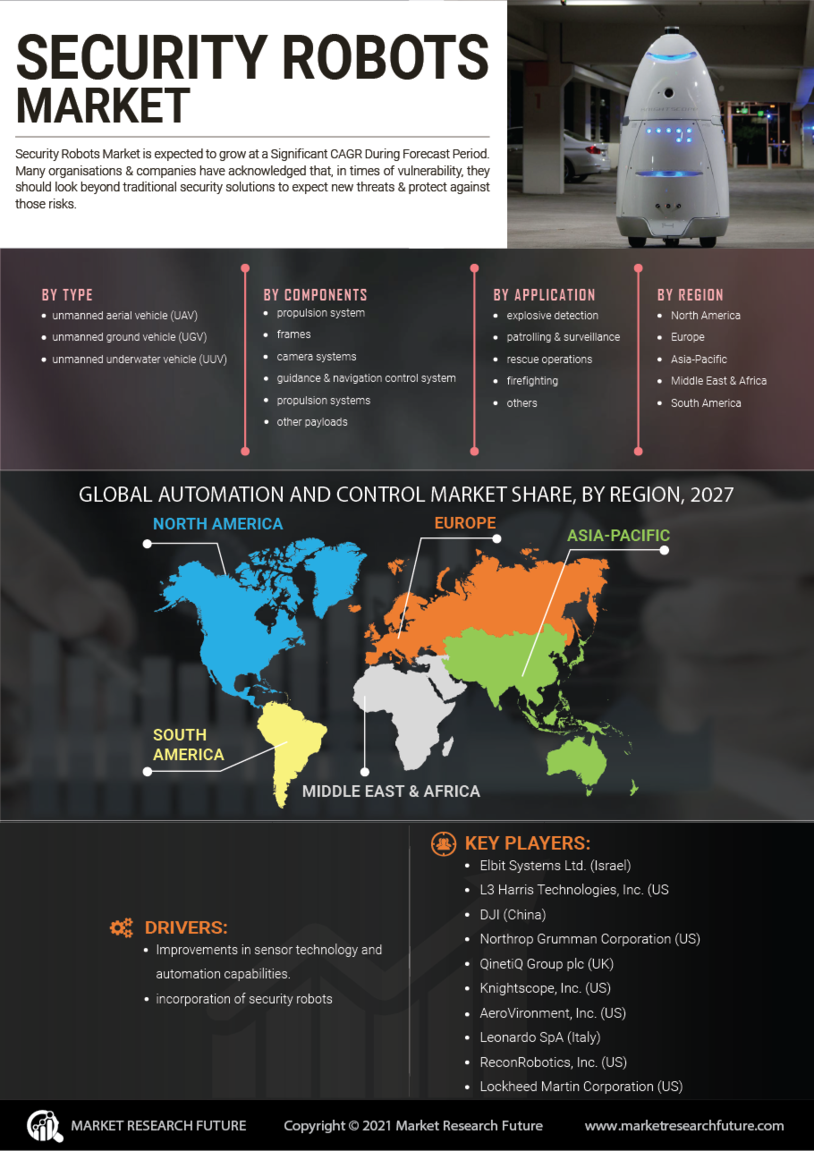

Rising Security Concerns

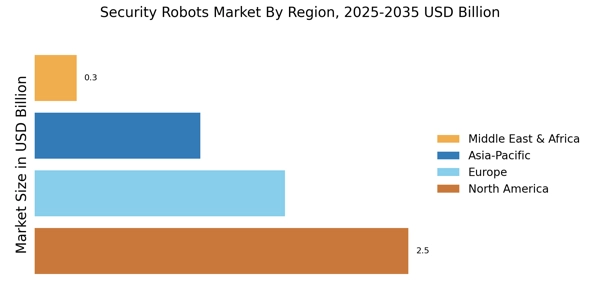

The Security Robots Market is significantly influenced by rising security concerns across urban and suburban areas. With increasing incidents of crime and the need for enhanced safety measures, organizations are turning to security robots as a proactive solution. The market is projected to grow as businesses and municipalities invest in robotic security systems to deter criminal activities. Data indicates that regions with higher crime rates are more likely to adopt robotic security solutions, suggesting a correlation between security concerns and market growth. This trend highlights the potential for security robots to play a crucial role in modern security strategies.

Focus on Cost-Effectiveness

The Security Robots Market is increasingly focusing on cost-effectiveness as organizations seek to balance security needs with budget constraints. The deployment of security robots can lead to substantial savings in labor costs, as these robots can operate continuously without breaks. Furthermore, the long-term investment in robotic security solutions is often justified by the reduction in theft and vandalism incidents. Recent studies indicate that businesses utilizing security robots have reported a decrease in security-related expenses by approximately 25%. This emphasis on cost-effectiveness is likely to drive further adoption of security robots in various industries.

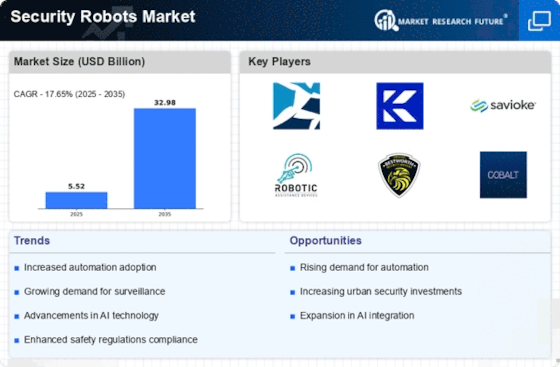

Increased Demand for Automation

The Security Robots Market is witnessing a notable increase in demand for automation across various sectors, including retail, hospitality, and public safety. Organizations are increasingly adopting security robots to enhance surveillance and response capabilities. This trend is driven by the need for 24/7 monitoring and the ability to respond to incidents in real-time. Market data suggests that the adoption of automated security solutions could lead to a reduction in operational costs by up to 30%, making it an attractive option for businesses looking to optimize their security measures. As automation becomes more prevalent, the market for security robots is likely to expand significantly.

Integration with Smart Technologies

The Security Robots Market is evolving through the integration of smart technologies, such as the Internet of Things (IoT) and cloud computing. This integration allows security robots to communicate with other devices and systems, enhancing their functionality and effectiveness. For instance, security robots can now share data with surveillance cameras and alarm systems, creating a more cohesive security network. As of 2025, the market is expected to see a rise in demand for interconnected security solutions, with estimates suggesting that the integration of smart technologies could increase the efficiency of security operations by up to 40%. This trend indicates a promising future for the security robots market.

Technological Advancements in Robotics

The Security Robots Market is experiencing a surge in technological advancements, particularly in artificial intelligence and machine learning. These innovations enhance the capabilities of security robots, enabling them to perform complex tasks such as facial recognition and anomaly detection. As of 2025, the integration of advanced sensors and real-time data processing is expected to drive the market further, with projections indicating a compound annual growth rate of over 20%. This rapid evolution in technology not only improves the efficiency of security operations but also reduces the need for human intervention, thereby reshaping the landscape of security services.