Market Trends

Key Emerging Trends in the Aerospace 3D Printing Market

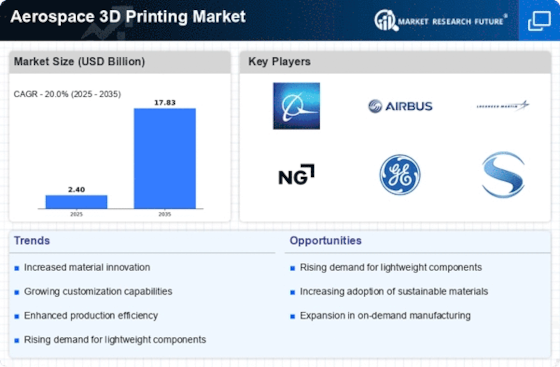

The Aerospace 3D Printing market has experienced significant growth and transformative changes in recent years, marking a paradigm shift in the aerospace industry. This cutting-edge technology, also known as additive manufacturing, has emerged as a game-changer by revolutionizing the way aerospace components are designed, prototyped, and manufactured. The market trends in aerospace 3D printing reflect a trajectory of steady expansion, driven by the industry's need for lightweight, cost-effective, and highly customizable parts.

One of the notable trends in the Aerospace 3D Printing market is the increasing adoption of additive manufacturing for critical aircraft components. Traditional manufacturing methods often involve complex processes and are time-consuming, leading to higher costs and longer production times. Aerospace 3D Printing addresses these challenges by enabling the production of intricate and lightweight components with reduced lead times. As a result, aerospace manufacturers are increasingly integrating 3D printing into their production processes to enhance efficiency and stay competitive in the dynamic industry landscape.

Moreover, the market is witnessing a surge in research and development activities focused on enhancing the materials used in aerospace 3D printing. Advanced materials with improved strength, durability, and resistance to extreme conditions are being developed to meet the stringent safety and performance standards of the aerospace sector. This trend reflects a commitment to pushing the boundaries of what is achievable through additive manufacturing, paving the way for the production of more complex and mission-critical components.

The aerospace industry is also experiencing a shift toward sustainable practices, and 3D printing plays a pivotal role in this transition. Additive manufacturing allows for the optimization of material usage, minimizing waste and reducing the environmental impact of production processes. Manufacturers are increasingly recognizing the importance of sustainability in their operations, and the Aerospace 3D Printing market is responding to this demand by providing eco-friendly solutions that align with global efforts to mitigate the environmental impact of industrial activities.

In addition to these advancements, collaborations and partnerships within the aerospace ecosystem are contributing to the growth of the 3D printing market. Aerospace companies are forming strategic alliances with 3D printing technology providers to leverage each other's expertise and capabilities. These collaborations facilitate knowledge exchange, accelerate innovation, and enable the development of tailored solutions to address the specific challenges of the aerospace industry.

As the Aerospace 3D Printing market continues to evolve, it is also witnessing increased investments from both established players and new entrants. This influx of capital is driving technological advancements, expanding the range of applications, and fostering the development of novel 3D printing techniques. The competitive landscape is dynamic, with companies striving to differentiate themselves by offering specialized solutions and staying at the forefront of technological innovation.

Leave a Comment