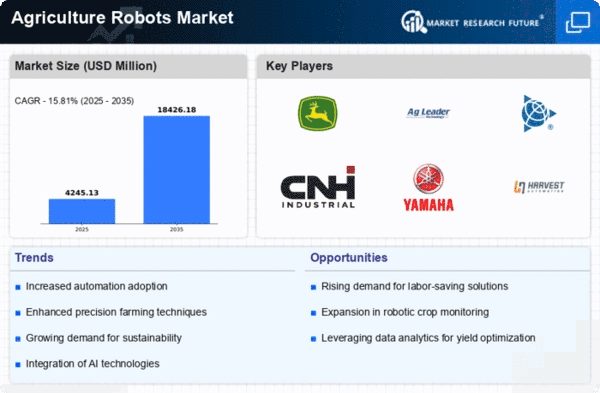

The Agriculture Robots Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for automation in farming practices. Key players such as John Deere (US), AG Leader Technology (US), and Trimble (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. John Deere (US) emphasizes innovation through its investment in precision agriculture technologies, while AG Leader Technology (US) focuses on developing user-friendly software solutions that integrate seamlessly with existing farming equipment. Trimble (US) is leveraging partnerships to expand its digital agriculture offerings, indicating a trend towards collaborative innovation that shapes the competitive environment.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. The market appears moderately fragmented, with a mix of established players and emerging startups. This structure allows for diverse strategies, as key players influence market dynamics through their operational focus and technological advancements, collectively driving growth in the sector.

In November 2025, John Deere (US) announced a strategic partnership with a leading AI firm to enhance its autonomous farming solutions. This collaboration aims to integrate advanced machine learning algorithms into their existing platforms, potentially revolutionizing crop management and yield optimization. The strategic importance of this move lies in its potential to position John Deere (US) as a leader in AI-driven agricultural technology, thereby enhancing its competitive edge.

In October 2025, AG Leader Technology (US) launched a new suite of software tools designed to improve data analytics for farmers. This initiative reflects a growing trend towards data-driven decision-making in agriculture, suggesting that AG Leader Technology (US) is keen on capitalizing on the increasing reliance on data for operational efficiency. The introduction of these tools may significantly enhance user engagement and customer loyalty, further solidifying the company's market presence.

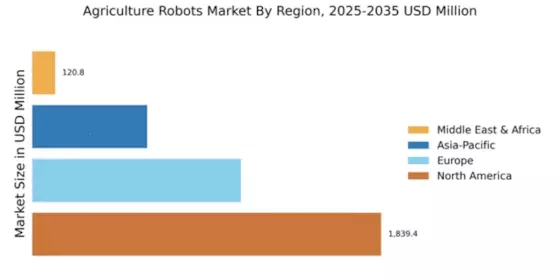

In September 2025, Trimble (US) expanded its global footprint by acquiring a European agri-tech startup specializing in drone technology. This acquisition is likely to enhance Trimble's capabilities in precision agriculture, particularly in crop monitoring and analysis. The strategic importance of this move is underscored by the increasing demand for aerial data collection in farming, positioning Trimble (US) to better serve its international clientele.

As of December 2025, the Agriculture Robots Market is witnessing trends such as digitalization, sustainability, and AI integration, which are redefining competitive dynamics. Strategic alliances are becoming increasingly vital, as companies seek to leverage complementary strengths to enhance their offerings. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition may ultimately reshape the market landscape, fostering a more sustainable and technologically advanced agricultural sector.