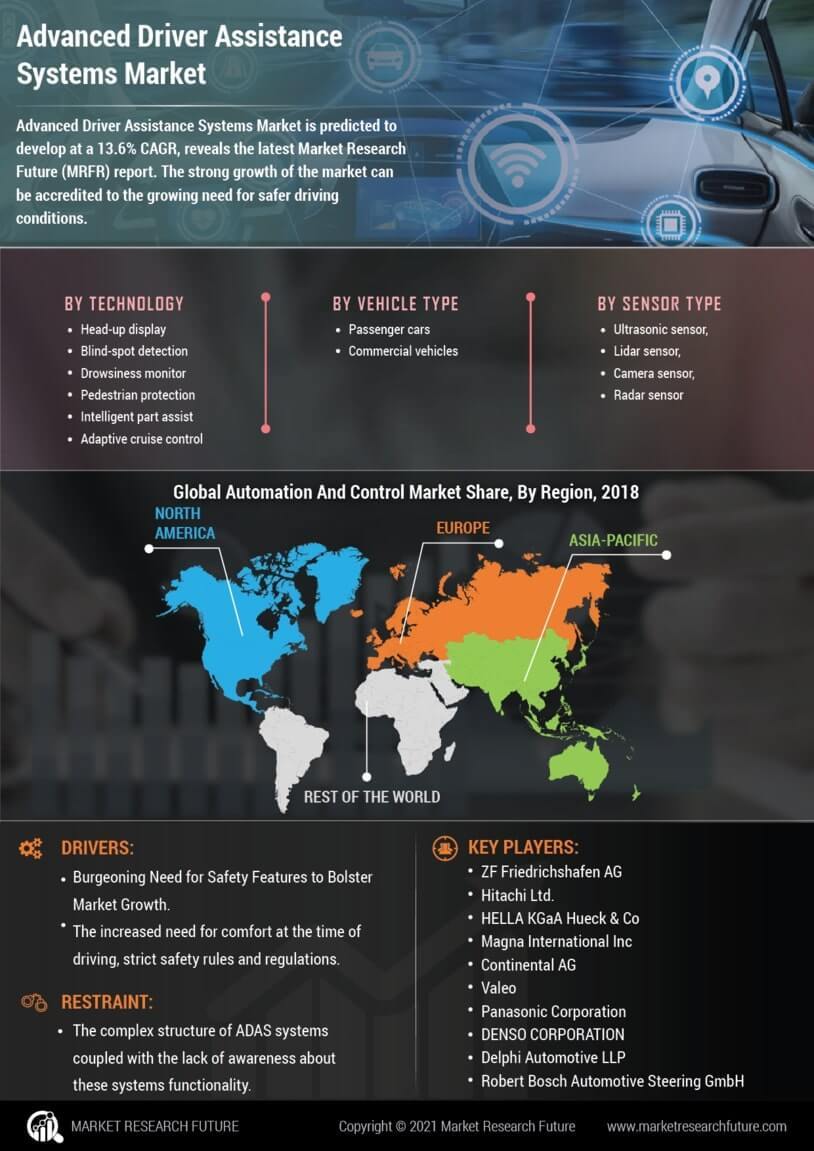

Rapid advancements in sensor technology are significantly influencing the Advanced Driver Assistance Systems Market Size. Innovations in radar, lidar, and camera systems have improved the accuracy and reliability of ADAS features. For example, the development of high-resolution cameras and advanced radar systems enables vehicles to detect obstacles and pedestrians more effectively. This technological evolution is expected to drive market growth, with projections indicating a market value of 122.3 USD Billion by 2035. As these technologies become more affordable and accessible, their integration into vehicles is likely to increase, further enhancing the adoption of advanced driver assistance systems.