Agricultural Coatings Market Summary

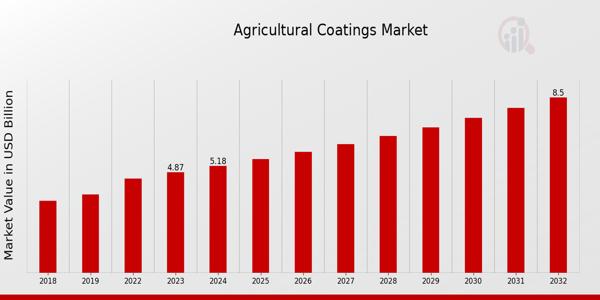

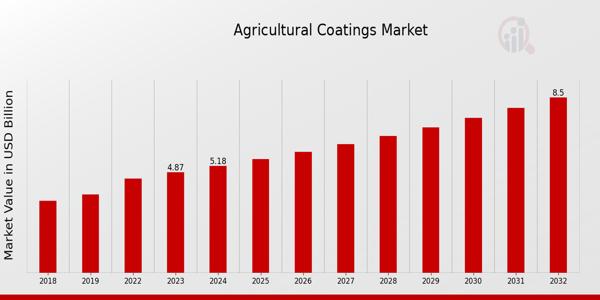

As per Market Research Future Analysis, the Global Agricultural Coatings Market was valued at 4.58 USD Billion in 2022 and is projected to grow to 8.5 USD Billion by 2032, reflecting a CAGR of 6.39% from 2024 to 2032. The market is driven by increasing demand for sustainable agricultural practices, technological advancements in coatings, and rising concerns over crop losses due to pests and adverse weather conditions. Key segments include Seed Coatings, Fertilizer Coatings, Pesticide Coatings, and Herbicide Coatings, with significant contributions from Crop Protection, Seed Protection, and Soil Enhancement applications.

Key Market Trends & Highlights

The Agricultural Coatings Market is characterized by several key trends.

- The market is expected to grow from 4.87 USD Billion in 2023 to 8.5 USD Billion by 2032.

- Seed Coatings valued at 1.3 USD Billion in 2023 play a crucial role in enhancing seed viability.

- Pesticide Coatings dominate the market at 1.7 USD Billion in 2023, vital for pest control.

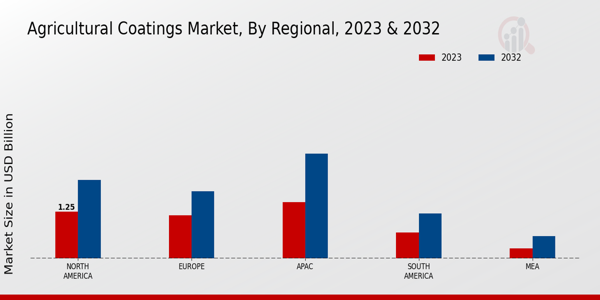

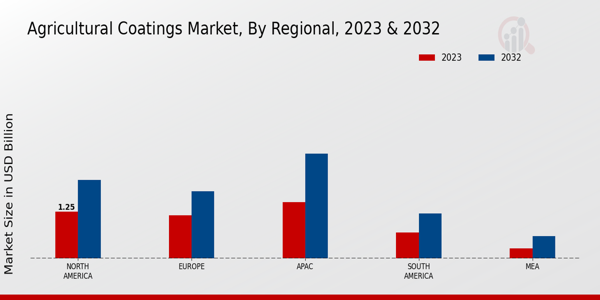

- North America leads the market with a value of 1.25 USD Billion in 2023, projected to reach 2.1 USD Billion by 2032.

Market Size & Forecast

2022 Market Size: USD 4.58 Billion

2023 Market Size: USD 4.87 Billion

2032 Market Size: USD 8.5 Billion

CAGR (2024-2032): 6.39%

Largest Regional Market Share in 2023: North America.

Major Players

Key companies include Nippon Soda, Nutrien, Nippon Paint Holdings, Nufarm, Corteva, Syngenta, Arkema, Koppert Biological Systems, BASF, Mitsui Chemicals, FMC Corporation, and Adama Agricultural Solutions.

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Agricultural Coatings Market Trends Highlighted

The need for farming products like crop safety and increasing interest in food security mainly fuels the Organic Coatings for Agriculture Market. With the advancement of agriculture, the demand for various coatings, which increase the life span and the overall effectiveness of different products, has increased. Moreover, the invention of products also markets leveraging as a manufacturer implements biotechnology and sustainable agriculture for the advancement of their product development. People are getting more interested in organic farming and coatings that relate to it.

Instead, they are more inclined to introduce non-polluting and biodegradable paints that meet the modern requirements of low-toxic agriculture.

One can spot participation openings in the agricultural coatings market through the growth of the specialty coatings market and the growing base of users of precision farming methods. The application of technologies such as smart coatings, which will have the functionalities of slow release and good adherence on the plant surface, is something that further brings out diversity in agriculture. Urban farming and vertical farming are also a new trend that is providing scope for new coatings aimed at these new farming techniques.

The market also has a wide scope for growth through product differentiation and customized solutions to end users with better yield and quality crop demand.

Weather-related trends are resulting in an increased concern for the environmental effects of farming and, hence emergence of sustainable practices and products. This made it necessary to redirect efforts to the development of protective coatings with the intention of reducing the amount of agrochemicals that are lost to the environment. There is increasing collaboration between farming communities and coating producers as they try to develop products for the current agricultural system while taking care of the environment. These trends are expected to characterize the business environment of the agricultural coatings market in the foreseeable future.

Agricultural Coatings Market Drivers

Increasing Demand for Sustainable Agricultural Practices

The Agricultural Coatings Market Industry is experiencing a significant shift towards sustainable agricultural practices. As the population continues to grow, there is an increasing need for efficient food production methods that minimize the environmental impact. Farmers and agricultural stakeholders are more inclined to adopt sustainable solutions that ensure effective yield while also preserving natural resources. Agricultural coatings, which encompass products such as crop protection agents, fertilizers, and biopesticides, are being developed with eco-friendly formulations that enhance plant growth without the harmful effects of traditional chemical inputs.

This movement towards sustainability is driven by consumer awareness as well as government regulations that prioritize environmentally friendly practices. Consequently, the demand for agricultural coatings that meet these sustainability criteria is anticipated to reach new heights in the coming years. By embracing eco-responsibility, farmers can not only improve their productivity but also contribute positively to the environment, thereby fueling growth within the Agricultural Coatings Market.

Innovative solutions, including natural and biodegradable coatings, are being introduced to cater to this demand, presenting lucrative opportunities for manufacturers and suppliers within the industry.

Technological Advancements in Coatings

Continuous technological advancements in coating formulations and applications propel the Agricultural Coatings Market Industry. The development of innovative coating technologies enhances the effectiveness and efficiency of products, leading to improved crop yield and protection. These advancements include controlled-release coatings that allow for the gradual delivery of nutrients and active ingredients to crops, ensuring optimal growth conditions.

Furthermore, the integration of smart coatings with features like enhanced adherence and weather resistance contributes to their longevity and effectiveness in diverse agricultural environments. As the agricultural sector adopts these new technologies, the market for specialized coatings that enhance product performance and sustainability is expected to see significant growth.

Rising Concerns Over Crop Losses

The Agricultural Coatings Market Industry is witnessing growth due to rising concerns about crop losses caused by pests, diseases, and adverse weather conditions. The need for effective protection solutions has become paramount as agricultural stakeholders aim to safeguard their investments and ensure food security. Specialized agricultural coatings that protect against various threats, including insects and diseases, are gaining attention.

These coatings enhance the resilience of crops and prolong their viability, making them a crucial component in modern farming practices. As farmers become increasingly aware of the potential risks to their harvest, the demand for advanced agricultural coatings that offer robust protection is expected to surge.

Agricultural Coatings Market Segment Insights

Agricultural Coatings Market Type Insights

The Agricultural Coatings Market has shown significant growth and diversification across various types which include Seed Coatings, Fertilizer Coatings, Pesticide Coatings, and Herbicide Coatings. As of 2023, the overall market value is noted at 4.87 USD Billion, with each type contributing relatively distinct values and growth potential. Seed Coatings holds a prominent position within the market, valued at 1.3 USD Billion in 2023, and demonstrates an essential role in enhancing seed viability and germination rates. These coatings often contain fertilizers, pesticides, or other materials that improve crop productivity, making Seed Coatings significant for sustainable agricultural practices.

Fertilizer Coatings are also important, valued at 1.2 USD Billion in 2023; these coatings enhance nutrient release, ensuring that crops receive necessary minerals at optimal times. This segment is crucial as efficient nutrient delivery systems are integral to meeting growing food demands, which underpins the importance of this type. The Pesticide Coatings category, valued at 1.7 USD Billion in 2023, dominates due to its significant role in pest control, thus protecting crop yields from various agricultural threats. The development of innovative pesticide coatings that reduce harmful impacts on beneficial organisms further underscores the segment's vitality.

On the other hand, Herbicide Coatings, valued at 0.67 USD Billion in 2023, represent the smallest segment within the Agricultural Coatings Market. Despite this, their importance shouldn't be underestimated, as effective weed control is essential for maximizing crop yield and quality. As the market evolves, challenges such as resistance to herbicides are encouraging the development of novel formulations, allowing this segment to gain a larger share over time potentially. The Agricultural Coatings Market data shows a clear competitive landscape among these types, with each serving critical roles in enhancing agricultural efficiency and output.

With majorities holding in Seed, Pesticide, and Fertilizer Coatings, these segments are expected to flourish, driven by rising agricultural demands and innovations in coating technologies. Overall, the segmentation in the Agricultural Coatings Market highlights the diverse applications and growth opportunities across each type, reinforcing their substantial contributions to the agricultural industry while continuing to evolve in response to market needs and challenges.

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Agricultural Coatings Market Application Insights

The Agricultural Coatings Market, expected to be valued at 4.87 billion USD in 2023, displays significant growth potential within the Application segment, which includes Crop Protection, Seed Protection, and Soil Enhancement. Crop Protection remains a crucial area, addressing the increasing demand for effective pest control solutions and contributing to the overall market growth. Seed Protection is also vital as it ensures seed viability and enhances germination rates, thus fostering productivity and sustainability in agriculture. Soil Enhancement plays an essential role in improving soil health and nutrient availability, which is critical for crop yields.

Collectively, these Applications highlight the strategic focus on maximizing agricultural output while promoting eco-friendly practices, responding to the prevailing trends of sustainable farming and food security. The opportunities in this segment support the expanding Agricultural Coatings Market revenue as innovative solutions continue to develop, catering to the evolving needs of farmers and agricultural industries. As the market evolves, these dynamics position the Application segment as a pivotal area for both growth and investment within the broader Agricultural Coatings Market industry.

Agricultural Coatings Market Formulation Insights

The Agricultural Coatings Market, particularly focusing on the formulation segment, has shown significant growth due to its essential role in enhancing agricultural productivity and product quality. In 2023, the market was valued at 4.87 billion USD, reflecting the increasing demand for effective agricultural coatings. Various forms, including liquid, powder, and granular categories, characterize the formulation segment. Among these, liquid formulations dominate the market owing to their ease of application and superior coverage on crops, making them a preferred choice for farmers.

Powder formulations, while somewhat less prevalent, offer benefits in specific agricultural applications where reduced water usage is crucial. Granular formulations are equally important, as they facilitate controlled-release properties, crucial for optimizing nutrient delivery to crops and minimizing environmental impact. The combination of these forms caters to diverse agricultural needs, presenting multiple opportunities for market growth and innovation. Market trends indicate an increasing awareness of sustainable practices, which further drives the demand in this segment.

Overall, the formulation aspect within the Agricultural Coatings Market shows promising potential, fueled by technological advancements and heightened agricultural productivity needs.

Agricultural Coatings Market End-Use Insights

The Agricultural Coatings Market, valued at 4.87 billion USD in 2023, is witnessing a notable focus on the End-use segment, which plays a crucial role in the industry's dynamics. In this context, the market encompasses various applications, including Agriculture, Horticulture, and Forestry. Agriculture represents a significant portion of the market, driven by increasing demand for crop protection solutions that enhance yield and quality. Horticulture also holds a key position, as the rise in ornamental plants and landscaping services boosts the usage of coatings that provide protective and aesthetic benefits.

Forestry, while relatively smaller in comparison, is important for the conservation of timber resources and the protection of forestry products. The ongoing emphasis on sustainable practices and the adoption of environmentally friendly formulations are pivotal trends shaping the Agricultural Coatings Market revenue, with the aim of mitigating environmental impact while meeting the increasing agricultural productivity demands. Market growth is further propelled by advancements in coating technologies, which allow for better performance and applicability across different agricultural settings.

As the industry evolves, challenges such as regulatory compliance and the need for constant innovation remain essential factors in the successful deployment of agricultural coatings.

Agricultural Coatings Market Regional Insights

The Agricultural Coatings Market is projected to reach a valuation of 4.87 USD Billion in 2023, with significant regional contributions shaping the overall landscape. North America stands out with a market value of 1.25 USD Billion, expected to grow to 2.1 USD Billion by 2032, reflecting its majority holding in the market due to advancements in agricultural practices and coatings technology. Europe follows closely, valued at 1.15 USD Billion in 2023 and anticipated to grow to 1.8 USD Billion by 2032, driven by strict regulations towards sustainable agriculture.

The APAC region demonstrates a notable expansion, from 1.5 USD Billion in 2023 to 2.8 USD Billion in 2032, supported by increasing agricultural production and a rising population. South America, holding a value of 0.7 USD Billion in 2023 and expected to reach 1.2 USD Billion by 2032, portrays an emerging opportunity due to growing interest in bio-based coatings. Finally, the MEA segment, though smaller, shows potential for growth, with a market value of 0.27 USD Billion in 2023, projected to reach 0.6 USD Billion by 2032, indicating increasing awareness towards agricultural sustainability.

The insights highlight the dynamics of regional strengths contributing to the overall growth in the Agricultural Coatings Market revenue.

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Agricultural Coatings Market Key Players and Competitive Insights

The competitive landscape of the Agricultural Coatings Market is characterized by a diverse array of players, each striving to secure a significant share of this evolving sector. The increasing demand for crop protection, alongside the rise in sustainable agricultural practices, has spurred innovation and expansion among manufacturers. Companies are focusing on enhancing their product offerings through advanced technologies that improve efficacy and reduce environmental impact. Strategic partnerships, mergers, and acquisitions are prevalent as firms seek to bolster their market presence and leverage each other's strengths to foster growth.

Moreover, an emphasis on regulatory compliance and sustainability is steering the development of bio-based and eco-friendly coatings, further intensifying competition as well-established firms and new entrants vie for consumer trust and market dominance.

Nippon Soda has established a strong foothold within the Agricultural Coatings Market, leveraging its extensive expertise in chemical manufacturing and product development. The company's strengths lie in its robust research and development capabilities, enabling it to innovate and introduce products tailored to the specific needs of farmers and agricultural enterprises. Nippon Soda places a high priority on quality and technological advancement, which are critical in formulating effective agricultural coatings that enhance crop yield and resilience against pests and diseases.

Furthermore, the company's commitment to sustainability and compliance with stringent environmental regulations positions it favorably among increasingly eco-conscious consumers and agricultural stakeholders looking for effective yet responsible solutions.

Nutrien stands out in the Agricultural Coatings Market due to its comprehensive approach to the agricultural value chain, encompassing everything from production to distribution. The company's vast network and scale provide it with significant advantages in product accessibility and pricing strategies, allowing it to cater to a wide range of customers. Nutrien's strength lies in its integrated solutions that combine fertilizers, crop protection products, and agricultural coatings, positioning it as a one-stop shop for farmers aiming to optimize their productivity.

Nutrien emphasizes research and innovation, ensuring that its product offerings are not only effective but also aligned with modern agricultural practices and sustainability goals. This strategic advantage enables Nutrien to maintain a competitive edge in the dynamic agricultural coatings landscape.

Key Companies in the Agricultural Coatings Market Include

Agricultural Coatings Market Industry Developments

Recent developments in the Agricultural Coatings Market have showcased significant growth and innovation, driven by increasing demand for crop protection products and sustainable agricultural practices. Companies like Corteva and Syngenta continue to expand their product portfolios, focusing on environmentally friendly coatings that enhance the efficacy of pesticides and fertilizers. Meanwhile, BASF and Arkema are investing in research and development to create advanced coating materials that improve stability and performance under varying climatic conditions. Notably, Nufarm and Nutrien are experiencing notable market valuation growth, reflecting strong consumer interest in their product lines.

Additionally, Nippon Soda is actively seeking strategic partnerships to enhance its position in the market. Mergers and acquisitions have also played a role in shaping the landscape, with notable activity from FMC Corporation and Adama Agricultural Solutions as they explore new synergies. Meanwhile, Nippon Paint Holdings has been rumored to be considering integration opportunities with complementary firms to bolster its agricultural segment. The overall market is responding positively to these movements, indicating a robust outlook as companies adapt to evolving agricultural needs ly.

Agricultural Coatings Market Segmentation Insights

-

-

Agricultural Coatings Market Type Outlook

-

Seed Coatings

-

Fertilizer Coatings

-

Pesticide Coatings

-

Herbicide Coatings

-

Agricultural Coatings Market Application Outlook

-

Crop Protection

-

Seed Protection

-

Soil Enhancement

-

Agricultural Coatings Market Formulation Outlook

-

Agricultural Coatings Market End-Use Outlook

-

Agriculture

-

Horticulture

-

Forestry

-

Agricultural Coatings Market Regional Outlook

-

North America

-

Europe

-

South America

-

Asia-Pacific

-

Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2022 |

4.58(USD Billion) |

| Market Size 2023 |

4.87(USD Billion) |

| Market Size 2032 |

8.5(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

6.39% (2024 - 2032) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2023 |

| Market Forecast Period |

2024 - 2032 |

| Historical Data |

2019 - 2022 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Nippon Soda, Nutrien, Nippon Paint Holdings, Nufarm, Corteva, Syngenta, Arkema, Koppert Biological Systems, BASF, Mitsui Chemicals, FMC Corporation, Adama Agricultural Solutions |

| Segments Covered |

Type, Application, Formulation, End Use, Regional |

| Key Market Opportunities |

Sustainable coating solutions demand, Expansion in organic farming practices, Advanced coatings for crop protection, Adoption of precision agriculture technologies, Growing need for biopesticides and herbicides |

| Key Market Dynamics |

Sustainability trends, Increasing crop yield demand, Technological advancements, Regulatory compliance pressures, Biopesticide adoption growth |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Agricultural Coatings Market Highlights:

Frequently Asked Questions (FAQ):

The Agricultural Coatings Market is expected to be valued at 8.5 USD Billion in 2032.

The projected CAGR for the Agricultural Coatings Market from 2024 to 2032 is 6.39%.

North America is anticipated to have the highest market value of 2.1 USD Billion in 2032.

The market value of Seed Coatings is expected to be 2.3 USD Billion in 2032.

Key players in the Agricultural Coatings Market include Nippon Soda, Nutrien, and Corteva, among others.

The market value for Pesticide Coatings is projected to be 2.7 USD Billion in 2032.

The expected market size for Fertilizer Coatings in 2032 is 2.1 USD Billion.

The APAC region is anticipated to grow to a market value of 2.8 USD Billion in 2032.

The market value for Herbicide Coatings is expected to reach 1.4 USD Billion in 2032.

Potential challenges may include fluctuations in raw material prices and environmental regulations affecting agricultural practices.