Increased Investment in Aerospace R&D

The Aerospace Direct Current DC-DC Converter Market is benefiting from increased investment in research and development within the aerospace sector. As companies strive to innovate and improve aircraft performance, funding for advanced technologies, including DC-DC converters, is on the rise. This investment is likely to lead to the development of more efficient and reliable power management solutions, which are crucial for modern aircraft systems. Recent reports indicate that R&D spending in aerospace is expected to grow significantly, reflecting the industry's commitment to technological advancement. This trend suggests a promising future for DC-DC converters, as they become integral to the next generation of aerospace technologies.

Increased Demand for Lightweight Systems

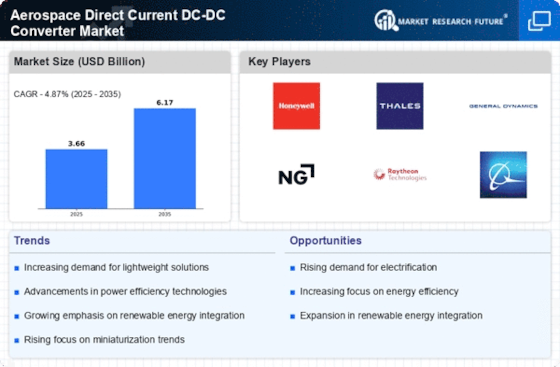

The Aerospace Direct Current DC-DC Converter Market is experiencing a surge in demand for lightweight systems, driven by the aerospace sector's ongoing quest for fuel efficiency and performance enhancement. As aircraft manufacturers strive to reduce overall weight, the integration of lightweight DC-DC converters becomes essential. These converters not only contribute to weight reduction but also enhance the overall efficiency of electrical systems. According to recent data, the aerospace sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade, further fueling the need for advanced DC-DC converters. This trend indicates a shift towards more efficient power management solutions, which are critical for modern aircraft designs.

Advancements in Electric Aircraft Technology

The Aerospace Direct Current DC-DC Converter Market is significantly influenced by advancements in electric aircraft technology. As the aviation industry increasingly embraces electric propulsion systems, the demand for efficient power conversion solutions rises. DC-DC converters play a pivotal role in managing power distribution and ensuring optimal performance in electric aircraft. The market for electric aircraft is expected to reach a valuation of several billion dollars by 2030, highlighting the potential for DC-DC converters in this evolving landscape. This shift towards electric aviation not only aligns with sustainability goals but also necessitates innovative power management solutions, positioning DC-DC converters as a critical component in future aircraft designs.

Regulatory Pressures for Emission Reductions

The Aerospace Direct Current DC-DC Converter Market is also shaped by regulatory pressures aimed at reducing emissions in the aviation sector. Governments and regulatory bodies are implementing stringent emission standards, compelling aerospace manufacturers to adopt more efficient technologies. DC-DC converters, known for their ability to optimize power usage and reduce energy waste, are becoming increasingly vital in meeting these regulatory requirements. The market is likely to see a rise in demand for converters that comply with these standards, as manufacturers seek to enhance their sustainability profiles. This regulatory landscape not only drives innovation in DC-DC converter technology but also positions these devices as essential components in the quest for greener aviation solutions.

Growing Focus on Renewable Energy Integration

The Aerospace Direct Current DC-DC Converter Market is witnessing a growing focus on renewable energy integration within aerospace applications. As the industry seeks to reduce its carbon footprint, the incorporation of renewable energy sources, such as solar power, becomes increasingly relevant. DC-DC converters facilitate the efficient conversion and management of power generated from these renewable sources, making them indispensable in modern aircraft systems. The market for renewable energy in aviation is projected to expand significantly, with investments in solar-powered aircraft and hybrid systems gaining traction. This trend underscores the importance of DC-DC converters in enabling the seamless integration of renewable energy solutions into aerospace applications.