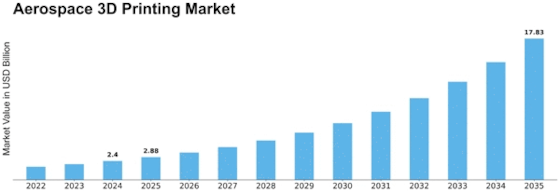

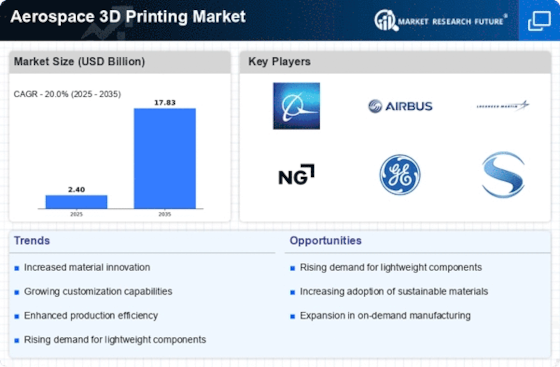

Aerospace 3d Printing Size

Aerospace 3D Printing Market Growth Projections and Opportunities

The aerospace industry has undergone a significant transformation with the advent of 3D printing technology, and the market factors influencing the Aerospace 3D Printing Market are diverse and impactful. One key factor driving the growth of this market is the increasing demand for lightweight and fuel-efficient aircraft. Aerospace 3D printing allows for the production of complex and lightweight components that were traditionally challenging to manufacture using conventional methods. This not only reduces the overall weight of the aircraft but also enhances fuel efficiency, a critical consideration for the aviation sector.

Another crucial market factor is the continuous advancements in 3D printing materials and technologies. As technology evolves, aerospace manufacturers can explore new materials with improved strength, durability, and heat resistance. These advancements enable the production of components that meet stringent industry standards for safety and performance. Additionally, the development of faster and more efficient 3D printing processes contributes to increased production rates, meeting the growing demands of the aerospace sector.

Moreover, the aerospace industry is highly competitive, and companies are constantly seeking ways to differentiate themselves and gain a competitive edge. Aerospace 3D printing allows for greater design flexibility and customization, enabling manufacturers to create unique and innovative aerospace components. This customization capability is particularly beneficial for producing low-volume, high-complexity parts that may be required for specific aircraft models or missions.

Cost efficiency is also a significant market factor. While the initial investment in 3D printing technology can be substantial, the long-term cost savings in terms of material usage, waste reduction, and production efficiency can be substantial. Aerospace companies are increasingly recognizing the economic benefits of 3D printing, leading to a broader adoption of this technology across the industry.

Furthermore, the global push towards sustainability and environmental responsibility has a notable impact on the aerospace 3D printing market. 3D printing allows for more sustainable manufacturing practices by minimizing material waste and energy consumption compared to traditional manufacturing methods. As sustainability becomes a key focus for both manufacturers and consumers, aerospace companies are incorporating 3D printing into their operations to align with environmental goals.

Market regulations and certifications also play a pivotal role in shaping the aerospace 3D printing landscape. As the aerospace industry is highly regulated to ensure safety and reliability, adherence to industry standards and certifications is crucial for 3D-printed aerospace components. The market is influenced by the continuous efforts of regulatory bodies and industry associations to establish and update guidelines for the use of 3D printing in aerospace manufacturing.

Leave a Comment