Emerging Markets and Global Expansion

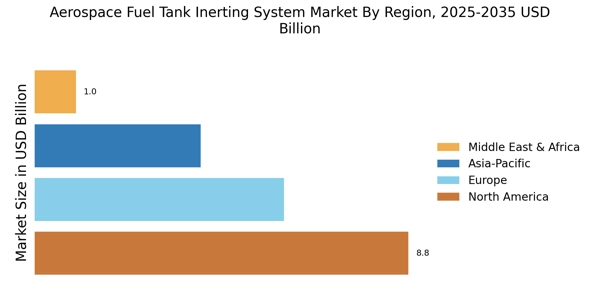

The aerospace fuel tank inerting system Market is witnessing growth driven by emerging markets and global expansion of aviation services. Countries in Asia-Pacific, the Middle East, and Africa are experiencing rapid growth in air travel, leading to increased investments in aviation infrastructure. This expansion necessitates the implementation of advanced fuel tank inerting systems to ensure safety and compliance with international standards. As new airlines enter the market and existing ones expand their fleets, the demand for inerting systems is expected to rise significantly. Market analysts project that the Asia-Pacific region alone could see a growth rate of over 6% in the inerting system sector by 2030. This trend indicates a robust opportunity for manufacturers to tap into these emerging markets and cater to the evolving needs of the aviation industry.

Regulatory Compliance and Safety Standards

The Aerospace Fuel Tank Inerting System Market is heavily influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations mandate the implementation of inerting systems to mitigate the risk of fuel tank explosions, particularly in commercial aviation. As safety becomes a paramount concern, manufacturers are compelled to invest in advanced inerting technologies to comply with these regulations. The market is witnessing a notable increase in demand for systems that meet or exceed these safety standards, which is expected to drive growth. Furthermore, the potential penalties for non-compliance can be substantial, prompting airlines and manufacturers to prioritize the adoption of effective inerting solutions. This regulatory landscape is likely to continue shaping the market dynamics in the foreseeable future.

Technological Advancements in Inerting Systems

The Aerospace Fuel Tank Inerting System Market is experiencing a surge in technological advancements that enhance safety and efficiency. Innovations such as advanced sensors and automated control systems are being integrated into inerting systems, allowing for real-time monitoring and management of fuel tank conditions. These technologies not only improve the reliability of inerting systems but also reduce the weight and complexity of installations. As a result, manufacturers are increasingly adopting these advanced systems to meet the growing demand for safer aircraft operations. The market for these technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend indicates a strong shift towards more sophisticated inerting solutions in the aerospace sector.

Sustainability and Environmental Considerations

The Aerospace Fuel Tank Inerting System Market is increasingly aligning with sustainability and environmental considerations. As the aviation sector faces pressure to reduce its carbon footprint, inerting systems are being recognized for their role in enhancing fuel efficiency and reducing emissions. By preventing fuel vapor ignition, these systems contribute to safer operations and lower environmental impact. The market is responding to this trend, with manufacturers developing more eco-friendly inerting solutions that utilize sustainable materials and processes. This shift towards sustainability is not only a response to regulatory pressures but also a reflection of changing consumer preferences. As airlines seek to improve their environmental credentials, the demand for innovative inerting systems is expected to rise, potentially leading to a market expansion of around 4% annually.

Increased Aircraft Production and Fleet Expansion

The Aerospace Fuel Tank Inerting System Market is benefiting from the increased production of aircraft and the expansion of airline fleets. With a growing number of aircraft being manufactured, there is a corresponding rise in the demand for effective fuel tank inerting systems. This trend is particularly evident in the commercial aviation sector, where airlines are investing in new aircraft to meet rising passenger demand. The market for inerting systems is projected to grow in tandem with aircraft production rates, which are expected to reach over 40,000 units annually by 2030. This expansion presents a significant opportunity for manufacturers of inerting systems, as they seek to equip new aircraft with the latest safety technologies. The interplay between aircraft production and inerting system demand is likely to drive market growth in the coming years.