Agricultural Adjuvants Size

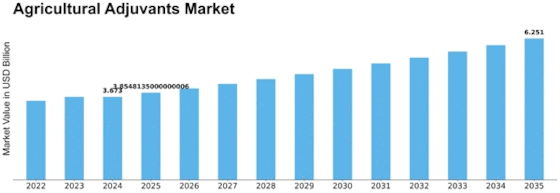

Agricultural Adjuvants Market Growth Projections and Opportunities

The market size of agricultural adjuvants is not set in stone by a huge number of variables that all in all influence the business' elements. A fundamental determinant driving the market size is the never-ending development of the overall horticultural area. The worldwide populace is expanding, and dietary inclinations are going through changes, which have prompted a developing requirement for expanded crop yields. Adjuvants used in agribusiness are pivotal for augmenting the viability of pesticides and herbicides, subsequently working with further developed crop security and expanded yields. The interest in adjuvants is moved and adds to the general market size by the rising need to take care of a developing populace, which thusly requires the reception of additional proficient and maintainable rural practices.

Administrative factors altogether impact the extent of the agricultural adjuvants market. A developing accentuation on natural manageability and tough guidelines overseeing the utilization of agrochemicals influence the turn of events and reception of adjuvants with decreased ecological effect. Guaranteeing adherence to administrative guidelines is basic for makers to effectively acquaint their items with the market and lay out an expansive base of help among ranchers. The market size is affected by the limit of adjuvant makers to fulfill and outperform developing administrative necessities relating to natural and medical problems.

Developments in adjuvant definitions and mechanical advancement extensively add to the market size of agricultural adjuvants. Nonstop examinations and progressions endeavor to foster adjuvants that display upgraded solidness, execution, and similarity with a broad exhibit of agrochemicals. Progressions, for example, float control specialists, surfactants displaying further developed wetting attributes, and adjuvants custom fitted to specific application advances all add to the expanded viability and far and wide utilization of adjuvants in contemporary agriculture. The market still up in the air by makers' ability to give creative plans that really tackle arising rural difficulties.

The market size of agricultural adjuvants is fundamentally affected by the financial climate and advancements in exchange. The expense and accessibility of fundamental materials for adjuvant creation might be impacted by vacillations in money trade rates, ware costs, and exchange strategies. Besides, considering the rural info industry's globalization, producers of adjuvants are constrained to agree with worldwide exchange guidelines and oblige changed territorial inclinations. Monetary contemplations influence the moderateness of adjuvants for ranchers, thus impacting the size of the market overall.

The growing use of accurate farming procedures is a critical determinant in impacting the market aspects of agricultural adjuvants. The use of accuracy cultivating advancements, including robots and GPS-directed work vehicles, empowers ranchers to precisely and exactly apply pesticides and herbicides to explicit regions. There is huge interest for adjuvants that work on the viability of agrochemicals in such exact applications. The rising pervasiveness of accuracy horticulture, which means to expand asset usage and decrease ecological damage, is the essential element moving the market for adjuvants planned explicitly for accuracy cultivating strategies.

The extension of specialty crops and the expansion of agrarian products add to the differed requests for agricultural adjuvants, which thus influence the market size. Adjuvant arrangements might should be altered to suit the specific qualities and difficulties experienced by particular cultivars. The extension of makers' yield portfolios because of market requests influences the general market size by expanding the interest for specific adjuvants. Makers who have the capacity to give a broad determination of adjuvant arrangements customized to various harvests are decisively situated to take advantage of this turn of events and increase their piece of the pie.

The essential element of market solidification by means of consolidations and acquisitions applies an impact available size of agricultural adjuvants. Consolidations, acquisitions, and coordinated efforts are used by organizations in this industry to expand their product offerings, get to new business sectors, and create cooperative energies. Market solidification impacts market size and adds to general extension through the combination of assets, the improvement of innovative work drives, and the stronghold of the marketplaces of significant entertainers.

the market size of agricultural adjuvants is impacted by different factors like the development of farming on a worldwide scale, administrative strategies, innovative advancement, monetary conditions, execution of accuracy agribusiness techniques, crop assortment, and market combination. Makers in the agricultural adjuvants area are gone up against with the continuous advancement of these variables, which requires the change of their systems and definitions to adjust to the moving requests of the agribusiness area and more extensive improvements in manageability, accuracy farming, and monetary conditions.

Leave a Comment